New Cryptocurrency Regulation in South Korea! Good News

Yoon Suk-heun, the new governor of South Korea’s Financial Supervisory Service (FSS), said that the country’s top financial regulator will consider easing cryptocurrency regulations.

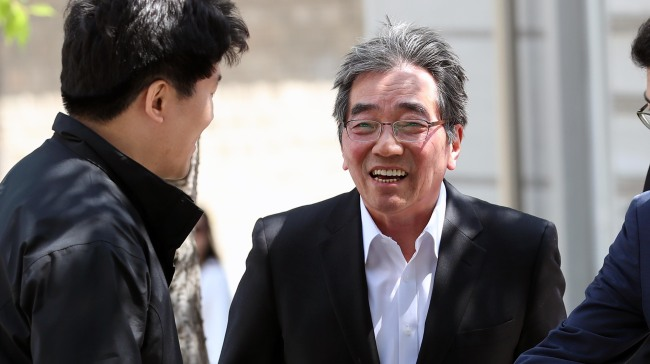

“Regarding cryptocurrencies, there are some positive aspects,” Yoon told reporters after President Moon Jae-in approved his nomination to lead the government agency. His nomination was submitted by the Financial Services Commission (FSC), which said on Friday that Yoon was an ideal candidate “to lead innovation” in the industry.

“The FSS will collaborate with the FSC when an inspection on policies and financial institutions has different configurations associated with different scopes. The FSC inspects policies, while the FSS examines and supervises financial institutions but with the oversight of the FSC,” Yoon said.

Prior to his appointment as FSS chief, Yoon, a visiting professor of economics at the Seoul University, had worked in the public in a number of positions including the head of a committee under the FSC that mapped out reforms for the regulator. He was also the chairman of the FSC’s Financial Administration Innovation Committee.

With Yoon heading the FSS, insiders predict structural changes in the country’s regulatory framework. Yoon like his two predecessors Choe Heung-sik and Kim Ki-sik, comes from a non-bureaucratic background.

Earlier this year, the FSC implemented new regulations banning anonymous cryptocurrency exchange accounts in an effort to clamp down on speculative investing in the cryptocurrency markets. The regulations essentially strengthen anti-money laundering rules, ban exchanges on issuing new anonymous virtual accounts, and forbid juveniles and non-resident foreigners from the market.

Cryptocurrency trading activity slowed down dramatically when the regulations were introduced with daily transactions of cryptocurrencies plummeting to around 400 billion won (US$372 million) from 4 trillion won (US$3.7 billion) before the implementation of the new rulings, according to Lee Jeong-ah, vice president of Bithumb, one of the country’s leading cryptocurrency exchange platforms.

In September 2017, South Korean regulators clamped down on initial coin offerings (ICOs), banning the fundraising method. Now, a group of South Korean lawmakers is reportedly working on a bill to legalize the practice.

A representative of Upbit, another South Korean cryptocurrency exchange platform that claims over one million users, told the Korea Times:

“We don’t oppose regulations. But you can’t entirely kill the markets by simply imposing regulations. What the new FSS chief should think about is how the regulators should provide remedies to help crypto trading and blockchain technology get better.”

Upbit is operated by Dunamu, a startup backed by South Korean Internet giant Kakao. In March, Dunamu unveiled plans to invest as 100 billion won (US$93 million) into blockchain ventures in the next three years.

Dunamu CEO Song Chi-hyung noted the growing interest in cryptocurrencies and blockchain in South Korea, and said that now was the right time for the country to catch this pivotal opportunity and “become the global mecca of blockchain-based technologies.”