What is Money? Pt. 2 & bitUSD as Sound Money

Sound money is a term that not everyone is familiar with. From Merriam-Webster, the definition of sound money: money not liable to sudden appreciation or depreciation in value : stable money; specifically : a currency based on or redeemable in gold — compare paper money, soft (https://www.merriam-webster.com/dictionary/sound%20money)

In my opinion, that is a rigid definition of sound money. I will use a more flexible definition and include any monetary system based on simple fundamental principles to which all of the stakeholders agree. One of the main reasons Bitcoin has attracted a devoted following over the past decade is because its core principles are embedded in transparent computer code. Supply, rate, and fees are predictable for the most part. Contrast that with Bitcoin's older relative: the government fiat monetary system. Criticism of fiat systems come from their lack of transparency and their exclusive decision making process. Cryptoassets offer alternative monetary systems for those not adequately served by the traditional fiat monetary system. One of the leaders is Bitshares and its companion pegged tokens like bitUSD.

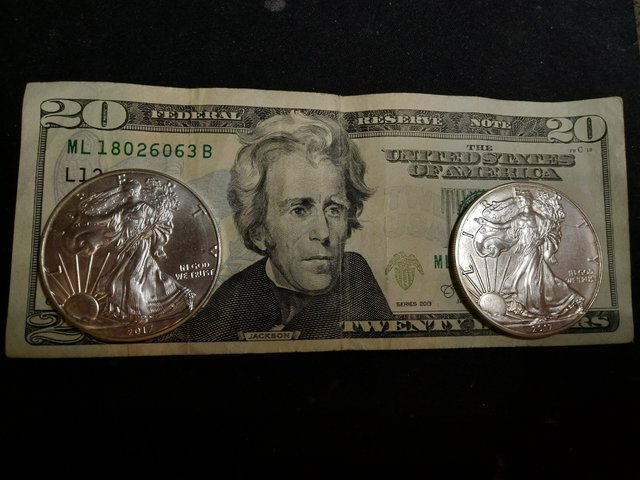

The difference between fiat USD and bitUSD comes down to the difference between a debt instrument and an equity asset. The fiat USD represents a future promise to pay - it is a note. Notice that this embeds the need for a counter-party in the transaction. A counter-party that will recognize the value contained in this note the same way you do. A counter-party that may or may not exist when the holder of the instrument seeks to exchange for value. Compare to an alternative system where the instrument of exchange is or contains the asset. This is how humans exchanged value for millennia. A gold coin does not derive value from another party. Individuals can ascribe subjective value to a particular unit of gold but the asset itself (and ownership) is contained within the coin.

Real assets are based on equity rather than liabilities. Think of a house on a piece of land. An individual who finances the purchase through an intermediary receives a mortgage - a debt instrument promising an amount agreed upon amount in exchange for the property. For the owner of the real property (not the holder of the mortgage), the parcel is properly viewed as an asset. At common law, this is known as allodial title. "Allodial lands are the absolute property of their owner and not subject to any rent, service, or acknowledgment to a superior." - Wikipedia (https://en.wikipedia.org/wiki/Allodial_title)

Having allodial title to assets is an often overlooked privilege in the modern digital economy. The holders of bitUSD retain allodial title to one dollar's worth of bitshares - a cryptoasset with a fixed supply. In the final comparison between fiat USD and bitUSD, the bitUSD is closer to the gold coin in the example above. Because every bitUSD is supported by sufficient collateral to allow the holder to settle for an equivalent amount of bts and no counter-party is needed. Allodial title and counter-party free assets are some of the principles for a diversified portfolio and I encourage you to consider whether such assets, like bitUSD are right for you.

Thank you for reading and I look forward to reading and considering your thoughts. Please enjoy this image - I hope you can tell which is the real asset and which is the debt instrument.

Great post, JR. I think it's important to note that while you do present a compelling argument for bitUSD through your comparison with fiat USD, this is simply setting the stage. You make a subtle yet important point where you said, "The holders of bitUSD retain allodial title to one dollar's worth of bitshares - a cryptoasset with a fixed supply."

So, not only is the bit asset backed (potentially over collateralized in some perspectives), but its protocol (another sources of value) carries the fixed supply parameter. Obviously, this just skims the surface but clearly there is a lot of potential in bitUSD.

Agreed that bitusd is more than the sum of its parts (literally). Good points. The motivation for this series is to set the stage for how cryptoassets can function as money and whether a community is better served by monetized debt or monetized equity.

A question beyond the scope of this post is how a medium of exchange is implicitly backed by the innovative technology it relies on. E.g. blockchain is potentially more valuable of an innovation than ACH transfers.

I like to explain it this way... With fruit. https://steemit.com/bitshares/@cryptick/understanding-bitassets-on-bitshares-using-fruit

I think the level of this article is a "little"above my own level of knowledge. I will reread it and look for other similar articles. I know that knowledge is acquired slowly, but I will not give up.

Thank you for your continued support of SteemSilverGold