2021 is coming, is there still a chance in the DeFi field?

2020 is coming to an end. I believe that this year has given many investors the feeling that: new projects are emerging one after another, Defi makes people feel ‘ get income so easy ‘ . But the good times did not last long. Since October this year , many DeFi project tokens have experienced a cliff-like decline. This Lego game seems to come to an end.

Is DeFi the future of decentralization?

As far as DeFi is concerned, it is impossible to simply judge. However, DeFi is definitely the most important part of decentralized finance. The content covered by DeFi is currently relatively thin. From decentralized lending, decentralized transactions to decentralized arbitrage pools, they are currently the three most important application scenarios in the DeFi field.

What other scenarios can DeFi expand?

The answer is that all the scenarios that are applicable to decentralized finance, and the segments that are not currently involved are mainly due to market demand and technical bottlenecks that still need to be resolved. For example, decentralized physical asset transactions, decentralized virtual asset transactions, decentralized credit ratings, etc.

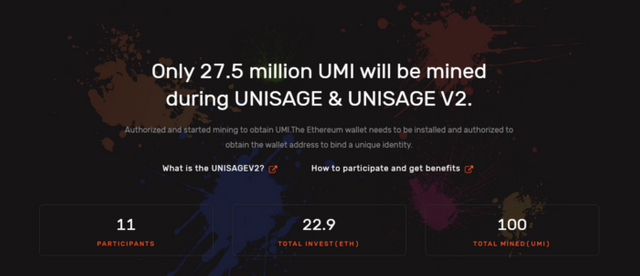

After a lot of searches and verification, Unisage is indeed a fairly high-quality new DeFi project

What are the highlights of Unisage ?

Highlight one, completely decentralized operation. After consulting its community media records and official website information, Unisage, as the first Unimine project, has undergone multiple rounds of contract testing and is completely open sourced from etherscan

Highlight two is the rising income mechanism. The initial apy is 183% , which increases with the increase in the number of games. It is completely different from the economic model of many DeFi projects that gradually reduce the income from high income. This is also in line with the spirit of blockchain for everyone and everyone.

Highlights three, backed by the United States legal foundation Unimine Inc . According to the official website information, the foundation will assist the project’s operation and promotion in the early stage of the project and provide protection for the legal compliance of the project. After the completion of the third phase of the mining experiment, a completely decentralized community operation will be implemented.

Highlight four, platform planning is long-term and scientifically effective. The prerequisite for any decentralized project to ensure long-term stable operation is that the economic model is sufficient to undertake selling, and the deflation effect is greater than the inflation effect. Unimine ‘s platform token UMI has a circulation of 100 million , and the platform will use all stages of mining ( Unisage , FIFO, custom mining) revenue to burn to the final target of 21,000 . The strong deflation guarantees long-term operating power.

Bright spot five, the ecology is extremely rich. According to its litepaper , the three phases of mining are planned to include ETH2.0 hosting, quiz mining, e-commerce mining platforms, financial derivatives business, etc., covering almost all aspects of DeFi , and the growth of the platform is unimaginable.

YFI, the leader of DeFi , will give many investors a lot of returns in 2020. We will wait and see how UMI will perform next.