In search of the most undervalued cryptocurrency in the…solar system?

Firstly I would like to start by stating that whilst care has been taken to ensure that information contained within this blog is taken from reliable sources, it should be noted that it is based on my opinion. Therefore, this opinion may not represent the views of the Decred development team or wider Decred community.

I’ve decided to start this blog with my own story of how I came to buy, hold and stake Decred.

Like most people, I first learned of cryptocurrency in 2014 when stories of people making millions from Bitcoin made international news. But (unlike some) I quickly lost interest when the price crashed and Bitcoin ‘died’. It wasn’t until last year that I started to pay attention again. I read stories that communities around the world had began to use Bitcoin as their preferred currency, unhappy with out of control inflation fueled by corrupt governments, or poor monetary policy. It appeared that the speculative value placed in Bitcoin in 2014 had started to turn into the real deal. It became something people depended on. With this, the price started to rise, and I began to see a real use for it. Since retail and trade was now global, borderless and online, it also made sense that traditional fiat currency just wasn’t fit for purpose any more. A digital world needed a global digital currency. So, I bought some!

To my delight the price of Bitcoin began to rise. However, whilst I was pleased with this, I became increasingly frustrated with the amount of time it took for my transactions to be confirmed. This made me question – is Bitcoin really a currency? Can people really wait an hour for their transaction to be processed when making a purchase? And can they really pay over $0.50 for a transaction? Not to worry I thought – after some research I read ‘SegWit’, and ‘Lightning’ were coming to save the day.

A little naive of me maybe, but it was my belief that Bitcoin was created by an unknown individual for the good of all mankind, and that it remained unchanged from the date of inception. It got me thinking – if Bitcoin really was a decentralized peer-to-peer currency controlled by no one, who was going to implement SegWit and Lightning? After further research I learned of Bitcoin Core, the ‘maintainers’ of the network. Although this made sense, I sort of wasn’t expecting it. While the thought of a single development team having control over the future of my finances was not ideal, I understood it was clearly needed for Bitcoin to progress.

At the beginning of 2017 I started to get excited about the prospect of SegWit and an improved Bitcoin network. But soon that excitement turned to worry when I heard of another development team, Bitcoin Unlimited, who opposed it. Worry turned to fear with talk of a Bitcoin hard fork. It became apparent that separate groups of miners and developers were fighting for control of Bitcoin. As a user I didn’t really seem to get a say. It was here the importance of governance was highlighted to me, and it began to make me question what I really value in a cryptocurrency. I set about making a list.

In top spot I decided that I value security most. After all, if I lost my coins then there would be no value at all! Second to security I decided that I valued governance. For a coin to be truly decentralized, and to avoid the current issues with Bitcoin, a proper governance system was needed. Governance enables a cryptocurrency to evolve, with community consensus. In third I placed development team. Without a capable development team the network is not secure, and it won’t make good progress over time. Based on the assumption that a lack of funds means lack of development, funding came in fourth. Followed closely by transaction speed, transaction cost, and finally privacy. Although I didn’t want everyone knowing about my finances, I figured that if you hold your own private keys this offers a degree of ‘nameless’ anonymity.

After completing my list I spent some time thinking about security. In the end I came to the conclusion that if governance is right then the network will grow, and with that so will security. Therefore, I decided that what I really value most in a cryptocurrency is governance. With the price of Bitcoin plummeting due to continued infighting between development teams, talk of hard forks and miners taking the network hostage, I went on search on the most undervalued cryptocurrency. The governance coin.

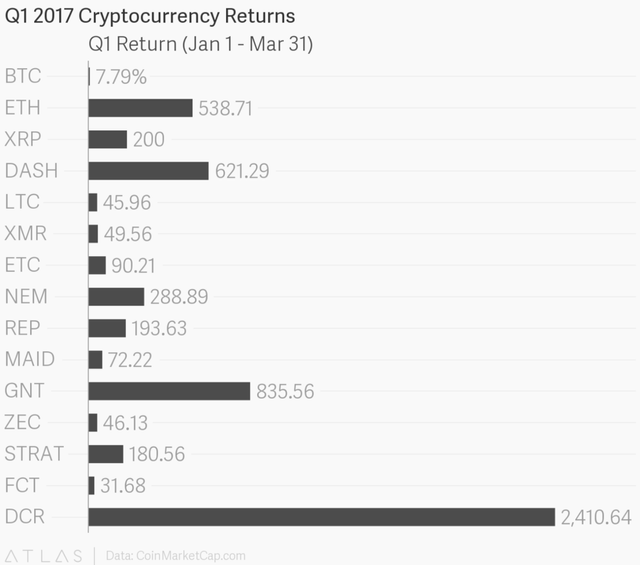

To my surprise I soon came across a something that seemed to tick all of these boxes. It was first brought to my attention by Charlie Lee (Coblee), the creator of Litecoin. Charlie tweeted that Decred was his choice of coin when it came to governance. After spending a few more days thinking, I made the decision to trade all my Bitcoin for Decred. It seemed perfect timing, with growing fears of a Bitcoin hard fork, everyone began to see the value in governance. How much do people value governance? To date Decred is the best performing cryptocurrency of 2017, its value increased over 2400% (see the below, published by coindesk.com).

There are other coins that have tried to get governance right, and there are new coins that plan on implementing governance systems in the future. But their systems aren’t first, and they aren’t the best – those titles belong to Decred.

I learned that Decreds governance started from the very beginning, when 8% of the 21 million coins that will ever exist were ‘airdropped’ to community members – for free. This ensured that right from the genesis block, the distribution of Decred was spread far and wide. Whilst part of this initial airdrop was set aside for development, it was agreed that these funds could only be used to pay for development work – no coins were to be issued developers for ‘free’. And in addition the development team agreed not to trade any of their coins for at least one year (in fact, the lead developer believes so much in Decred that he is still funding the majority of development out of his own pocket).

From day one the foundations of Decred were built with governance in mind – for everyone. Like most new coins over the last few years, the developers could have held an initial coin offering (ICO). However, the problem with an ICO (which has been particular true of recent) is that wealthy investors can buy up a large proportion of the total coins in circulation. As a consequence this could result in more centralized decision-making, giving fewer people control.

To further ensure no single group could dominate the network, the Decred development team implemented a hybrid ‘proof-of-work’ and ‘proof-of-stake’ mining system. This prevents miners from blocking decisions made by the wider community (as seen in Bitcoin today). POW miners generate new blocks and the POS miners (the holders) vote to validate these blocks, ensuring that they meet the consensus rules of the network. To do this POS miners purchase tickets with Decred, a process that involves locking up coins until their ticket is selected to vote. On average this takes 28 days, but can take up to 142 days. Therefore staking prevents voters from selling their coins until their ticket has been selected. As such, this prevents any malicious voting; as to do so would also reduce the value of the voters coins. As an added bonus, users are also rewarded with Decred for voting (currently approx 1.5 DCR). This allows holders to make interest with their coins. I see it a bit like a savings account – only better!

Perhaps the greatest thing about Decreds governance structure is its hard fork voting system (now live with v1.0). Anyone who holds Decred will be able to make a proposal for work they want the development team to carry out. Proposals are then voted on, the developers do the coding, and then the community votes again for a hard fork. But, another good thing is that the new code is built into the blockchain prior to a hard fork vote taking place. So whether the community decides for or against a hard fork, it automatically activates the code to make changes according to the outcome of the vote. Therefore, the development team cannot enforce any changes.

To ensure the continued, development, progression and evolution of a coin, funding is required. However, when someone gives funds, they normally do it because they believe it will benefit themselves in some way. Very rarely is human behaviour truly altruistic. To get around this issue Decred is self-funded. A small percentage of Decred mined from each block is set aside to fund future development. And, guess who decides how those funds are spent? The Decred holders! The governance system in Decred is unique, it’s a first, and I don’t believe it will ever be beaten.

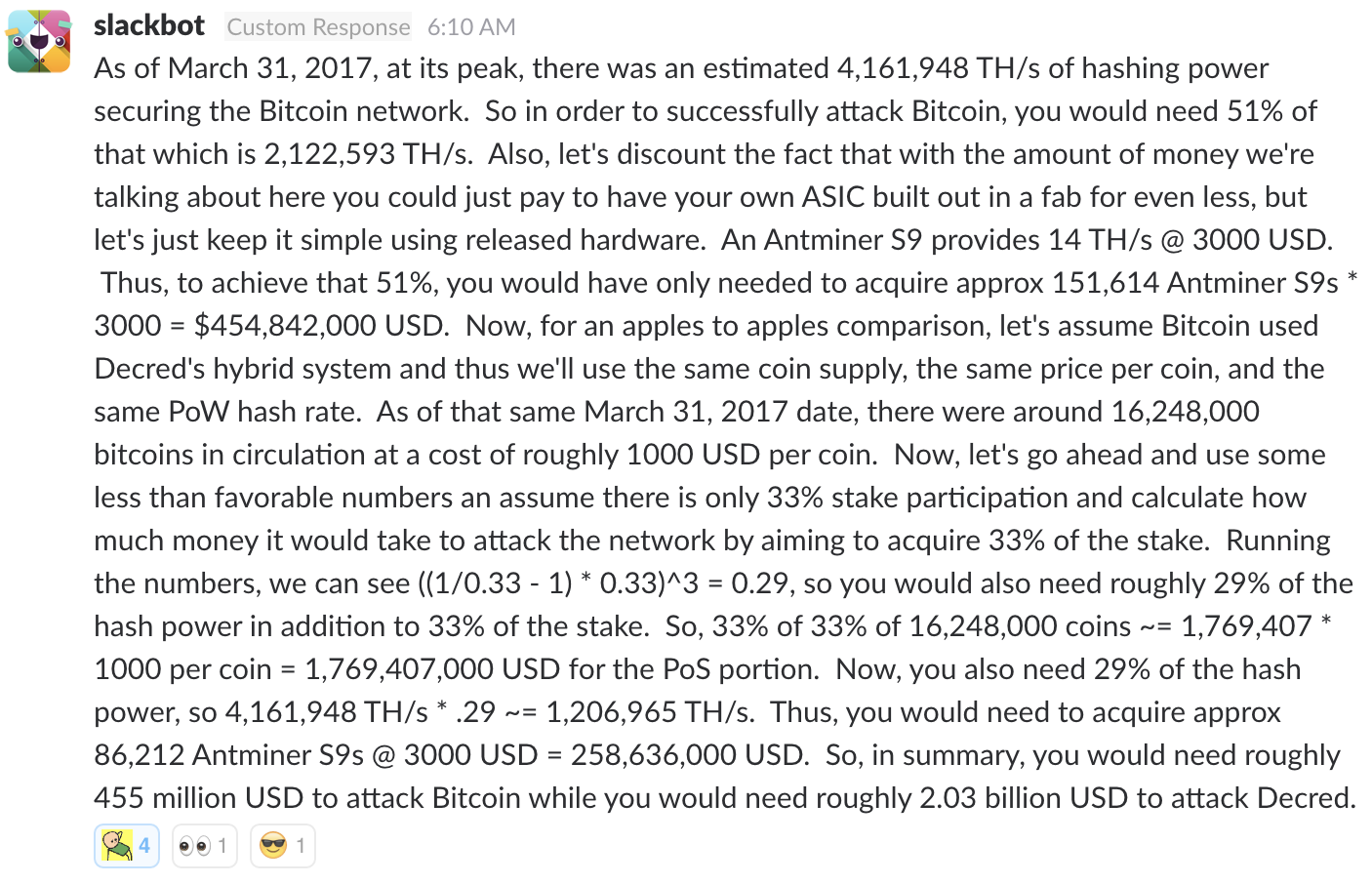

The great thing about Decred is that although it takes top spot for governance, it also ticks every other box that I value. Along with its unique governance system it has an amazing development team. Decred is in the capable hands of the highly respected creators of BTC suite, holders will soon be voting for Lightning, and later this year the development team have privacy enhancements planned. And, until I read the below response from the Decred Slackbot, it was also unbeknown to me just how secure Decred is too!

Together, these unique features mean the opportunities for Decred are endless. Great developers have the funds to make Decred an even greater coin in whatever way the holders vote. This ability to evolve and progress in whatever direction the holders want it to ensures it is future proofed!

Pretty much everyone in the Decred community believes in the future of Decred. It’s their coin, they dictate the path it takes. The trading channel on Slack may as well be called ‘Hodlers’ because most buy, hold and stake. And the community is growing, rapidly! As I write this blog there are almost 2400 active members in Decred Slack, a number that increases more and more everyday. The community stretches nearly every continent accross the globe, and everyone is willing to help each other out. Whether you’re a newbie, a developer, a trader or long-term hodler, whether your from Britain or Brazil, everyone is part of the same Decred community. If you hold Decred you are part of the Decred Decentralized Autonomous Organization (DAO), and its future. New cryptocurrencies might come along and try to create a better ‘Decred’, but they can never come along and recreate its community. After all, this is what matters most, without users a cryptocurrency is useless!

I love Bitcoin, and I think it will always be around, but maybe as a digital gold rather than a digital currency. Fundamentally Decred is the ultimate coin – it’s in a league of its own. Despite this Decred is currently placed 15th on coinmarketcap.com, with a marketcap of just over $70 million. To put this in perspective, Dash has a marketcap of over $700 million. For all the reasons discussed above, in my opinion Decred was and still is the most undervalued cryptocurrency in solar system. With its 2400% increase this year it might have already made the moon, but when governance is back on the agenda, it might just reach the stars! So, how undervalued is Decred? You decide!

M. K.

If you are part of the Decred community and have a story, news or anything else you want to contribute to The Decred Digest please get in touch!

Congratulations @thedecreddigest! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

I didn't know anything about DCR until I read your post. I alerted DCR/BTC here on steemit from a technical perspective only because I tried not to read into it. Thanks for your post...