Cryptocurrency Firms powerfully on the road in becoming banks

Hello steemains,

As we all can see that Bitcoins starts gaining momentum and there are various reasons because of which we have seen some spikes in its price recently.

Today we will talk about its progress towards becoming banks so everyone can understand the crypto importance

When bitcoin came out, supporters believed that the decentralized cryptocurrency would decimate the banking industry.

Several years later, as digital currencies became more mainstream, these networks were suddenly commanding billion dollar valuations. Meanwhile, cryptocurrency exchanges, brokerage services, and over-the-counter market makers have started to look into purchasing shares of banks and even becoming the banks themselves.

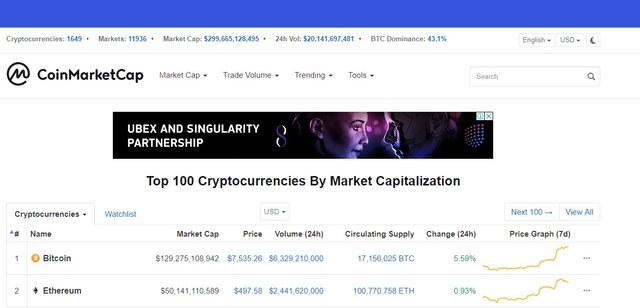

A lot has changed since the Bitcoin network was launched back in 2009 when the cryptocurrency was a tiny little network with just a few users.Now there are over 1600+ digital assets and the entire cryptocurrency market capitalization of all of them combined is valued at $294Bn USD. In the early days,financial institutions scoffed at cryptocurrencies but now it’s pretty hard for them to ignore the massive economy growing around them.

These days some of the exchanges and market makers are becoming incredibly large and dealing with very large quantities of money. Moreover, a few businesses and cryptocurrency exchanges look like they are adopting a different kind of attitude —

‘If you can’t beat them, join them,’ by either attempting to become banks or purchasing shares of these financial institutions.

Coinbase Looks Into a Federal Banking Charter

Since the early days,coinbase has been a digital asset heavyweight and the firm continues to make more money while expanding its services.There are those that believe Coinbase will someday become a fairly large sized ‘bitcoin bank’ with its 20Mn users that have traded $150Bn USD worth of digital assets since the company’s inception.

Reports had detailed that Coinbase had been visiting officials at the U.S. Office of the Comptroller of the Currency (OCC) in early 2018. A federal banking charter would allow Coinbase to offer a plethora of banking features.

Binance is also planing to launch a ‘Decentralized Community Owned Bank’

Extremely large international cryptocurrency trading platform, Binance, has become one of the largest exchanges in the world and just recently the firm purchased a 5 percent stake in a financial institution called Founders Bank. Binance says the bank based in Malta will utilize cryptocurrency tokens and distributed ledger technology.

Binance and the Founders Bank are attempting to get a license in the EU so they can operate under the correct regulatory statutes.

Litecoin foundation acquire 10% stake in german bank

Litecoin Foundation revealed the organization and the firm Tokenpay had purchased 9.9 percent stake in WEG Bank AG. The goal is similar to the Binance – Founders Bank roadmap, as the German WEG Bank AG, the Litecoin Foundation, and Tokenpay will offer blockchain and cryptocurrency solutions to customers.

What do you think about these businesses exploring becoming banks or purchasing a stake in these financial institutions?

Let us know what you think about this subject matter in the comment section below.

You got a 50.00% upvote from @luckyvotes courtesy of @zayushz!

This post has received a 13.54% upvote from @lovejuice thanks to @zayushz. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

You got a 8.00% upvote from @joeparys! Thank you for your support of our services. To continue your support, please follow and delegate Steem power to @joeparys for daily steem and steem dollar payouts!