Vena Network—Open Protocol for Tokenized Asset Financing and Exchange

Vena Network aims to create a decentralized digital asset financing and exchange network through Vena Protocol. The Vena Protocol is divided into two layers:

Basic protocol layer, which mainly includes registration, configuration, routing, and management of upper layer financial businesses.

The asset protocol layer, based on assets, completes user-defined financial businesses through the implementation of the terms contract interfaces

Vena Network Help you realize decentralized collateral lending and OTC trading of cryptocurrency and fiat currency We Can build a decentralized digital asset financing and exchange network, in which everyone can process P2P cryptocurrency collateral lending and OTC trading anytime and anywhere, enabling free exchange between cryptocurrency and fiat currency.

Users joining Vena Network can benefit from the development of the cryptocurrency market, realize asset financing and exchange in a cost-effective, safe and efficient manner, while also can mitigate the risks associated with factors such as cryptocurrency price fluctuations and dishonest financial intermediaries.

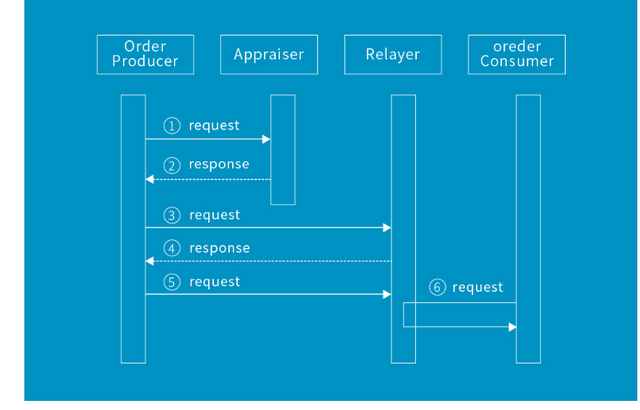

Vena nodes are the key elements of Vena Network. Vena Protocol pre-sets two roles, appraiser and relayer. A Vena node can consist of either a single role or a combination of two roles, or can contain all kinds of service providers derived from market competition. In the pre-set roles, appraiser is a trustworthy order producer and appraiser of the default risk of the debtor in the business scenario of debt issuance, and relayer accelerates the process of all debt financing orders in Vena Network without need of trustworthy third parties.

Characteristics of Vena Network

Construct the distributed commercial network by using tokenized economic model

Users shall get decentralized identity authentication to conduct credit and fiat currency related transactions

Well-defined protocol design. The basic protocol layer is highly abstracted to improve the degree of freedom for secondary development, bringing more ecological roles with more innovation scenarios; the asset protocol layer endogenously supports standard contract library including debt contracts (debt issuance, credit, collateral loan) and trading contracts, which acts as a business forerunner to build an asset financing and exchange ecosystem.

Achieve closed-loop circulation of digital assets from asset issuance to the secondary market trading, and can directly complete spot transactions, right of pledge transfer, and the circulation of collaterals (only supporting Stable Coins) within the Vena Ecosystem.

Support NFT (non-fungible token) standard and achieve value-added collateral loan for portfolio through self-defined terms contract

The third party implementing template contract library in asset protocol layer will retain the copyright, thereby establishing a template contract transaction and service market, and the author may charge the user for the service fee.

Different roles in protocol ecosystem will receive compensation, for example, appraiser can use its own data model to provide users with quality credit evaluation services and gain profit.

Support ETH, ERC20, BTC, EOS, and BCH, and more cryptocurrencies in the future

Support the transaction between cryptocurrency and fiat currency and the collateral loan

Solve the risk that the counterparty viciously withdraws from the transaction by smart contract with time lock (Timelock Contract)

Only support the irreversible fiat currency transfer so as to minimize the risk of refund (see https://en.bitcoin.it/wiki/Payment_methods)

Distributed jury network works as main protection mechanism for fiat-to-cryptocurrency exchange.

Restrain the transaction amount (50ETH) in transactions involving fiat currency to lower the overall risk exposure

All transaction details are held in smart contract and signed by both trading parties, which can be used as evidence when there is a dispute.

Regularly call the price predictor oracle contract through clocks of differenct chains ( such as ethereum-alarm-clock), and obtain the real-time price of token from the trusted-oracles-set

Solve the risk of collateral price falling through compulsory liquidation mechanism

Solve the risk that the collateral price quickly falls below the debt amount (no time for compulsory liquidation) through additional protocol token issuing mechanism

Implement the decentralized governance with Aragon software

Safely construct and manage smart contracts with Zeppelin_OS

Issue source code with open source permit (AGPL)

Vena Node Network

The main role of the Vena node network is to promote the liquidity of Vena Network, Vena node can use Vena SDK to customize and provide users with comprehensive transaction services including but not limited to lending, asset transactions, credit evaluation contract plug-in transaction, etc., and earn profit by collecting fees

Guarantee

Certified Vena nodes shall deposit VENA Token as a guarantee according to a certain percentage in the Vena Foundation

High Liquidity

Certified Vena nodes can put orders into shared liquidity pool, Vena nodes can share orders and earn fees by promoting transactions, and improve liquidity of transaction network by economic incentive of profit sharing

Safety

Digital assets of users are kept in their wallets or locked in smart contract. Vena nodes do not hold digital assets of users, thus avoiding the moral hazard of platform running away. At the same time, it also greatly reduces the cost of safety required for asset deposit for nodes

Description of Vena Protocol

Vena Protocol Token

To promote the development of Vena Network, and enable more people to participate in the Vena ecological construction, share Vena ecological earnings, and establish a decentralized collaborative decision-making mechanism, Vena team will issue ERC 20 token based on Ethereum blockchain, VENA Token, which shall be mainly used for the inner circulation of Vena ecosystem, and motivate Vena users to construct, use and maintain Vena Network. VENA Token shall become the lubricant for the stable operation of Vena Network.

Use Cases of VENA Token

To establish a verified Vena node, a certain number of VENA Tokens should be deposited in Vena Foundation.

To take the post of Vena verification juror, a certain number of VENA Tokens should be deposited in Vena Foundation.

Paying OTC trade service charges in VENA Tokens can enjoy 50% discount.

Users borrowing money with VENA Tokens as collateral can enjoy 50% service charge discount, and obtain higher loan-to-value ratio and lower liquidation limit.

The order of borrowing money with VENA Tokens as collateral shall be highlighted.

VENA Token holders can participate in Vena DAO voting, and become a member of protocol governance decision-making level

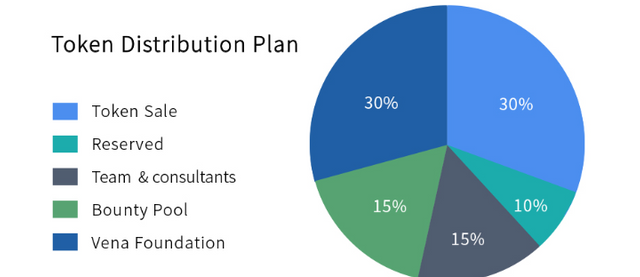

Token Distribution Plan

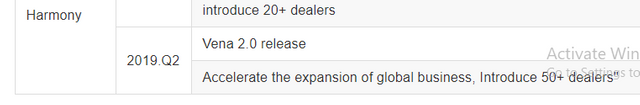

ROADMAP

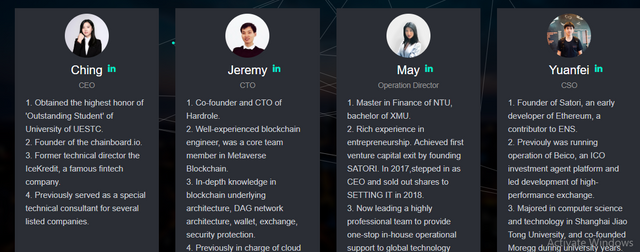

TEAM

For more information visit

Website https://vena.network/en.html

Whitepaper http://whitepaper-en.vena.network/#8-roadmap

Twitter https://twitter.com/VenaProtocol

My BitCointalk profile: https://bitcointalk.org/index.php?action=profile;u=2293100

My ETH Address: 0xEE5E677832A32f9aCf1381B05ec7f2160550c0f2