Explanation of the importance of DDT quarantine accounts!

What is a quarantine account?

A segregated account is usually a segregated fund that effectively separates the client's assets from the financial institution's own assets. From the perspective of maintaining the normal operation of the market, effectively separating the assets of customers from the assets of financial institutions will help the initiators to remove risk assets from the balance sheet, which will help the initiators improve various financial ratios and improve The efficiency of capital use meets the requirements of risk capital indicators.

The exchange of funds for foreign exchange, the term includes two meanings:

First, traders use custodian banking services to place client funds and margin deposits in bank accounts that are different from the company's. The funds of the sub-contractors can only be used for the purpose that the customer wants to use.

Second, the funds and margin deposits between customers and customers are managed separately. A client's funds and margins can only be used for their own transactions, settlements, guarantees, and other purposes that are defined by the customer.

The starting point of the fund segregation setting is to ensure the trader's funds are safe and not maliciously occupied by the trading platform or innocent. A foreign exchange segregation account cannot be used as a working capital for a foreign exchange dealer, so it is also an efficient and transparent way to protect client funds. The client funds are placed in a bank account different from the company, and the investment funds that can protect the client or the trader in the law cannot be misappropriated by the foreign exchange dealer.

Most forex traders use a single bank escrow account and place client funds under this account name. For the fund custodian bank used by the trader, since the domestic foreign exchange business cannot be directly carried out, it is necessary to conduct foreign exchange trading through some foreign platforms. The foreign exchange fund custodian bank is the custodian bank of client funds. Most formal platforms are generally funded (Australian financial service providers have been able to use client funds for other purposes, including use as company operating funds. In November 2016, ASIC issued a statement saying that Australian financial services licensees will be cancelled. OTC Derivatives Client Trust Account Funding). When an investor chooses a foreign exchange dealer, he or she must choose a foreign exchange dealer who can provide a bank trust customer account. The bank trust account will be supervised by the entrusting party, the trustee and the bank. The client funds and the foreign exchange dealer company's working capital are separated into different bank accounts, which can make the investor's transaction funds get more security and guarantee. Special funds.

If it is not isolated, it means that the dealer can use the client's funds, which will be very dangerous. Traders who generally run money are similar situations. They can be imagined as P2P. What kind of danger would be if there is no isolation and random appropriation. It is safer to choose a foreign exchange dealer that can provide a hosted public account for investment funds. It is difficult for individuals to tell if a trader is quarantined, so it is best to choose a strictly regulated dealer.

NFA's regulatory requirements for segregated accounts?

National Futures Association

(National Futures Association, NFA), a non-commercial independent agency for US futures and foreign exchange transactions. The National Futures Association (NFA) is a self-regulatory organization of the futures industry established in 1976 in accordance with Section 17 of the US Commodity Exchange Act. It is a non-profit membership organization. Section 17 of the Commodity Exchange Act is derived from Chapter 3 of the Commodity Futures Trading Commission (CFTC) Act of 1974, which regulates the registration of the Futures Association and the CFTC's supervision of the Futures Professional Self-Regulatory Management Association. On September 22, 1981, the CFTC officially became the "Registered Futures Association" by the NFA. On October 1, 1982, the NFA officially began operations.

Official website:

Http://www.nfa.futures.org/

Regulatory query URL:

Https://www.nfa.futures.org/basicnet/

Basically, all foreign exchange regulators around the world require brokers to separate their clients' funds from their own operating funds. In the United States, all local brokers (including Introducing Brokers) must be registered as NFA members, and the CFTC requires brokers to have a net asset size of no less than $20 million and is subject to annual audit. Therefore, a trader with insufficient strength can not establish a foothold in the United States, which can reduce the losses caused by the bankruptcy of the brokerage company. In addition, the NFA/CFTC has also established a fund segregation system.

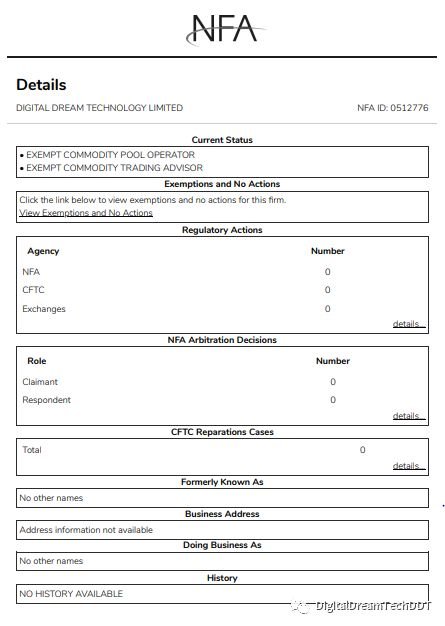

DDT in NFA Regulatory Number: 0512776

Or enter the company name query:

DIGITAL DREAM TECHNOLOGY LIMITED

DDT quarantine account

Alfa Bank, the largest private commercial bank in Russia, was founded in 1990 and is headquartered in Moscow. It operates in seven countries (Russia, UK, Ukraine, USA, Netherlands, Belarus, Kazakhstan) for individuals and businesses. Providing financial services, mainly active in Russia and Ukraine, in terms of the amount of capital, among the top ten banks in the two countries. Services include investment banking, corporate banking, and retail banking. The website language is Russian and English.

Russian website: http://www.alfabank.ru/

English website: http://alfabank.com/

Segregating accounts separates client funds from broker operating funds. All traders' funds will be deposited in a third-party bank account in the name of the client and will be completely separated from the broker's own working capital and other trader's funds. The funds are kept by a third-party custodian bank, and the broker cannot use it privately. This means that the trader's funds and deposits can only be used for their own transactions, settlements, guarantees, and any other use that is limited by the trader himself. In the event of an unforeseen event, such as the bankruptcy of a broker, the establishment of a segregated account protects the trader's funds from loss.

Digital Dream Technology

In ALFABANK Isolation Account Number:

EDRPOU 42671403

DDT Customer Isolation Account Number:

US Dollar USD (840)

Account Number 26003026660001

Euro EURO (978)

Account Number 26003026660001

Ukrainian hryvnia GRYVNA (980)

Account Number 26002026660002

Ukrainian hryvnia GRYVNA (980)

Account Number 26003026660001