What is NEO? Should You Invest?

NEO was originally created as AntShares (ANS) by Da Hongfei and Erik Zhang in 2014. It is referred to as China’s first blockchain platform. In June of 2017, it was announced that AntShares would be rebranded as NEO.

Much like Ethereum (ETH), Neo is a smart contract ecosystem built on a distributed ledger technology known as blockchain. Despite the media attention and constant comparison between the two platforms, there are some major differences between Ethereum and NEO, more on this below.

NEO's mission is to create a "smart economy" that revolutionizes the commerce market by digitalizing and keeping record of real-world assets on the blockchain. To accomplish this mission, NEO uses e-contracts (a.k.a. smart contracts) to generate digital tokens that have boundless use cases. NEO describes their mission in the following statement from their white paper:

NEO's focus is on asset management and exchange, differing from the focus of Ethereum which is a platform for decentralized applications (or DAPPS). Ethereum gains its value from the applications (DAPPS) built on top of the platform, NEO also gains value from the products or applications built on top of the system, but it shifts the focus from generalization to specialization and legalization. I think one of the main selling points of NEO is their focus on legal digital assets in every country, more on that later.

The NEO Consensus Algorithm:

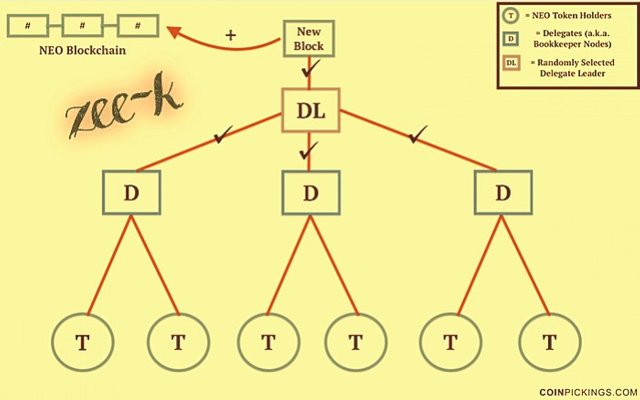

NEO operates on a consensus algorithm known as Delegated Byzantine Fault Tolerance (dBFT). dBFT aims to solve a fundamental problem in distributed computing - how do distributed nodes, who know nothing about each other and who receive information at different times come to a consensus? In other words, how do we ensure that data is valid, in the correct order, and recognized by all nodes in the network, regardless if there are 5 nodes or 500 nodes?

In a nutshell, dBFT works in the NEO ecosystem as follows: every NEO token holder has a right to vote on delegates. Delegates (a.k.a. bookkeeping nodes) verify each block written to the blockchain and each of them are responsible for keeping their own ledger of transactions that occur in the NEO ecosystem.

For each new block, a random delegate is chosen as the delegate leader. The delegate leader "proposes" their record of transactions for the given block to the other delegates, the delegates then compare their own records to the one proposed by the leader. If there is greater than a 66% (two-thirds) consensus, then the block is added to the NEO blockchain. If there is less than a 66% consensus, then a new delegate leader is randomly chosen and the process starts over again until a 66%+ consensus is reached. See

2 Tokens:

NEO and GAS are the two tokens driving the NEO platform. Both NEO and GAS have a total supply cap of 100 million tokens each.

The NEO token has 2 main roles in the NEO ecosystem: (1) to slowly generate new gas (until the GAS cap is reached), and (2) enforce network integrity by allowing NEO tokenholders to vote on consensus nodes and receive newly circulated GAS.

The GAS token has 1 major role in the NEO ecosystem: to serve as a utility token for service fees on the NEO blockchain. GAS is circulated in 2 main ways: (1) all system fees are recycled and then distributed to all NEO holders proportionally. (2) Transaction fees, paid out in the form of GAS, are collected only by consensus nodes.

In their white paper, NEO makes it clear that the NEO token is not a digital currency and should be classified as merely a blockchain protocol. By allowing the use of fiat currency on the platform and side-stepping the definition of a "digital currency", NEO is living up to their desire to work with governments and not against them.

The NEO token represents shares in the NEO ecosystem. NEO tokenholders have voting rights as well as entitlement to dividends paid out in the form of GAS. 50 million NEO tokens were distributed during its ICO and another 50 million sat under a lockout period of 1 year which actually expired on the day of this writing, October 16, 2017.

The "lockout" tokens are managed by the NEO council (the project's founders) and are to be used only for the development and support of the NEO ecosystem. The distribution of these "lockout" tokens is explained in the NEO whitepaper, here is a snippet of that section:

"10 million tokens (10% total) will be used to motivate NEO developers and members of the NEO Council

10 million tokens (10% total) will be used to motivate developers in the NEO ecosystem

15 million tokens (15% total) will be used to cross-invest in other block-chain projects, which are owned by the NEO

Council and are used only for NEO projects

15 million (15% total) will be retained as contingency

The annual use of NEO in principle shall not exceed 15 million tokens"

Why Invest in NEO?

(1) Wide-Ranging Applications

(2) Holding NEO Generates Dividends

(3) Compatibility

(4) Focus on Legalization

(5) Fixes a Major Flaw in the Current State of Tokenization

(6) The NEO Team

(7) Advanced Features of NEO

(1) Wide-Ranging Applications:

Just like Ethereum, NEO has a wide array of potential applications.

The NEO Whitepaper provides a list of future Decentralized Applications they plan to support:

(1) Smart fund

(2) AI-assisted legal smart contract

(3) Social networking

(4) Automated tokens liquidity providers

(5) Decentralized exchange

(6) Secure communication protocol

(7) Data exchange market

(8) Intellectual property trading market

(9) Prediction market

(10) Advertising market

(11) Hashpower market

(12) NeoGas market

(2) Holding NEO Generates Dividends

As I mentioned above, NEO token holders receive dividends in the form of GAS proportional to the amount of NEO tokens they hold. If you'd like to calculate how much you'd make holding NEO tokens, use this calculator. GAS will be generated by NEO token holders until the year 2038 when the GAS supply cap is reached.

NOTE: In most circumstances, you must hold your NEO tokens in your own wallet in order to receive GAS dividends. Most exchanges do not pay GAS to those who hold NEO on their platforms.

I believe in the long-term mission of NEO and I expect the value to rise significantly over the coming months/years. Being paid a dividend while waiting for mass adoption of NEO is an incredible benefit, especially at current rates (at the time of this writing, I'm averaging a 15% annual GAS payout on my NEO holdings).

(3) Compatibility:

The NEO platform does a great job distinguishing itself from other platforms such as Ethereum. With Ethereum, developers must learn a new coding language - Solidity. NEO is compatible with all of the major coding languages, here is a list of their current compatibilities:

(1) JSON-RPC

(2) C#

(3) Visual Basic

(4) .Net

(5) JAVA

(6) C

(7) C++

(8) Python

(9) Go

(10) JavaScript/TypeScript

In addition to being compatible with the major coding languages, NEO is also compatible with the major operating systems:

(1) Docker

(2) Red Hat 7.1 / CentOS 7.1

(3) Ubuntu

(4) Windows 7 SP1

(5) Windows Server 2008 R2

(6) Possible Future support of:

(7) Debian

(8) FreeBSD

(9) Linux Mint

(10) openSUSE

(11) Oracle Linux

(12) OS X

(13) Fedora

(4) Focus on Legalization:

The NEO team wants to work with governments, not against them. Their whitepaper discusses several legalities and why they aim to focus on compliance, but what really shows is the way in which the NEO ecosystem was designed. An in-depth look at how NEO and GAS work shows that NEO is trying to be compliant from the beginning.

A few major ways that NEO is working toward compliance:

(1) The NEO team clearly states that NEO is not a digital currency, merely a blockchain protocol

(2) NEO claims to have built-in KYC (Know Your Customer) and AML (Anti Money Laundering) API's

(3) NEO claims to have a built-in asset retrieval mechanism - if one loses their private keys, they could retrieve the assets held by that particular address without the help of a third-party

(4) The separation of the tokens NEO and GAS allows for a more legally compliant structure

With all the legalities of tokens and blockchains still in question by many governments, it's promising to see a platform so dedicated to work with governments to become legally compliant rather than trying to side-step or undermine them. In my opinion, if NEO succeeds in being able to legally digitize assets in all countries across the globe, adoption of the platform will be massive.

(5) Fixes a Major Flaw in the Current State of Tokenization:

The NEO team claims that the current state of tokenization is flawed in a major way:

"The transfer of tokens is much like the transfer of money, that is, the tokens could be transferred from the sender to the receiver with or without the latter’s consent. This kind of transfer is fine with currency, which does not carry obligations, not with assets like stock equities and creditor’s claims that do carry complicated rights and obligations. Thus, the transfer on Antshares is conducted in the form the e-contracts. In most cases, the transfer of assets requires the digital signatures signed with the private keys from both the sender and the receiver. In certain cases, an extra signature from the issuer of the asset is required. Recording transfers of assets on the Antshares is merely an onchain solution of the transfer of offchain assets. There are no new legal relationships that parties could enter into, so unlike the tokenization, flaws in laws are eliminated."

With the majority of ERC20 tokens the recipient's address has no say in the transaction (ERC20 tokens are those that use the Ethereum platform). If a transaction is sent to address Y, address Y has no way to decline the transaction. If they do not want the tokens and the obligations that may come along with holding those tokens, they are not able to reject the transaction.

As the NEO team mentions, this isn't an issue in regards to currencies (like Bitcoin or USD), because currencies don't carry obligations. However, in many cases of cryptocurrencies, stock options, etc. there are obligations that these assets carry. Therefore, it's the right of the recipient to decide whether or not they want to receive such obligations. The NEO ecosystem accomplishes this by requiring both the sender and receiver to sign off on a given transaction with both of their private keys.

Advanced Features of NEO:

I mentioned a few applications of the NEO platform above, but there are many other projects that the NEO team is working on/supporting that will benefit the NEO ecosystem, here are a few of them:

(1) Superconducting transactions - In an attempt to bring a higher level of efficiency to the ecosystem, NEO proposes a system for handling order matching "offchain" by a centralized exchange, but settling exchange transactions "onchain"

(2) NeoX - A project that would allow transactions to move across other blockchains

(3) NeoFS - A project that would allow large files to be divided and distributed in the NEO ecosystem

(4) NeoQS - QS stands for Quantum Safe, this is theoretically resistant to attacks from Quantum computers, which could pose a threat to blockchains in the future

Disclaimer: This is not financial advice. Any investments or actions you take should be based on your own research and knowledge of the markets.

Thanks for reading!

You can never solve a problem on the level on which it was created.

- Albert Einstein

Anytime! Glad you liked it!