Cryptocurrencies have already recovered from last weekend’s crash

When cryptocurrency markets crashed 20% a few days ago, I wrote “the next day or so will tell us if this was a temporary bump in the road or the start of the next major correction.”

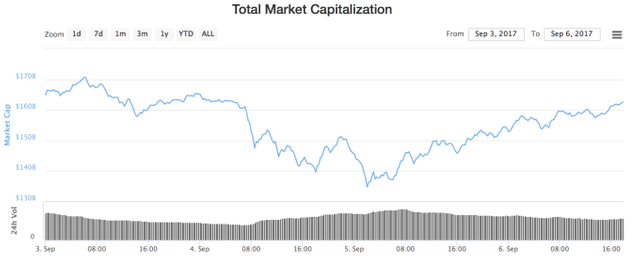

Well here we are, a day or so later. And the temporary crash seems to have just been a bump in the road. The entire market cap of cryptocurrencies is up 16% from a low of $135B yesterday to $162B today.

Bitcoin is back above $4,600, which is about 13% higher than yesterday. Ethereum is trading around $333, which is 16% higher than the low it hit earlier this week.

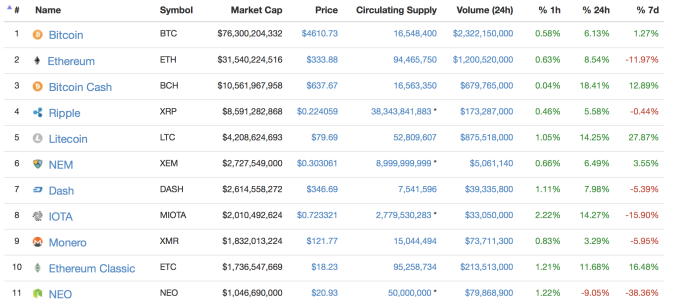

Checking the chart below shows that results are pretty similar across the board. Most currencies are up double digits over the last 24 hours, bringing them close to where they were before the weekend’s crash.

There is one exception – NEO, the Chinese-based ICO/cryptocurrency never recovered and is down 39% over the last week – but this makes sense, because the crash was likely caused by China’s ICO ban, which particularly affects NEO.

Of course extreme volatility is common in the cryptocurrency world – even double-digit swings in major currencies like Bitcoin and Ethereum. But a market-wide crash that affects every single digital currency, like we saw over the weekend, is almost always a sign of some outside influence and not day-to-day volatility. In this case the influence was China’s ICO crackdown.

Today’s recovery shows that the cryptocurrency market (and accompanying valuations) is more resilient that some have thought.

While cryptocurrency investors are reluctant to admit it publicly, many think the rapid appreciation in value over the last few months is the sign of a bubble about to pop. Some of those same investors are hoping that rising valuations will actually come down a bit, to give the industry time to catch its collective breath.

Essentially this recovery reveals a cryptocurrency market resilient enough to withstand the shocks of government regulation, meaning that the steady climb of value continues.