DCC Finance: World's First Distributed Banking Ecosystem!

What is Distributed Credit Chain?

Distributed Credit Chain is the first distributive banking public chain it is built on the fundamentals of blockchain technology. It is decentralized, open, irreversible, autonomous and private. It is going to transform and evolve the banking industry. A distributive bank is not a traditional bank but rather an ecosystem of distributive financial services. Unlike the traditional financial services, the distributive banking ecosystem creates a true peer-to-peer communications model of cooperation across all region, sectors, subjects and accounts. It will enable business participants in different countries to provide financial services in a more convenient and efficient and powerful way.

The team will begin by focusing on the credit industry first. They are focusing on the credit industry because the history of the credit industry goes a long way back. It has created and played an important role in the exponential expansion of the human civilization. For instance, everyone in the Western world has an opportunity to get some form of credit. This helps people buy things like houses, cars, start businesses, go to schools and so on and so forth. The credit industry has improved the quality of life for a lot of people in developed countries from around the world. Everyone wants to live in developed countries, DCC gives everybody from around the world the opportunity to improve their quality of life by providing them access to credit in a cheap, private and efficient way.

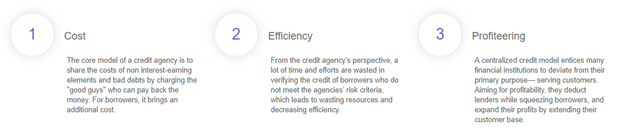

What problems is solving?

The traditional finance industry is highly centralized. Financial transactions rely heavily on endorsement and support of large financial institutions with substantial transaction fees paid out to these institutions. Monopolistic financial institutions have in fact raised lending interest for borrowers and reduce interest income for lenders. Right now, in most countries there are about four to five major banks that get the majority of businesses from the general public for things like day-to-day transactions giving out loan to customers and so on and so forth. The people who run these banks in your communities, they know what kind of prices their competitors are offering and every bank in your area pretty much keeps prices around the same range. Sometimes it feels like they're all working together, there's no surprise that every bank keeps prices nice and high and at the end of the year, management walks away with multi-million dollar bonuses and lavish business trips on private jets to luxurious resorts. To put it bluntly, they are getting paid that kind of money for maintaining that stranglehold that the banking industry has had in the general public for 100-plus years. This kind of thing happens in a lot of different industries though not just banking. This also happened with taxi companies, it used to be very pricey to take a taxi for a lot of people then one day out of nowhere. Boom!

Uber comes along what ever did was very simple. Uber created a tremendous amount of competition for all the taxi companies from around the world. I looked at the stats online, taxi companies now have millions of competitors. Because of new innovations like Uber and Lyft, it put a lot of these taxi companies out of business but it also put a lot of money back into the hands of the consumer. Distributed Credit Chain incorporates similar fundamentals. Essentially, they are increasing competition amongst each and every bank from around the world. One particular feature that the platform has which I think is brilliant. It's a distributed credit data sharing network. This will make your local bank have to compete with every single bank on the entire Planet. The consumer will be the greatest beneficiaries of this scheme. If your local bank won't offer you the lowest interest rates for your house and that's fine you'll get it from another bank who will be more than happy for your business.

In an other example, let's say a business owner in India have an urgent need for credit to renovate his growing business. The local banks in the region are off for him roughly 10 to 12 percent interest rates respectively. This is not a fair deal. Because, for every dollar that a normal person deposits in a bank, the bank is legally permitted to lend out ten times that amount using that $1 that was deposited as collateral. So if the bank is offering ten to twelve percent interest rates for loans, this means that they are making roughly 200 percent plus profits on the deals with zero liability. This is not a fair deal. So the question is this then, where can the business owner in India turn to to access lower interest rates? He can turn a distributor credit chain to get a much lower interest rate in Canada. Distributed Credit Chain facilitates the recording and tracing of his financial history and credit score on the blockchain architecture. A Canadian bank will then be able to see his loan requests and assess his borrowing risk and ultimately make the decision to grant him a loan at a lower interest rate down 3%. Moreover, he will be able to get the money that he needs at a reasonable interest rate to keep growing his business that he's a very passionate.

How it works?

DCC tokens will also be used to pay for jobs in a DCC ecosystem. In a DCC system, the people that require data or reports from data institutions also need to pay and DCC tokens for these services. Furthermore, credit institutions also need to pay DCC tokens to the certification body when verifying the validity of the data. And in addition, individuals applying for credit also need to pay in DCC tokens for the application contract. The entire ecosystem distribution of interest can be dynamically adjusted so that the credit processing resources can be tilted towards individuals but more DCC tokens.

This just means that the system will favor of people who have more DCC tokens, meaning the people who contribute more to the system will benefit more from it by holding tokens. DCC tokens will also be used to incentivize people who maintain good credit in the ecosystem. When people apply for loans, a portion of that money will be put into a reward pool and that money will be shared evenly amongst all the people who are maintaining good credit in this system. And lastly, DCC tokens can be used for cross-border credit credentials because the DCC system provides a cross border across scenario and cross currency credit service of digital assets. DCC can correspond to values of different legal tenders of loans in various countries which greatly facilitates the multinational business of lending service agencies.

Team

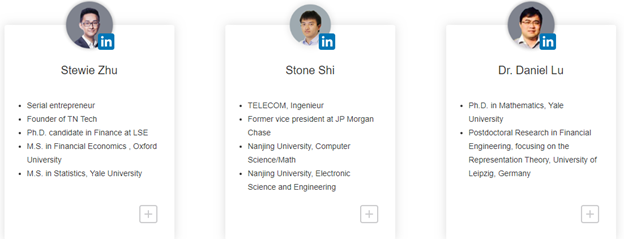

Core team

The core team is really strong. They are highly educated individuals with relevant experience in banking business and finance. Stewle Zhu is the founder of Distributed Credit Chain. He was a CEO of TN tech that's like a leading financial technology company in China. It was sold in three years to a public company, it did very well at TN Tech. Mr. Zhu led a team to develop internet-based credit systems for over a dozen of trust with multi billion USD annual loan facilitation amounts. Stone Shi was the former vice president at JP Morgan Chase. And the last gentleman is Dr. Daniel Lu. He's the chief innovative officer, he has two PhDs – the first one is the mathematics PhD from Yale University as well as a financial engineering PhD from Leipzig University.

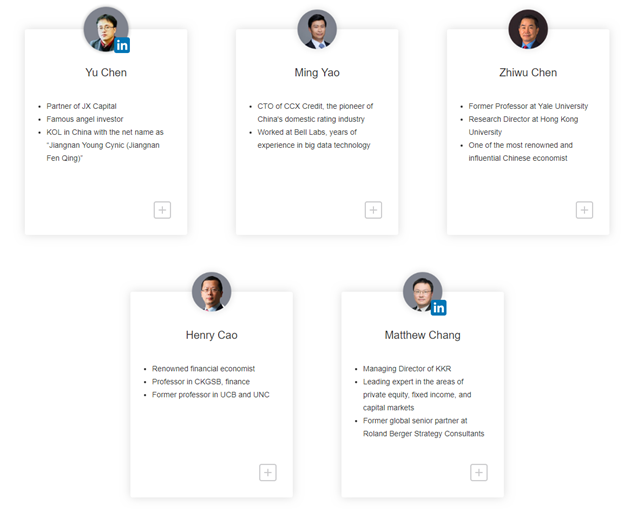

Advisors

The advisors have PhD's law degrees and master's degrees in areas of finance capital markets, big data analysis research, business and some are venture capitalists. They have all owned and ran successful businesses related to the field of business AI technology and finance. What I don't see on the website are team members with blockchain development experience. I know that they have these team members with blockchain experience because their test net is already running but I would like to see them shine some light on some blockchain developers, so people are aware that they have them over. I think the team advisors, partners and backers are all-star if this thing works and they are successful.

Conclusion

I really like this project because the idea is revolutionary and the investors and partnerships are extraordinary. A team and advisors are highly educated individuals of high-quality experience in relevant fields they are more than equipped to handle the task at hand. Aside from the big bonuses which were offered in the private sale that only affects 18% of the total tokens, I don't see many flaws in this project. Now in my opinion, if this would be, the credit chain follows their roadmap and takes their marketing very seriously. There's no telling how far they can go. But I believe that they will change the banking industry forever.

Useful links

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3209215.0

Telegram: https://t.me/DccOfficial

Twitter: https://twitter.com/DccOfficial2018/

Github: https://github.com/DistributedBanking/DCC

Medium: https://medium.com/@dcc.finance2018

Author:

Bitcointalk username: tangdu

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1020295

Congratulations @tangdu! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Final results coming soon

Congratulations @tangdu! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!