Can the Fed’s Decision Ignite Bitcoin’s Price Surge?

Bitcoin's price has historically shown little movement throughout August. This trend seems set to continue, with data from 10x Research suggesting that returns typically remain flat or even dip in September. Despite this, current conditions could introduce some surprises.

Federal Reserve’s Impact

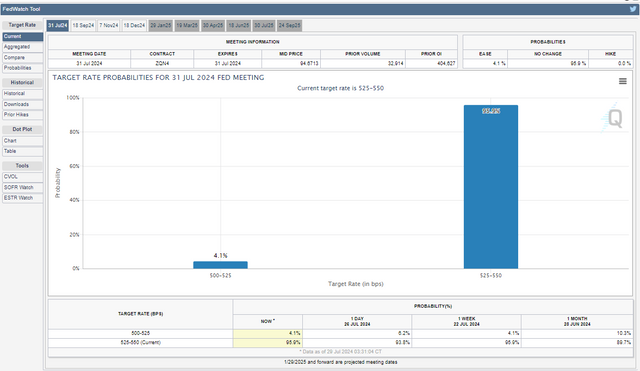

A significant factor this month is the Federal Reserve’s upcoming interest rate decision. The Federal Open Market Committee (FOMC) will meet on July 31 to determine its stance. CME data indicates a 96% likelihood of no rate cuts in August, while there is an 85% chance of a 25 basis point cut in September. This decision could be pivotal for Bitcoin’s short-term movements.

Market Reactions and Upcoming Decisions

Following a successful Bitcoin conference last weekend, all eyes are on the Federal Reserve’s announcement. Bitcoin is showing strength, trading nearly 15% higher on the monthly chart and approaching the $70,000 mark. This bullish trend may continue if favorable conditions persist.

Influence of the Election Year and Inflation

The election year and recent low inflation prints could create a bullish environment for Bitcoin. However, the impact of these factors remains to be seen, particularly with $1 billion worth of token unlocks scheduled for August. These unlocks might influence Bitcoin’s price dynamics.

Global Economic Influences

In addition to the Fed's decisions, the UK Central Bank is also expected to announce its rate cut decision this week. These global economic decisions could further impact Bitcoin's price and market sentiment.

While August is historically a stable month for Bitcoin, current economic indicators and upcoming financial decisions could bring unexpected movements. Investors should stay informed and prepare for potential changes in market dynamics as the month progresses.