Quadrillion Dollars of Debt to Send the World into Economic Oblivion

While the $22 trillion U.S. national debt is quite a number to be concerned about, it's peanuts compared to the larger private debt bubble that will sink the world economy when it pops. Politicians are talking about the national debt, even if they aren't going to do a damn thing about it. But that debt isn't what's going to trigger the next global financial crisis.

Source

It could happen, as the debt depresses GDP growth and causes the value of the dollar to drop, raising inflation, etc. But the national debt and Treasury bonds are propped up by the Federal Reserve system. As long as that stays up, they can probably keep creating debt for a while to come, since politicians aren't facing negative political consequences for letting it keep going.

The real issue is the private debt, which isn't backed by an unlimited printing press money supply from the Fed. Private debt can default much quicker, and that' the corporate, consumer and student debt.

We're at $250 trillion in debt globally, from $100 trillion in economic assets. It doesn't add up. There is shortage of money to pay it back. It can't add up in the end. Plus, there is the fantasy number-game gambling magic of the derivatives market, which is at close to a quadrillion ($1,0000 trillion). This "everything bubble" could lead to everything busting.

By comparison, the government debt bubble is at about 2.2% of that global debt bubble. It seems clear which one poses a greater risk to us all.

As the mortgages, student loans, car loans, and credit cards debt grow, it will become harder for millions to pay the debt back. And many are already feeling the looming debt crisis. Home sales are falling, farm loan delinquencies are highest in 9 years and more than 7 million Americans are delinquent on the auto loans. Student loans have 5.1 million defaulting, which are the second largest category of consumer debt after mortgages.

The stock market is another monster of bullshit that's ready to blow. stocks have been pushed to their highest int he largest bubble. The S&P500 is even higher than it was prior to the 2008 crash. Corporations have even manipulated their stocks by buying back their stocks which makes it seems like a "hot" performing thing to get in on.

Corporate bonds have also ballooned by 30%, or $3 trillion, over the past 10 year to $5.2 trillion. And, most of them are one tier from being junk bonds, so they are worthless really. Just a big magic-number game with little to no substance in reality.

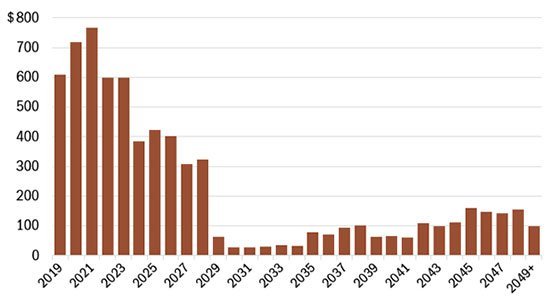

In the next 2 years, hundreds of billions of commercial debt is due, and many more hundreds of billions due in the years after, which doesn't account ofr debt not yet incurred to add to it.

Source

Apparently, we're in the biggest bull run in history. The money magic game has never been so "good". Many valuations are based on artificial propping from the bull market, not on real fundamental in reality. Much of the buying is automated now, and based on trends of high-frequency trading. When some whales start to sell off, the programs will follow and the market will turn bearish fast, with stocks dropping out of the sky as sell order pile up.

We've never had a proper reset from hitting the ground of reality. The last collapse was averted with bail outs, and some bail ins. This time around they will try the same in order to prevent the fraud and house of cards from collapsing. You can could on more bail ins, as the banks take your money from you. We're so far up int he clouds of fantasy that if we do hit the ground, it will be deadly. but, that is needed for things to come back to reality, and not be a bullshit number-magic ride int he clouds.

Thank you for your time and attention. Peace.

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

Like what I do? Then consider giving me a vote on the Witness page :) Thanks!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.

I look forward to, but feel a little bad for the people that are truly unprepared by no fault of their own, the coming economic Armageddon. As you mention there is all kinds of shit that’s spiraling out of control and there’s no way to stop it at this point. I know people who are in debt up to their eyeballs and live paycheck to paycheck without a pittance of savings to keep them afloat when it turns sour. I tried to talk to a family member about this recently and they refused to acknowledge it. They said ‘the stock market is doing awesome! It’s a great economy what are you talking about?’ I tried for another couple minutes to show them how bad it was but they didn’t want to listen.

Posted using Partiko iOS

Yeah, sadly, most ppl are so caught in the illusion that they willfully remain ignorant thinking they know :/

Do enough people even have the money for them to take anymore? Even many who should be doing well based on income are spending more than they make, their true assets being but a small fraction of the debt they owe.

Which is why this

is coming. The question I have is the extent they plan to force harsh slavery on the people to finalize their claim on the debt that is worth more than what has been produced.

Lol, you can always go to jail if you can't pay, like what happens when ppl have outstanding tickets or whatnot :/ Then welcome slave labor :/

People just don't care to wake up. They value games, light content,memes, and having fun more than knowledge that can awaken a great human potential on the planet.

Bail-ins are all but guaranteed at this point. So are negative interest rates - where you are charged money to save - on top of inflation, which is already a form of tax payable to banks and creditors.

But the worst weapon against sound economics is derivatives. Due to the fantastic leverages available through certain kinds of derivatives, and the brobdingnagian enormity of the derivatives market, even a very minute trigger can shuffle the entire house of cards.

What is obvious from even a cursory glance at history is that the individuals producing the actual wealth that financial tricks and schemes deliver and concentrate into the hands of rentiers aren't protected from the tricks and schemes that will topple the markets sooner or later.

I don't use banks. Until the underlying structure of markets changes to respect the actual producers of wealth, I won't.

I hope everyone does appropriate due diligence regarding the structure of markets and finance, because when they seize your accounts to add to their balance sheets in a meltdown, not having done so will make your losses your fault. There are other mechanisms to transfer, store, and increase stake that aren't subject to seizure by banks preventing losses on their books. Rational people will discover, use, and profit from them.

Thanks!

yeah the horizon looks dark, and few see what's coming. We all pay the price for the mischief of few, because no one is held accountable... look at the previous 2008 crash... just some fall guys got in trouble...

The ones who come confiscating houses and things for the banks, will be government.

I think, if enough people resisted and help each other fend of the government mercenaries, and just stayed in their houses that the banks had no way to confiscate all those houses and things etc.

Of course people have to wise up to that possibility. Which would be the hardest part to accomplish.

Maybe a first step for people in debt is to watch this video and solidify in their mind (at the 4:40 minute mark) that they don't have to feel indebted or guilty to these crooks! And then make plans on how to stay in your house, for example, with the help of neighbours, friends, family or other victims of these crooks.

Also watch this to get another perspective.

It is a fact that fraudulent claims have no standing, are not payable, and you are lawfully immune from them. Given that the entire fractional reserve mechanism is fraudulent, Americans do not owe the national debt.

That doesn't matter in corrupt courts, however.

No matter what endeavor you are considering, basically the principle of caveat emptor is the essence of prudence. Don't play with fire, and do invest in fireproofing, and you're gonna get burned a lot less than people that don't.

Returns only matter if you can actually keep them and spend them.

that is the 'stockholm syndrome breaking' epiphany.

One you realize there is no obligation to crooks, you can start to play your own game.

Indeed, a majority could stand against the gangs of the state, but numbers are needed. I'm familiar with the Larken Rose video, great stuff ;) Thanks for the feedback.

The problems will start after interests have been raised. In the us this has been happening, in eu not yet (just got confirmation that it will be another whole year before anything might change). Once low interest debt has to be refinanced at higher rates, that's when the trouble will come. I myself intend to go on a great buying spree than

Yeah, tighten the belt and watch the life get squeezed out :P

Cheers my friend

I've made links of your last 3 posts that touched me in https://refind.com/

just in case you don't know it yet. :)

Keep shooting consciousness bullets.

Thanks bro ;)

Is that site useful? You just share links?

Yes, maybe the use is limited, but I saw a good way to promote steemit.

As always, I like to test all the blockchains apps, the community around them and if the use case is adopted.

Anyway, for me, it seems better than Twitter. hehe

Big hug my friend.

À bientôt . :)

The system based on debt is exhausted. I hope that the opportunities for cryptocurrencies in the future to increase, Bitcoin or another, may be the gold of the 21st century.

I hope as well, but who knows how it will turn out :/

This is the apex of The Babylonian Woe, by David Astle which correctly asserts that the money masters of the time co-opted and used religion as a front for their machinations. America today with its irrational religiosity juxtaposed to the Fed is the synthesis of this long term civilizational psy-op.

Hi @krnel!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 7.379 which ranks you at #60 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 199 contributions, your post is ranked at #17.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Crypto only needs to survive while this current finacial system collapse on its own weight.

No. It needs to be immune from seizure, as well as able to be useful.

Those are both different than mere continuation of existence, and neither is considered much.

If Citi says you need to pay them and you have crypto, how can you prevent them from taking it? If you think your keys are secret, you're going to learn what the Intel Management Engine and other similar factory backdoors are when that happens.

Also, I can think of plenty of ways that crypto can just be rendered useless. You can only spend it across a network, and it is obvious that every aspect of the internet is being censored. In the UK, where today you have to show ID to buy a spoon, they've passed legislation that requires ID to access certain content.

Give that thought. That can happen literally overnight, to any form of content, in any jurisdiction. Crypto will be of little use when it can only be transferred via pony express.

As far as i know blockchain transactions are very secured, you can't hack that. Quantum computing may be the treat for the future. Of course if a government point a gun to a person to force him give his private key to seize the coins.

Users must own his keys and handle it carefully and also not trusting big amount on centralize exhanges.

I think crypto and blockchain technology as of now, still secure, trustworthy and a very effective way of transacting.

The IME (Intel Management Engine) is an onchip direct hardware backdoor built in. It bypasses the boot process, encryption, and can freely access RAM, HD, etc.

If there's some kind of financial crisis of the proportion you mention, unless you made your chipset in your computer, you don't own your keys.

This would be tough for non tech like me, but this is a serious stuff, thanks for the info.