"Biggest Theft In Crypto History": Over $400MM Stolen From Japanese Crypto Exchange

Content adapted from this Zerohedge.com article : Source

Live price at https://www.livecoinwatch.com/price/NEM-XEM

by Tyler Durden

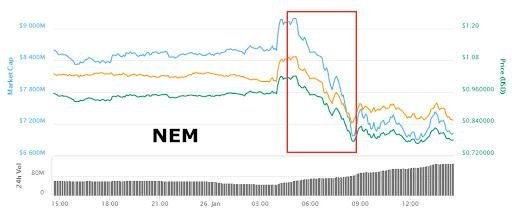

Earlier today we reported that cryptocurrencies tumbled overnight after one of the most popular - if unlicensed - Japanese exchanges, Coincheck, halted withdrawals of funds and cryptos amid broad confusion as to what prompted the halt. Additionally, Coincheck said it had stopped deposits into NEM coins, a hint that something was very wrong with what until last night was the 10th-largest cryptocurrency by market value, and which tumbled nearly 20% overnight, dragging the rest of the sector lower as news of the Coincheck fiasco spread.

Speculation was rife: "Coincheck is a very well-known exchange in Japan," said Hiroyuki Komiya, Chief Executive Officer of Tokyo-based Blockchain Technology Consulting. "We've seen several outages at various crypto exchanges recently, so the extent and seriousness of Coincheck's halt isn't yet clear. We're all very eagerly awaiting to hear more detail on what's happening."

We didn't have long to wait: shortly after the halt, theories started to emerge as to what may have happened, with some speculating that the exchange may have been hacked after noticing that a massive ($110 million) transfer from Coincheck's Ripple wallet:

110 mil usd in #Ripple (XRP) were sent from the Japanese cryptocurrency exchange Coincheck to an unknown address. Hacking suspected.

— Costin Raiu (@craiu) January 26, 2018

And then, the worst case scenario was confirmed by Coincheck itself told financial authorities that it had lost 500 million NEM cryptocurrency coins in today's cyberheist, which at the current exchange rate amounts to roughly $400 million, according to Nikkei.

NEM Foundation president Lon Wong also confirmed Coincheck was hacked, calling the stolen funds "the biggest theft in the history of the world", as quoted by CryptoNews. According to Wong, the hack had nothing to do with NEM and the blame lies exclusively with Coincheck:

"As far as NEM is concerned, tech is intact. We are not forking. Also, we would advise all exchanges to make use of our multi-signature smart contract which is among the best in the landscape. Coincheck didn't use them and that's why they could have been hacked. They were very relaxed with their security measures," Wong said.

"This is the biggest theft in the history of the world," he added.

The hack, at recent NEMUSD exchange rates, would make it even bigger than Mt. Gox - which lost a total of $350 million in 2 hacks, one in 2011 and 2014 - by $50 million.

As noted above, Coincheck was one of the few crypto exchanges not registered with Japan's Financial Services Authority - a regulator responsible for overseeing exchanges in the country - unlike the other prominent cryptocurrency exchanges, such as bitFlyer and Quoine. Furthermore, according to MineCC, CoinCheck used hot wallets not cold wallets, which are not secure.

Which may explain why local regulators are only now looking into what happened:

- JAPAN FSA SAYS LOOKING INTO FACTS OF COINCHECK CASE

While little additional information was available as of this moment, Coincheck added that the hacked NEM was sent illicitly outside exchange, at which point the trail was lost however "no other issues found with other currencies on exchange." Of course, the historic, nearly half a billion dollar hack is a big enough "issue."

The Japanese exchange also said that it was "working hard to secure client assets", and that it doesn't know how many total coins were lost, adding that it was not clear if NEM losses were internal or external.

And while memories of the historic Mt.Gox hack suddenly rush front and center, Coincheck said that it plans to start trading of unaffected currencies. In retrospect that may not be a good idea.

Paradoxically, cryptocurrencies have risen as the Coincheck hack news spread amid expectations the thieves will convert their stolen NEM coins into another cryptocurrency.

If they wanted to save their business the same way BitFinex did they should halt withdrawal and give a haircut of everyone's balance.

But the fact that the amount stolen would could have collapsed NEM's global market make the whole thing a huge clusterfuck.

Example : Some guy has 80% of STEEM's supply on an exchange that get hacked. Although he would have crashed the price to near 0 by selling even 1% of that, he's incurring a liability far far bigger on the whole market.

The country's biggest Crypto currency exchanges check their code, without any explanation, stopped trading bitcoin withdraw their assets and customers.NEM based were forbidden to trade, and thus value lost 14.5 percent to $ 0.81 until it landed. The Tokyo-based company, according to Bloomberg News, without a license from the Japanese financial institutions, and this in spite of the country's most popular Crypto Currency exchange. On the other hand, the U.S. Treasury Department terrorism and financial intelligence Division for the supervision of banks and financial authorities of Asian Crypto currency activity, there are suggestions that must make more efforts.@zer0hedge

While, on the surface this looks like a black mark against cryptocurrencies, it actually could work in its favor.

Holding crypto on a centralized exchange can be hacked....yet on a decentralized blockchain (ie an exchange on the blockchain like BTS), then hacking cant happen.

This is something that is going to really start to awaken people to the danger of centralization.

Yeah decentralized blockchain can cause no hack.

Reading the article there are so many things being pointed out but some of them are quite scary and all relate to security issues and not being licensed by the Japanese Financial Services and the use of hot wallets which they admit are not secure. Hopefully in light of what has happened and regardless of how much is lost this will cause them to look at all the security in place and upgrade what needs to be upgraded, if for no other reason than peace of mind for future investors - and we know there will be some

@zer0hedge..bro Up until this event, Cryptos had been stolen for about $400 million so today is a one day double of Cryptos..The idea is theoretically possible however the "hack" can easily be confirmed by seeing the transaction on the blockchain explorer ... if you see it there then genuine coins were moved out of the exchange "slush fund" and onto the blockchain and into someone's wallet. Those coins had to really exist in the exchanges NEM cold wallet. This would worsen the exchanges situation .. yes ? the slush fund ..Washington recklessly accuses Russia and China of hacking while providing no evidence backing its claims.At the same time, it’s silent about most Internet servers located in America, facilitating its espionage, including hacking to obtain unauthorized data. Washington rules mandate doing what “we” say, not what “we” do.So in the U.S., our regulations (state that) if you're a bitcoin wallet you're subject to the same regulations as a bank."We want to make sure the rest of the world, and many of the Group of 20 countries are already starting on this, have the same regulations. We encourage fintech (financial technology) and innovation but we want to make sure all of our financial markets are safe," he said.They are sowing FUD and shaking in their boots.thank you for sharing info with us...

$400 million Cryptos had been stolen!!!seriously??

You're absolutely right that if the software code is open source then the value is not so much in the code but in the network. Anybody can, e.g., copy the Ethereum network (and some did) but noone has managed to attract - by a wide range - the same number of nodes and developers. And the security of the blockchain heavily depends on network size. To state that there is no value in a large decentralized blockchain is simply not true. The 900+ projects that decided to build their applications on the Ethereum network clearly indicate otherwise. A few examples: Several big banks are currently automizing their compliance functionalities on Ethereum. Innogy, the clean energy subsidiary of German energy giant RWE, has put its entire EV fueling stations on Ethereum. And even the United Nations use Ethereum for their World Food Program. Obviously, those companies disagree that there is no value to them in the Ethereum blockchain. And for using their applications they need Ether, the native token of Ethereum. So, Ether may not be an asset as it does not generate cash flows but it surely is some kind of commodity that allows users to use the blockchain.

@zer0hedge

Wow, maybe a good time to buy some more?

This is really an important topic

Since the morning and there are problems with the Japanese CoinCheck, which began to stop buying his work Nem and then was stopped selling and then was stopped all withdrawals of the platform in all forms and still the news of imports from the Yabat on this matter.

The news is that it was stolen by the value of 500 million dollars Net NEM done early in the morning. And there is no confirmed news yet. Perhaps this is why the market trend to red color today.

Its NEM fell by 17% today, higher than the other top 10 currencies in the coinmarketcap as well, and among the factors that may confirm the news of the theft. Since the simplest thing is that the thief sells his coins instantaneously so that all its effects are hidden and difficult to follow.

If this is true, its negative effect will last for at least 24 hours and will be considered the biggest theft ever made after MTGOX in 2011. And to remember the months of thefts in the field of encrypted currency were as follows:

Japan's MTGOX platform in 2011 was stolen by a total of $ 350 million, now estimated at 1.3 billion

The NiceHach platform two months ago promised the import of stolen goods last January 2018 worth 75 million dollars

Pfinx provided $ 70 million in USDT and the money was returned to subscribers over time

A process that was stolen by the Dai etherium that produced the etherium classic in 2012

The process of parity wallet, which differed opinions Are you stolen or wrong programmer? With a value of 30 million dollars in July 2017

BITSTAMP in 2015 with a value of $ 5 million

The IOTA governor, who was discharged from the currencies of 4 million, was not known by the official and the team explained that the reason for the fall of the owners of portfolios who were born seeds to the governor is unreliable and was about a week ago.

Thanks for the valuable participation. @zer0hedge

Very important thank you for your participation

Here are some victims of theft

Kaspersky Lab, a Russian company specializing in the field of security and electronic protection, said it has detected about 45 thousand attacks on the encryption software "WNA Krai" confirming that the Russian Federation was one of the countries most affected by these attacks.

According to the Russian Interfax news agency, Russian Interior Ministry servers were hit but that did not lead to the diversion of information. Russian media reported that the Russian mobile network company "Megavon" closed several servers of its computer network due to cyber attacks.

Sharbank, one of Russia's largest banks, has also announced that its systems have been attacked in a similar manner, which it claims has not affected its services because of the system of protection it relies on and faces such attacks.

The British newspaper The Guardian reported on Friday that the electronic system of the national health system "NHS" was subjected to systematic penetration caused by major technical problems.

Hospitals and clinics in cities and counties in Britain, including the capital London, were unable to access the patient's personal database, a spokesman said. He said all patient data had been encrypted by hackers demanding payment for the removal of the encryption system, There are no signs yet to indicate the success of hackers in stealing patient and employee data.

In Spain, several companies were attacked, and Telefonica said it had learned of an "electronic security incident" without affecting customers and services. It was also reported that Iberdrola Energy and Gas Natural were also affected by the attack , And instructed the employees of these companies to close their computers.

In France, Renault was the biggest hit, with the company saying it had stopped working at its plants in Sandoville, France and in Romania, to prevent the spread of the virus through its systems. @zer0hedge

NEM is already going strong. I really love their tech. The stupid exchange didn't use proper security. That's all. People have grown to know and see FUD. So I guess people were buying the dips like crazy.

Market was down already. Nothing goes down forever. The coolest epic thing would be a new high for cryptos. That'll show how bad assume we are. I just hope STEEM would stay cheap. This is still my day zero on blockchain and I'm having a great time on busy.org

I think I'm going to put some money into the platform. That should help me get follows. At the moment I have zero followers. That's d-zero on day zero with zero followers.

This is actually my first comment. Keep up the fight buddy. (Fight Club is a 10/10 movie 4 me)

Glad 2 meet you and follow!