From Coil to Climb: Navigating Cryptocurrency Listings and the Potential of Polar Inu

.jpg)

Introduction to Cryptocurrency Listing Dynamics: In the volatile world of cryptocurrency, the act of listing on platforms like CoinGecko can significantly shape a coin’s trajectory. This process can be likened to a “coil loading,” where the potential for movement is stored and then released, often leading to dramatic price shifts. Let’s explore how these dynamics play out for coins like Polar Inu, particularly focusing on the impact of market cap, visibility, and investor psychology.

Exchange and Listing Impact: When a cryptocurrency is listed on a prominent tracker like CoinGecko, it often experiences increased visibility. This can act similarly to a “coil loading” where the listing can be the trigger for price movement. Listings can lead to heightened interest, particularly if the coin starts to show significant movements.

=

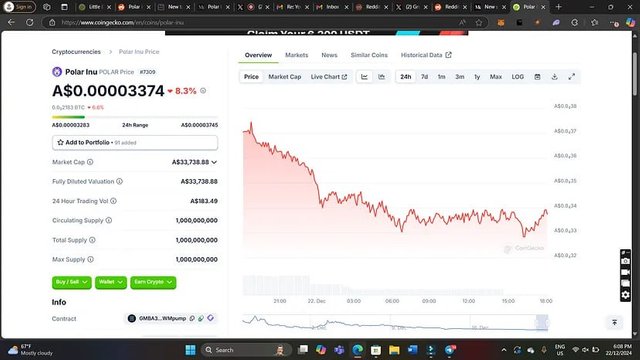

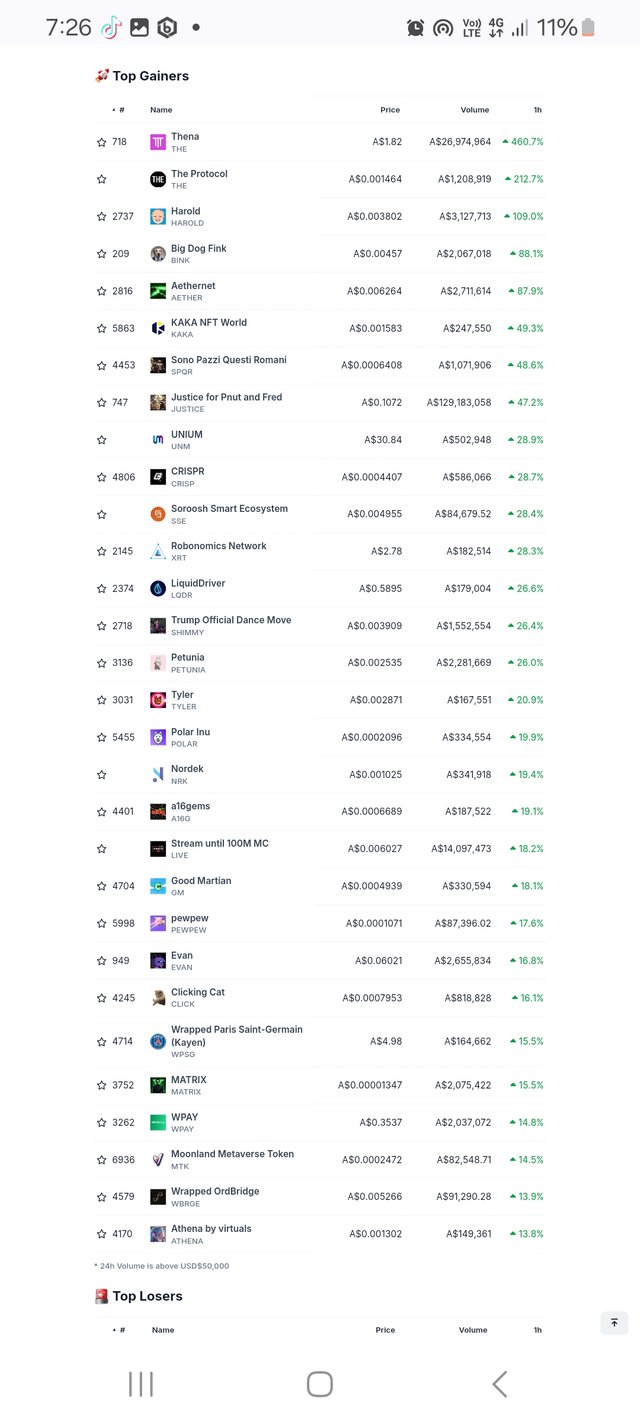

Attention from Top Gainers/Losers: If the cryptocurrency moves sharply in either direction, it might appear on CoinGecko’s list of top gainers or losers. This visibility can further attract traders and investors looking for quick gains or opportunities to invest in trending assets. For a coin finding itself at a much lower than listed market cap, which is common for CoinGecko listings, this spotlight can be particularly impactful. Knowing that many Inus take a retracement before they officially climb the charts, such listings can set the stage for dramatic recoveries.

FOMO (Fear Of Missing Out): A rapid upward movement can indeed trigger FOMO, especially if the daily gains are in the range of 100–200%. This kind of momentum can lead to more buying pressure, further inflating the price in a short period. For projects like Polar Inu, which might be listed at a much lower market cap, this FOMO effect in the upwards direction can be highly promising. The initial low visibility can give way to significant attention once the coin begins to surge, potentially leading to a virtuous cycle of increasing interest and investment.

Case of Little Bunny Rocket: From what we know, Little Bunny Rocket (LBR) was a textbook example of how speculative interest can drive price. Listed with a market cap around $20,000, LBR experienced an incredible 9000x increase, soaring to a peak market cap of $180 million. I sold before it reached $100,000, enjoying a few Xs in profit. New listings, particularly those at low market caps, can attract a surge of new traders and investors due to their visibility on platforms like CoinGecko. However, without substantial underlying value, such coins can be prone to sharp declines after their initial hype.

Lower Market Cap: Finding ourselves at a much lower than listed market cap, which is common for CoinGecko listings, and knowing that many Inus take a retracement before they officially climb the charts, listing at a much lower market cap can be highly promising for projects like Polar Inu. This phenomenon underscores the potential impact of increased visibility and the dynamics of FOMO in the crypto market, particularly when tied into the lists of top gainers and losers.

Example of $LBR: LBR’s journey is a cautionary tale of meme coin hype where the excitement was temporary. In contrast, Polar Inu is positioned differently; it’s not just another meme coin but a project directly tied into Polar’s ongoing progress. While LBR’s ascent was a spectacle of speculation, Polar Inu’s development is a continuously evolving narrative, where the project’s growth and value are intrinsically linked to tangible advancements and community engagement. This suggests a potentially more sustainable trajectory than purely speculative meme coin ventures.

Remember: These movements are often speculative and can be very volatile, leading to quick gains but also potential rapid losses. It’s essential for investors to do thorough research beyond just the excitement of a new listing or price surge.