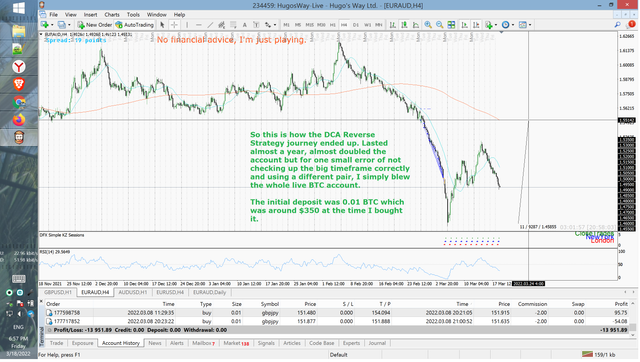

DCA Reverse Strategy failed after 1 year (18-March-2022 update)

It's been a long time since I have posted here but have to tell you... LESSON learned, I was always tempted by DCA (dollar cost average) strategies but after this experience I have a VERY CLEAR opinion about it.

1.) not worth the stress

2.) it's just a question of time when it fails.

3.) It just takes your energy, money and focus that you could have used to improve in a real strategy (anything with a Stop Loss).

It's interesting that even before I started testing it on many markets, even crypto, building different scripts and bots and *indicators, read other people's experiences and studies that it's actually a failure strategy, I have still had to find out the hard way. So after over 2 years in total and especially this 0.01 BTC loss after a year of trading, I feel like I don't need to test it anymore and can comfortably just ignore it and focus on a strict strategy with tight and stable SL.

As you can see in the picture, it was almost a 1000 pip dump from my first trade and to avoid liquidation would practically need double the size of my account - while it was working perfectly fine all those months before.

I can just advise and confirm that DCA strategy, is simply not a good idea at all. NOT even for a short amount of time as it just confuses you and gives false hopes. I hope I could help somebody with this experience.