Ethereum, the new Bitcoin

About myself

This is the first time I post anything on steemit. I will try to post informative and in-depth looks at cryptocurrencies that I think will be booming in the near future. I will prefer quality over quantity, so I won't post often, but when I do, I try to make it worth your time.

Please consider that although I provide many sources and reasoning, it's important to do your own research and never use only one source before investing. Never trade what you can't afford to lose.

This post will be about Ethereum, because I think it will perform really well in Q3 and Q4 of 2017

Ethereum

The past

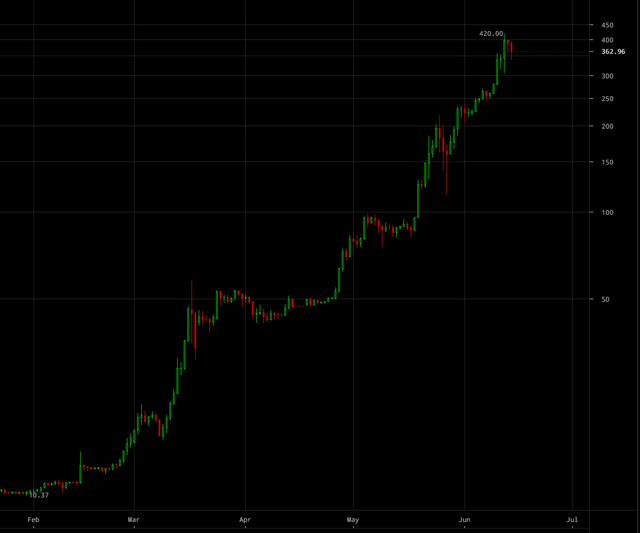

Ethereum has been growing exponentially ever since its creation in Q3 2015. As you can see, it has consistently doubled (at least) every month, sometimes even more than that.

Even though Ethereum is a very young coin (barely 2 years old) it already has a staggering market cap of of $34 billion, which is over 30% of all of the cryptocurrencies combined, and if we exclude Bitcoin, Ethereum actually has more value than all of the altcoins combined.

Why did Ethereum outperform the rest by so much in such a short time? Let's take a look at the fundamentals.

The fundamentals

To understand Ethereum, first we must understand Bitcoin, and what went wrong there.

Programmable money

Bitcoin, the first 'programmable money' is has seen a little adoption as speculative asset, currency and to a lesser extend a store of value (although, for the latter takes time to develop, because you can only trust a store of value after it has a proven track record of decades at least). Bitcoin has been around for almost a decade now, and no "killer app" has been developed to make use of their ability to be "programmable money". As Ethereum shows, that was not for lack of creativity or ideas, but because Bitcoins restrictive language makes it difficult to write apps on top of it.

How does ETH perform in that aspect?

We only need to look at all the assets and currencies that have already been build on top of Ethereum to notice ETH stacks up much better than bitcoin. As Ethereum already serves as the platform on which services like Golem, Augur and ICONOMI are build, to name just a few examples.

Ethereum is simply much easier to work with because it support two programming languages that are far easier to learn and far more intuitive to work with than the language bitcoin is using. Even a major German newspaper called Bitcoin a pocket calculator compared to Ethereum as an iPhone. That is far from the only major newspaper writing about Ethereum either, but I digress, more about that later.

The importance of this can not be overstated. Entire corporations were build around being a platform for apps. Tech giants Google and Apple rely completely on applications on their respective platforms.

Scaling and 'governance'

" If a kingdom becomes divided against itself, that kingdom cannot stand; and if a house becomes divided against itself, that house will not be able to stand. "

- Jesus, Mark 3:24-25

For the past few years, the community of bitcoin has been divided over debating how bitcoin should scale. What should have been a routine upgrade turned out to be a disaster that torn the community apart, resulting in many big investors and even developers to lose trust and turn their back on bitcoin. These were people that truly believed in Bitcoin, but were turned away by the lack of good governance.

But you might say, a decentralized government should not be governed at all, lest it be centralized? Fair point. Ethereum does not actually solve this problem, but at least their project has so far not run into major problems after they forked from the DAO disaster resulting in ETH and ETC, both of which have performed well since. In a later article I will write about Dash, the only currency that actually properly solved the governance problem, but that's a topic for another day.

Ethereum does not have a leg up on bitcoin in this regard technically, but at least the community is not divided, and the last time it was divided, they were not scared to split and put their money were their mouth was, resulting in two perfectly working forks of Ethereum (ETH and ETC). So in case another big point of contention arises, it's possible we will just see another version of Ethereum pop up, and there is nothing bad about that. Don't take this as relationship advice, but sometimes a friendly breakup is better than a hateful relationship. See /r/btc and /r/bitcoin.

I am sure Bitcoin would have been much better off if they would have forked and have two versions of bitcoin running, like ETH and ETC did.

While unlike Bitcoin, Ethereum does not derive its value solely because of transactions per second, it is still a large part of what gives Ethereum its value. In the past week, Ethereum has started to outperform Bitcoin in transactions/second. Simply because Bitcoin has reached their upper limit on how many transactions will fit into their blocks. Without a blocksize increase, Bitcoin can no longer meet the demand for transactions per second, and this demand is now being supplied by Ethereum, which has more capacity than bitcoin.

Even though Ethereum also does have a transaction limit, this limit is higher than that of Bitcoin. On top of that, Ethereum is being upgraded constantly, so I do not foresee any problems with upgrading the capacity on Ethereum. Even if Ethereum does not scale beyond its current limit, this limit is still at least 5 times higher than that of bitcoin.

Keep in mind also that Ethereums value does not solely rely on transactions, because Ethereum's core focus is not based on being a currency, unlike Bitcoin. It is therefore no surprise that there are other coins that can serve better as a currency than Ethereum ever could, because every choice is a trade-off, and Ethereum won't sacrifice utility to focus on only one aspect.

Brand recognition

The only thing keeping bitcoin relevant right now is the network effect and the brand recognition.

Given a headstart of several years over Ethereum and most altcoins, Bitcoin is much more known than any of the altcoins. However, the world is waking up to altcoins, and Bitcoin will not be able to stay ahead if it doesn't adapt. Which it already can't do because they can't even manage to do a routine capacity upgrade.

Ethereum has increasingly been mentioned in positive light in the media in the past month, and google searches for Ethereum are starting to surpass google searches for Bitcoin in most developed countries.

Momentum

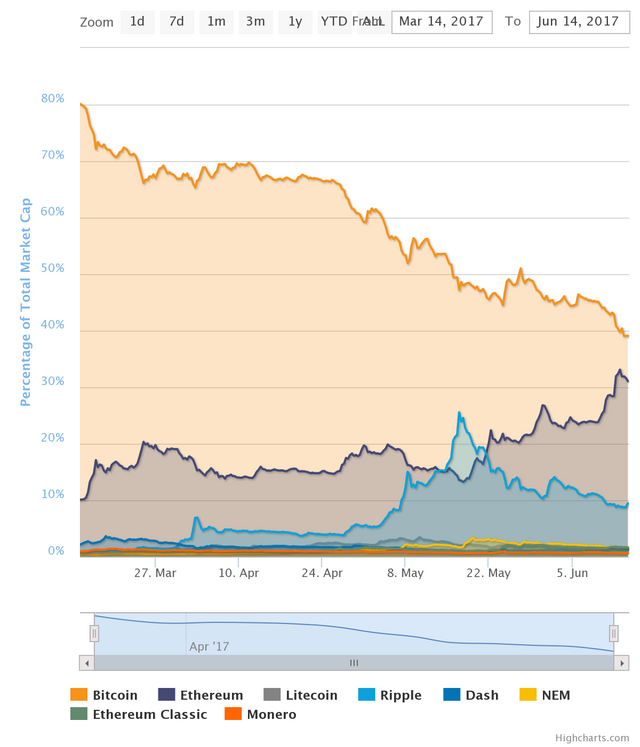

It is no wonder than that bitcoin lost 40% of their market share in one quarter, dropping from 80% of total cryptocurrency market value in March to under 40% in June.

Many people have just shrugged this away and assumed this was because of the massive amount of new coins being created, each taking a small share of the pie. However, consider that in that same timeframe, Ethereum went from only 10% of the total cryptocurrency market value to a whopping 32%, putting the combined market value of Bitcoin and Ether at over 70%. Other altcoins therefore barely even have an impact at all.

At this rate, Ethereum looks destined to overtake bitcoin before the end of the month, and reaching 60%+ of total cryptocurrency market value by September. If we take a conservative estimate and assume the total cryptocurrency market cap would be around $200 billion by September then Ethereum would trade at roughly $1250 by September.

For up to date statistics on Ethereum overtaking market share, check http://www.flippening.watch/

Q3 2017 forecast, news and rumors

The third quarter of this year starts of with Ethereum being the first cryptocurrency to challenge the market dominance of Bitcoin. This in itself is a very bullish signal, as bitcoin has maintained between 80 and 90% market share for years, and only by Q2 2017 has it began losing dominance. Most of this market share was absorbed by Ethereum. Which shows us two things.

- Cryptocurrency is a winner-takes-most market.

- Ethereum is positioned to take the lead for now

Based on this alone I believe by the end of Q3 2017 Ethereum will have at least 60% of the total market share of cryptocurrencies and I expect it to stabilize at 80%+ by Q4.

The event often referred to as "the flippening" will likely catch mainstream media attention, as Bitcoin and Ethereum are already regularly reaching the mainstream media and social media (which is the new mainstream media). This will further bring Ethereum under the attention of potential investors, who will see Ethereums amazing track record and eventually greed will overcome doubt.

That alone is more than enough good news for the year, however, almost too good to be true there is even more good news.

Ethereum is doing big things at the GBCC tomorrow, bringing a whole branch of EEA dedicated to China on board. China is a big player in the global market, and they are very well acquainted with bitcoin already. Bringing large Chinese companies on board will spike demand in China, which is a very bullish signal indeed. They are also trading partners with Russia, where Putin already showed signs of interest in Ethereum.

As much as I think cryptocurrency is bigger than politics, it is still good news to have economical powerhouses jump on board. Provided they don't ruin the currency like Blockstream/AXA did with Bitcoin.

I expect Ethereum to end Q3 2017 at around $2000 per ETH.

Q4 2017 forecast, news and rumors

An upgrade to contracts called "Metropolis" will be rolled out. I don't understand enough of it to know what affect it will have, but I wanted to list it for completion.

A bank in Switzerland announced their plans of launching what amounts to an ETF for cryptocurrency in Q4 2017.

Their goal is to raise ~$113 million of assets under management in year one with the ambitious target of $3.4 billion within three years. Wealthy investors have already dedicated tens of millions. Switzerland has been very loose in their regulations towards cryptocurrency, and even experimented with local governments to allow the payment of government services in Bitcoin. There is a good change an ETF will be approved in Switzerland.

All in all, this seems like it could be the best year for Ethereum. I expect the price of Ether to be $5000 by year's end.

Last notes

Of course nothing can rise this quickly forever, doubling in value every month forever is impossible. Ethereum has been doing that for at least the past 6 months, and might still keep doing it for several more months, however it will stop growing eventually. The question is when.

Considering also that exponential growth like this usually stop only when there is a reason to stop. In nature, things grow exponentially all the time, such as populations or organisms, like rats on an island. The only time when they stop growing exponentially is when they start to compete over resources. In other words, there's more rats than the island can support.

In the case of Ethereum, the growth could continue for a while longer because compared to the world economy Ethereum is just a drop of water in the ocean. It's barely noticeable, and even if it keep doubling each month till the end of the year, it still won't make a dent in the world economy. Therefore, although I fully realize it won't keep growing forever, it has a long way to go before reaching its limits.

To demonstrate how fast a growth of 100% per month is, here are the values Ethereum would be if this trend would continue. Note that I do not think this will happen. Do not take this as investment advice, this is merely for demonstration.

June 1, 2017: $222

July 1, 2017: $444

August 1, 2017: $888

September 1, 2017: $1776

October 1, 2017: $3552

November 1, 2017: $7,104

December 1, 2017: $14,208 (this would mean a total market cap of about $1.3 trillion, which is more than 10 times the current market cap of all cryptocurrencies combined).

I do not think it is impossible, given that it has already done this in the first half of 2017, and $1.3 trillion is still small compared to many other financial sectors. However, I do not count on it happening as there is a big chance that it won't happen.

Sources:

https://cryptowat.ch/coinbase/ethusd/1d

https://blog.coinbase.com/ethereum-is-the-forefront-of-digital-currency-5300298f6c75

Süddeutsche Zeitung Nr 132. Samstag/Sontag 10./11. Juni 2017 Page 33

http://www.cnbc.com/2017/06/12/ethereum-price-hits-record-high-after-bitcoin.html

http://fortune.com/2017/06/12/ethereum-bitcoin-2017-all-time-high/

https://bitinfocharts.com/comparison/transactions-btc-eth.html#3m

The only danger I see right now is quick ban of cryptos in China, because of too many people switching their focus from real goods production to cryptoponzi madness. You know, thinking that one can easy triple their money, without doing any hard work, just by clicking buttons... Look at how many ICOs do we have per month now, and I bet we can only see a tip of the Chinese iceberg from here. Now imagine that more and more people 'invest' in ICO, drop their real jobs, get burned, etc etc, now we have less food and goods produced+low morale= GG.

That might be possible, but on the other hand, China is the main country developing and producing ASICs, so that might actually boost their production as well.

Nothing is ever sure in investing though.

I hope people won't be so irresponsible to leave their job prematurely.

Congratulations @zimmah! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGood points in this post. I was about to start a similair discussion. The current total market cap of all cryptos might seem high but blockchain is here to stay and will involve all our lives. I do see a bright future for everyone that's hold's their coins with a long term vision. I found this amazing platform: https://www.coincheckup.com I'm really enthusiastic about this site, they let you analyze every single coin out there. For example: https://www.coincheckup.com/coins/Ethereum#analysis To see the: Ethereum Investment research.

Nice post! I will follow you from now on. I give you a vote!