Dafribank and digital business

Dafribank tackles the needs of the growing class of digital entrepreneurs. Because it is borderless it is thereby accessible to anyone that has access to the internet, with the aid of the web one can begin transactions and business no matter the geographical location. Dafribank has come with a provision of coverage for the banked and unbanked population of Africa. Over $6 million was raised by the bank through investors in 2020. Under Dafribank users find features that aid their transaction and payment processes and grant them a guaranteed, well-secured platform for any kind of transaction the user wishes to perform.

Sales and marketing of tokens

Token sales kicked off in 2020 and were sold for 7 months, and it ended in May 2021, a total of ten million tokens were allocated to each month. The bank adopted a method of purchase that favours all manners of investors both low income and high-income clients, it was let out at an affordable rate. The purchase of tokens is spread across the 7 months for each investor, and each investor is mandated to buy the same dollar worth of DBA at different price points. An example is shown below:

First month ------$0.01

Second month----$0.02/token

The third month ------$0.04/token

Fourth month-----$0.08/token

The fifth month -------$0.16/token

The sixth month -------$0.32/token

Seventh month-----0.64/token

Prospective investors are subjected to a whitelisting process that entails KYC (know your customer) and AML (Anti-money laundering) to fulfil all the requirements the bank deems necessary.

Aiming for the top

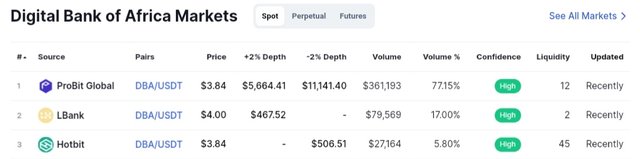

The latest statistics have shown that some African countries have constantly and consistently ranked amongst the top countries in cryptocurrency trade, crypto has a huge potential in Africa which connotes that soon every bank will be engaging in such trade and since Dafribank has led the pace and aiming to be number in such dealings. DBA, the token adopted by the bank was originally programmed to provide an alternative currency to aid users to harness the modern tools across the Dafribank ecosystem.

Evolving

The recent adaptation and investment into cryptocurrency have made the market increase patronizing crypto oriented banks and business ventures, dealing with tokens with each venture having an assigned token. Dafribank has committed itself to not leaving anyone behind and carrying everyone along in the digital worldwide growth and development. It believes in improving cultural connectivity to bridge the gap between the digital divide.

Solving problems

It has been easier for people to get access to the banking platform and trade efficiently and transparently since the advent of cryptocurrency trading. Dafribank has committed itself to make an exception and solving the problems of banking online and digital operations suffered by conventional and infrastructural banks. The bank has tasked itself with the duty of protecting the funds of its investors and customers.

Conclusion

More 200, 000 customers all over the globe make use of Dafribank because of the adoption of smart, digital and borderless tactics. Dafribank is also known as Digital bank for Africa (DBA) it serves as an electronic getaway system for entrepreneurs and merchants who have gone digital.

Projects Links

Website: https://www.dafribank.com/

Telegram: https://t.me/DBATalk

Twitter: https://twitter.com/DafriBank?s=09

Facebook: https://www.facebook.com/DafriBank/

Instagram: https://www.instagram.com/dafribank/

Linkedin: https://www.linkedin.com/mwlite/company/dafribank-limited

Authors Details

Bitcointalk Username: Jeffsonwite

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=3324909

DBA address (Trustwallet): 0x2e5a64Fe7E50B0cA5b4178bF17EF06282207756e