Adara Exchange Infrastructure: Nostrum Apparatus Perfectus

Trading has evolved greatly over the last three decades, with the biggest changes taking place in late 2000s when improved communication channels allowed for high frequency trading. Since that moment, one of the key competitive advantages for every exchange has been speed, cryptocurrency not being an exception.

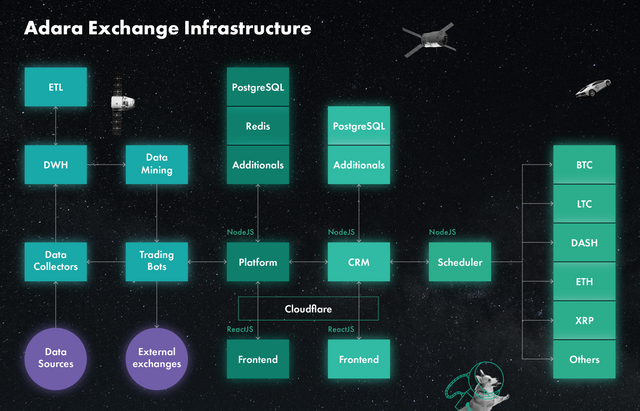

Stable performance of the order processing engine, low latency transactions and a zero failure rate are demanded from every exchange daring to compete these days. We were very much aware of that when first designing the Adara Exchange, the core element of the Adara Universe. We would like to share details of our exchange infrastructure which we internally call Nostrum Apparatus Perfectus, aka ”The Perfect Machine.”

Adara’s technical infrastructure approach faced two demands: general requirements as a security token exchanges and the future implementation of it being a decentralized exchange. In order to maximize its functionality and capacity, we used the advanced solutions for Adara’s exchange infrastructure allowing for:

General Structure

The user operates via a localized frontend module connected to the platform via websocket for real time data exchange using the algorithm the frontend has chosen.

When an order is placed, a command is sent to the platform where it is processed along with command from other traders.

The centralized exchange uses functionality provided by the Lambda Amazon Cloud Platform and using Node.js. All transactions are recorded and stored in the Amazon Cloud Platform, whose database features are reliable, consistent, and has the ability to do horizontal auto-scaling. Order book data is stored in a Redis cluster, an in-memory database technology that also features horizontal auto-scaling and distributed in-memory replication.

This results in maximum speed (and minimal latency) and potentially unlimited scaling of operations. In multiple stress tests, the Adara Exchange was on average able to process 945,000 transactions per second and produce 10,000 order book updates per second for each trading pair.

Bots and Automation

The platform is connected directly to trading bots which operate under their own pre-designed algorithms and trading strategies. Adara will provide investors with multiple opportunities to create their own trading bots that could react specific signals or implement auto-following tactics. For example, you wouldn’t need to wait for the particular move in front of your screen; in case some technical analysis signal calls for the buy or sell move (“BTC price has crossed its 200 day trailing average”) the bot will place an order automatically.

In the nearest future Adara will provide investors with a comprehensive set of tools allowing to manage their positions based on risk metrics they choose as well as many external management options when the account is run by a qualified trader, or mimicking techniques that allow to copy other traders’ moves.

CRM and Scheduler

The platform is the system’s core. It is connected to the Customer Relationship Management system. CRM allows to account for users’ positions and portfolios, see all trading history and measure performance.

CRM is connected to the Scheduler which enables cooperation with the outside world. That is where assets are deposited and withdrawn, incoming and outcoming transaction with all blockchains are carried. Storing assets is the area where security and data protection is of extreme importance.

In order to maintain the highest level of security Adara implements a variety of different safety measures, such as Advanced Encryption Standard (AES) which is one of the most secure encryption algorithms available today, utilized by high profile entities such as the NSA, Microsoft, Apple and the US government. Additionally, Adara uses full-disk encryption (FDE) on all servers and developer machines to prevent data being stolen. AI driven independent security audits will be provided by the U.S. based company Wallarm, who will apply machine learning to detect and identify anomalies in user behavior. Integrated into the software development aspect of Adara is the Microsoft Security Development Lifecycle (SDL), which is an industry-leading software security assurance process. Lastly, Adara stores 80% of digital assets in offline, multi-signature wallets.

Future Developments and DEX

The elimination of a third party via peer-to-peer transfers of assets is the core of a decentralized exchange (DEX). Adara believes that our DEX represents the future of asset management and trading. Thus, as technology advances, Adara will implement decentralized elements and features in its architecture where it makes sense.

DEXs convey a multitude of information during digital asset transfers, such as key information on liquidity, trade logic and fund management. Open or closed smart contracts that are publicly verifiable and auditable are a common solution. Here, order settlement is the creation of a smart contract after the order is filled and settled on the blockchain.

Other projects have chosen to create their own protocol combined with a native token. In some cases, they are blockchain agnostic solutions, meaning they could potentially transfer any token inherent to any blockchain. Promising projects Adara is looking at are for example 0x, Loopring or Cosmos, but others like Kyber, Airswap or NEM are also on our radar. We are flexible to change to any combination of solutions that better fits the needs of the exchange.

You can contact us via

Thanks for this. I cant wait to get invested with the Adara platform!

This moment is really close! We expect to start in early September.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.