Debt On Track To Destroy The American Middle Class

Content adapted from this Zerohedge.com article : Source

Some are starting to sound the alarm of the amount of debt U.S. households are carrying.

Debt could well be the final nail in the coffin of the middle class. Wages are basically flat over the last 20 years so the easy credit approach the banks are taking is what allows Americans to maintain their lifestyle.

This is tolerable when things are going well with the economy and people have jobs. Any pullback could create a snowball effect since there are no real assets for the middle class to fall back upon. While the wealthy can handle this situation, the middle class finds themselves quickly underwater.

American consumers have a collective outstanding household debt of about $13.15 trillion of which nearly $1 trillion is the credit card debt alone, households are truly on a debt binge. These figures should be a wake-up call to all the Americans. The convulsive household debt has surpassed the bubble of 2008 and is still escalating. The economy may not be doing so great, after all.

Compared to 2008, the automobile credit balances have increased to $367 billion whereas the outstanding student loans are around $671 billion. Moreover, 67 percent of household debts belong to consumer mortgages. In 2016, twenty-five percent of all the Americans purchased a new or used vehicle and two-thirds of them are repaying through high-interest, long-term loans.

We are seeing now that household debt has exceeded income for the majority of Americans.

Credit card debt is particularly concerning since it carries such high interest. We are also seeing mortgage debt become an issue with rates starting to rise. Presently, we are not at the 2008 levels in this area but a housing crisis could be brewing. This also has a snow ball effect since consumer credit gets hit also.

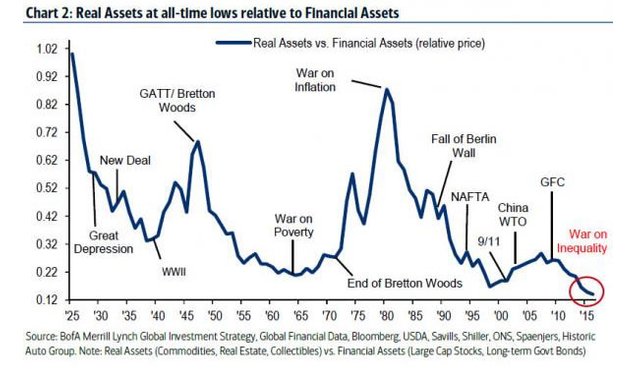

The decline in automobile sales is already an indication of the future consumer debt crisis. If lenders continue to provide easy access to credit regardless of its looming default and delinquent potential, retail purchase will face a sharp decline in 2018. This will have serious consequences on the overall economy. The Federal Reserve and other global lenders are a significant contribution to the problem. They allow printing of trillions of dollars and yens for the lenders to distribute to the borrowing consumers at a high interest, leading to a worldwide inflation. All this printed wealth is merely an illusion yet it is raising the cost of living. Prices are rising at an alamingly faster rate compared to the consumer income. There is no increase in real assets. All this is but a mere mushrooming of debt.

Any downturn will be handled by the wealthy. The middle class do not have the resources to do this. When we get to the point of recession, default becomes the only option.

The next crisis will likely be over student debt, so many millenials are entering adult life and the work force with up to $150,000 student loan debt. No job will ever pay enough to cover this debt and allow them to live comfortably in a home they own. This means less tax revenue, less resilience in the event of large financial crises (no savings or equity to fall back on, huge dependence on keeping whatever job they can find), and growing disparity between the wealthy and working poor.

It is not sustainable, and it affects too many Americans for this not to devastate the economy when that bubble finally bursts.

There are 9 ways to qualify so that so do not have to pay your student loans or pay a very reduced rate. These plans are for the gov't loans - not the private ones.

Unless you are making excellent money. You will qualify for one of the plans. The first notification you get about your loans after graduating tells you about what those plans are and how to apply for them. I have recommended looking into this to many people in a couple of my mom's groups on fb. Anyone who has answered me has been thrilled to qualify in days if not hours.

If you get on one of those plans - each month you are on it is a credit toward you paying in full even if you don't . After 20 years the whole this is "paid" on several of the plans.

No one should be struggling to pay student loans when this is such a slam dunk. All you have to do is jump through the hoops. It is a huge help to the debtor while also a huge problem for the broader economy. The larger economy is a house of cards farce anyway, so why should an individual psychology major care about that?

It’s a “slam dunk” if you’re willing to hold your loans for 25 years waiting for them to disappear. Keeping your income steady and not earning any bonuses (like if a small coin you invested in moons) for 25 years is a very restrictive way to pay off loans.

Earning the money and paying them back is hard too.

Those little notes are shackles.

That’s the next “show” crisis. The one we will see.

The next real crisis is in education. It’s too expensive. It’s dangerous. And it’s outdated.

As more people pull out of the traditional education systems, those with no resources (the poor, again, surprise) will now be stuck in schools that get exponentially worse.

A decade of that and you’ll start to see poverty beyond control.

This was what started the last crisis and we are still recovering, but what is worth to notice is that almost nothing is being done to avoid this bubble to explode again in the future.

I know the banks and the authorities are not supposed to prevent any crisis because it might accelerate it, but they could do more in relation to this debt problem.

If you think of an economy as a body, money is like the blood of the economy. Right now, too much of the money is in the hands of too few people.

When too much of the blood is all pooled up in one small part of the body, the rest of the body suffers.

These people just want to sit on their money and let everyone else do all the real work. The debt itself isn't the real problem. It's the people who own that debt.

Also, the $20 trillion figure is going to get even worse. As long as politicians/lawmakers keep on using tax dollars to buy votes through government spending, things are going to keep getting worse.

Thats why more people should buy bonds and save and invest.

What if we just don’t pay it back?

That would cause another recession.

Maybe we should make the government pay it since they "lost" $21 trillion. I mean that was taxpayer money right?

Obviously the system isn't working. Everyone is in debt. What countries aren't in debt right now? Global debt keeps going up, and the people most affected are the poor and middle classes.

My hope is that blockchain technologu can help even the playing field. Money is just something that we give value to to barter. We could easily use something that is given to everyone, like people have been talking about a basic income for all. Let's see what happens, in the meantime, do what you can to get debt free. Sad thing is, once you're in debt the system is designed to make it difficult to get out

The only way our fiat currency can exist is with debt. If we try to pay the debt, we would have no money and be left with the interest to pay.

Which makes for a pretty terrible system haha, we are debt based, yet everyone is so worried about all the debt

plus we are not taught financial education so we live above our means. We don't live below means then we can't make more money. It is one of the reason the rich get richer. I You should pay of all debt, Put 10% of income into precious metals like gold.This is a must have and if you can't do that then you need to finance your money better. I would also recommend 15% into investment and 15% into pension but not everyone is able to do that. Just save as much as you can and put it into investments.

That debt the government has will keep on growing and soon government will default on it.

Chicken or the egg?

Debt is simply people living beyond their means and focusing on the wrong things. Continually shocks me that so few really stop to think about what the purpose of debt is and who benefits the most from it.

Short answer: banks and those who rely on the credit system to build their empires benefit the most while the everyday person is burdened by obscene debts that keep them under stress and in need of work.

It’s not “simple” when it’s a lifestyle that is shoved down your throat since birth.

Your surprise means that you are unable to see all the traps that are laid out specifically to keep people in debt.

It’s not just vanity that keeps people in debt, people are conditioned to need certain things.

That is not an excuse. Just because you get pressured to do something, does not mean you should do it.

These Federal Reserves and other global lenders are indeed a significant contribution to the massive debt among the middle income earners. The wages have flattened yet consumption is increasing for the middle income earners making the public cut back on their savings and go access more debt which the banks make easy for them to obtain. They get these debts to satisfy their needs and desires which they feel can't be fulfilled with the meagre incomes they get. Allowing printing of huge amounts of dollars for the lenders to distribute to the desperate public at a high interest rate is what is putting the middle income earners in this intolerable state. The inflation worldwide is growing drastically raising the cost of living everywhere you go. And now I feel this state is not about to end for the middle income earners who have to continue surviving on their meagre incomes on addition to the loans they get to cover up other bills.

I keep wondering how the next generation is going to live if this keeps going on as there are limited investments inform of assets made by the middle income earners who make up the highest population.

I don't think you understand how the fed works. Down below is the link on how it works:

https://steemit.com/economy/@brittishbear/how-the-us-money-system-works-the-intro

By the way it is comercial banks that lend to the people. People want to live in houses they can't afford, etc so they go to the bank to borrow. Lending is cheep right now but it can't last like that forever. We need to be taught how to finance our money properly but that will never happen.

It can happen. You can do it here.

People want to wake up, they just don’t m ow how.

If people do want to learn about finance then YouTube and google is all you need. I make some blogs so feel free to read if you want any information.

Are you serious, are you serious? Total household debt soared to a record $13 trillion dollars in 2017. Total household debt increased to just over $13 trillion in the fourth quarter of 2017. American indebtedness has eclipsed levels seen on the eve of the Great Depression. Americans are burning up those credit cards. Americans have run up almost a 1 trillion credit card tab. Mortgage debt grew by staggering numbers. Housing loans make up the largest portion of American household debt as well. As the debt grows, the creditworthiness of borrowers is dropping. The median credit score for those taking out new mortgages decreased in Q4 2017. Auto loan balances continued to rise. Currently, Americans owe $1.2 trillion on vehicle loans. Student loan debt stands at a staggering $1.38 trillion. student loan debt is one of the biggest factors driving a growing trend of millennial struggling to transition into independence. I don’t exactly know what these numbers mean, because of it’s overall complexity, but one thing is for sure, we are not heading in to a good direction and we should get ready while we can.

Oh man, these numbers are just scary, you are right, most of us don’t know what these numbers mean, because of overall complexity, but it does not mean anything positive for our future.

It means we are leading for a recession. Don't be all gloomy. This is the chance for you to become a millionaire.

It means we’ve been pretending that we aren’t in a recession.

We don't enter a recession until the economy goes down. Right now, it is the opposite but one will happen soon.

@zer0hedge..bro The plan has been to outsource production and undercut labor by rampant h1b visa fraud (its almost 99% fraud- NOBODY advertises jobs domestically first for real - they go straight to the PhD mills in China or the India tech schools - Why follow the law when cheating gets you lower costs.) And as a side effect of sanctuary/open borders you have blue collar devastation.

And everyone is racking up debts. Spending savings to bridge the gap in squeezed earnings.

But as soon as the dollar reaches a magic number, maybe, just maybe, Milton Friedman was right, and velocity will budge. And if it budges it might accelerate and BLAMO! Your mortgage principal turns into a days pay, the Indian sql guys cost more each than a all the Americans employed and Mexican peasants will come here as wealthy tourists, not wetback illegals.

Not that it won’t suck, but maybe the fed accidentally set up a hard bottom that the bastards can’t drag us below...thank you for sharing with us..

@zer0hedge,my thought is, if I am going to give any substantial gift, it is going to be something permanent that materially improves their situation. In other words, keeping them out of student debt should college still matter at that time, keeping them out of car debt on their first car (but not expensive), something like that.

I am still a long way from that time, but I did see some parents ruin their kids by giving them money to maintain a lifestyle that could not reasonably be maintained by someone in their late 20s or early 30s after the parental money should be cut off. That causes the child to go nearly crazy towards their parents, spouse, or both for more money, when in reality they need to reduce their lifestyle to build wealth.

Living in a retrofitted greenhouse for $140 a month in college didn't kill me, and driving a crappy cars in grad school didn't kill me either. Having no school or car debt, however, is super awesome.

very nice