Bitcoin & Altcoin Price Analysis 25 Jan

Yesterday produced a green candle in the Bitcoin market. Bringing some hope to an otherwise gloomy market. This on the back of the Weiss cryptocurrency ratings paper which was released yesterday, amid much controversy. BTC seemed to have shrugged the ratings off and closed the day on the green.

The 2nd round of BTC futures close tomorrow, it will be interesting to see the effect that this has on price. Myself and a few others have been speculating that the decline in price over the last few weeks is as a result of traders shorting the futures market. The last 2 green days are poking some holes in my hypothesis though. Lets see what happens today.

BTC price is hovering around the resistance level of $11 500, this coincides with the 236 Fib level, and is thus a significant level. If it manages to close the day above this price then it may find support here going forward. In order for the bulls to gain control we would need to see price close above the 8 day exponential moving average (EMA 8) and then test the EMA 20 level. For now, price is still below these moving averages. The RSI is flattening out, but has not yet reached the oversold mark. MacD is flattening too, eyeing a reversal in the trend. Something to watch out for is divergence between price action and the RSI.

I am still watching the development of the bullish Gartley pattern I highlighted a few days back. I will keep an eye on this. Watching for price to come down into the green box at the “D” point. If it does this, then we could see an upmove to the “C” and “A” levels. To understand more about the Gartley pattern, read here.

In other news, the island nation banking hub of Bermuda indicated at the World Economic Forum at Davos yesterday that they are looking into creating a land registry on the blockchain. This is a fantastic test case of how smart contracts can be used in the real world. Audit giant DNV GL are partnering with VeChain to create a logistics blockchain which will track all shipments in real time, another great application of the tech.

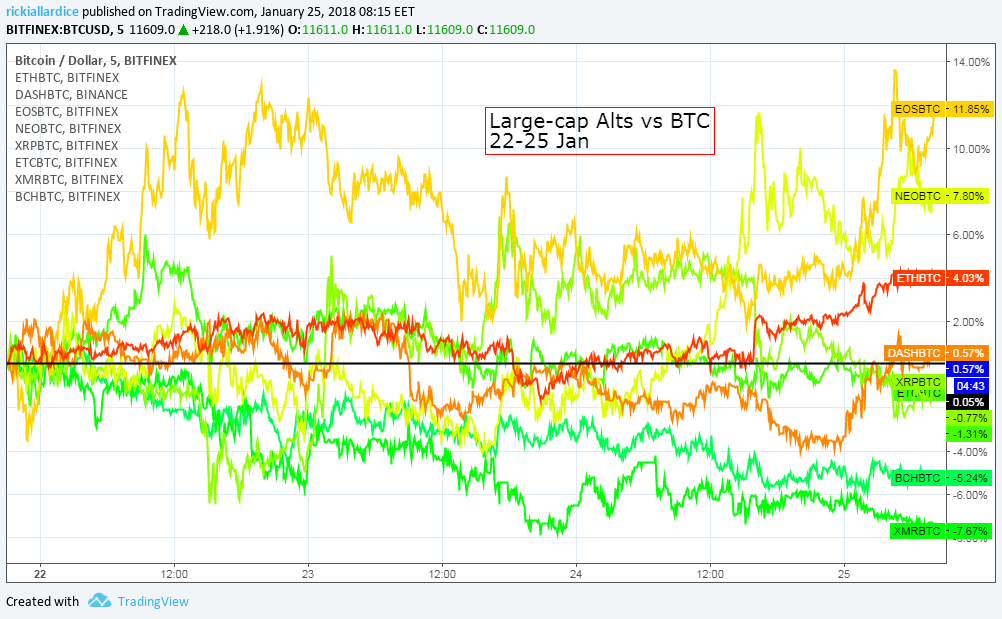

The altcoin market has bounced back over the last three days, on the back of a rising Bitcoin price. However, of the large-cap alts, only EOS, NEO, Ethereum and Dash have managed to gain ground when priced in Bitcoin. EOS is leading this charge and still showing its strength even in these trying times. I would keep an eye on this this coin. NEO is hot on its heels. These two coins are in direct competition with one another in the smart-contracting and decentralized app space. Their largest competitor is Ethereum.