2018 in review: ICOs

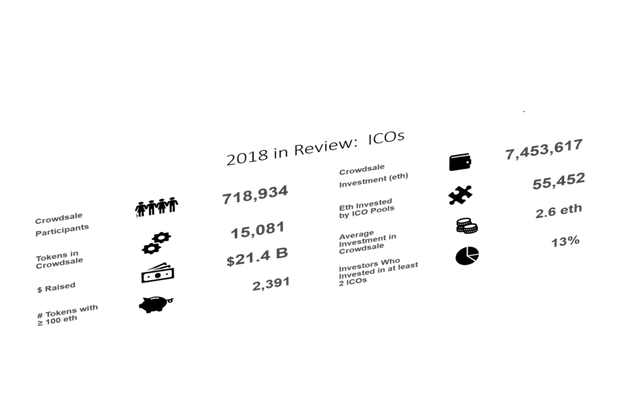

2018 has been a fabulous year for the ICOs - twice as many ICOs, thrice the money raised versus 2017… A superficial researcher exploring the early days of cryptocurrency in 2043 could have come to this conclusion based on the statistics. As we know there are: “Lies, damned lies, and statistics”.

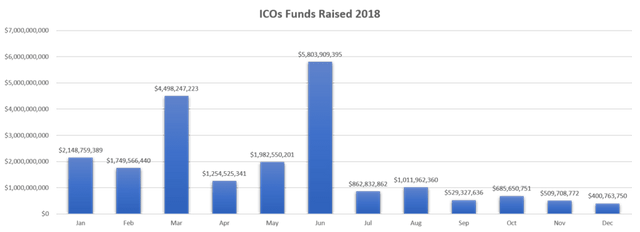

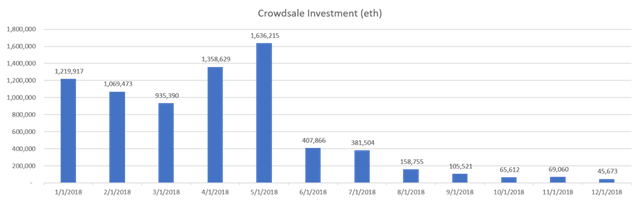

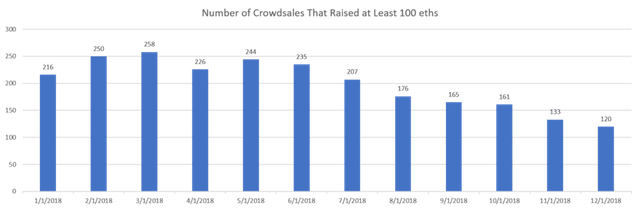

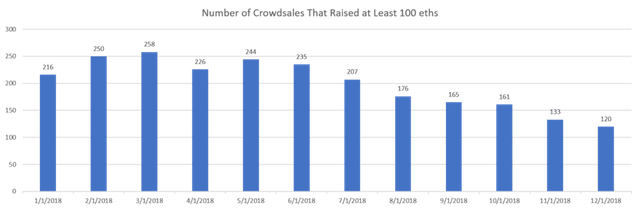

The crypto market reached its zenith in January, the inertia allowed for a few more months of successful ICO fundraising (note, that the numbers are heavily skewed by EOS and Telegram). In the first six months of the year, $17.5 billion was raised, in the second - $4 billion, so a considerable cooldown. February 6, 2018, Jay Clayton, Chairman of the SEC, testifying in front of the Senate’s Committee on Banking, Housing and Urban Affairs stated: “By and large, the structures of ICOs that I have seen involve the offer and sale of securities and directly implicate the securities registration requirements and other investor protection provisions of our federal securities laws”. The U.S. government hasn’t come out with any specific ICO regulation, it hasn’t been banned it, there is not a single federal law that governs it. Yet, all the carefully measured statements made and the actions taken throughout the year by the SEC, have made it abundantly clear that ICOs, as we knew it, are over. There are three major implications for the market that arise from it:

- Anyone wishing to offer coins in the ICO to the American citizens needs to comply with the Securities Acts of 1933, 1934 and any other regulation pertaining to the offering of securities.

- Those who had allowed Americans to participate in their offerings might have to restitute them in full (fiat equivalent).

- Most of the crypto exchanges are in violation as they have allowed American citizens to trade tokens that will be considered “unregistered securities” and themselves do not have proper licenses to be trading securities.

The impact of this reckoning is further multiplied by the predominant position of the USA in the global financial markets and the desire and the ability of its judicial system to exercise its power extraterritorially.

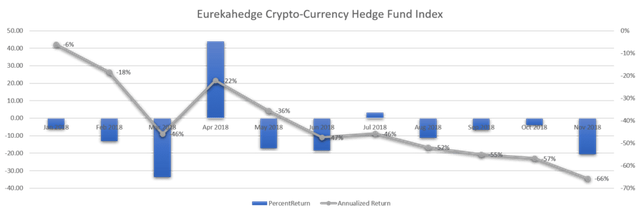

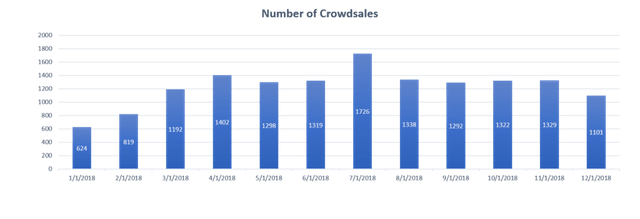

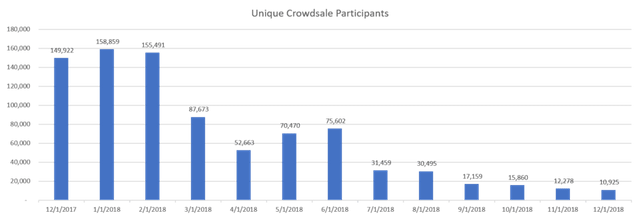

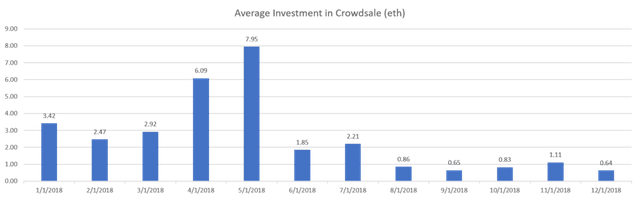

This crowdsale was slowly dying caught between the rock and a hard place - collapsing ether price and regulatory pressure. As ether and bitcoin were depreciating, so were most altcoins. The crowdsale was dependent on the crowd investing in one ICO, receiving exponential returns and then reinvesting it into the next ICO. Everyone was feeling rich and wanted to become even richer. But once this cycle was broken, there was no way of fixing it. ICOs turned to crypto funds, hundreds of which popped in late 2017 - early 2018. However, so-called “professional investors”, “smart money” haven’t done a much better job than the crowd.

Thus, 2018, instead of becoming the year when this new fundraising model become mainstream, turned out to be the year when many of the inadequacies of this model have come to the surface. It’s not to imply that the ICO is dead for good. It will come back whether in the form of STO or in some other form that we can’t yet envision. Despite all its faults, it introduced unprecedented democratization of the investment process in human history.

Predictions for 2019

- STOs

- More stablecoins

- Tokenization of real assets (real-estate in particular)

- Return of the crowdsale towards the end of 2019 in some shape or form

- Possible reinvention of the “utility” token

- Focus on privacy ecosystems

2018 in Review: ICOs (data: bloxy.info)

Originally posted on Crypto Insider : https://cryptoinsider.com/2018-review-icos/