Accepting Bitcoin and Altcoin Payments for Merchants

Introduction to Cryptocurrencies

The pseudonymous Satoshi Nakamoto paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System” laid the foundations and core purpose for distributed ledger technology in 2009.

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

While Bitcoin and Altcoins development over the years is casted in stone, it can still be reviewed in my earlier article, “Bitcoin: A Digital Asset Revolutionising The Financial World”.

Paying in Bitcoin Using Mobile Applications

Bitcoin was designed to facilitate payments between peer to peer in a trust-less environment. This value of transfer between two parties is performed without exchanging anything physical or digitally backed by commodities or faith and credit of the economy.

Why Accept Bitcoin and Altcoin Payments?

Today, making payments using Bitcoin and Altcoins is very efficient and convenient for online retailers or even brick and mortar stores (using Bitcoin service providers such as BitPay). This is another step of evolution towards a cash-less economy.

Shutterstock (Copyrighted)

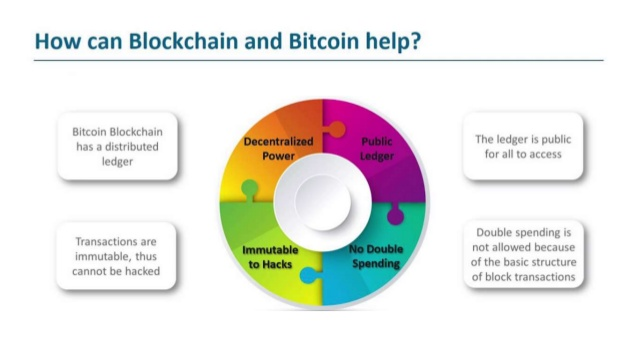

Cryptocurrency Adoption is a Win-Win Scenario.

To consumers, immutable transaction logs tracks every inflow and outflows providing accountability and transparency. This is useful when dealing with regulators or financial institutions when it comes to tax reporting or loan applications.

”Block Chain Bitcoin and Crypto Currency”,Nidhin P Koshy (2017)

Retailers experiences massive benefits accepting payment in Bitcoin and Altcoin. Firstly, it reduces the multitudes of inefficiencies going through multiple payment gateways and middlemen without facing chargebacks due to blockchain’s immutable nature. Secondly, this payment scheme distinguishes the business over its competition especially attracting a more diverse and younger millennial crowd with the increasing interest in cryptocurrency. On top of all, this transfer of value enables funds to be available promptly after a certain number of network confirmations. Retailers have the option of keeping the funds in Bitcoin or converting them into FIAT currencies to fund their operational costs.

What Other Written Articles DO NOT Tell You

It not always sunshine and rosy supporting Bitcoin and Cryptocurrencies Payments in general. There are additional issues that merchants have to deal with supporting these new modes of payment.

1) Limited Scalability

Currently, the transaction per second (TPS) of the Bitcoin network is around 3–4 supporting non-segwit transactions. This is expected to scale up to 7–8 TPS assuming all of the transactions on the network are SegWit in the distant future.

Bitcoin Network Transaction Rate (blockchain.info)

While the number of transaction on Bitcoin network has been slightly languish these few months (chart above), history have proven that this number is highly correlated to the Beta of Bitcoin price. During the height of Bitcoin Prices in Dec 2017 - Jan 2018, it was estimated that average priced transaction would take days to be confirmed on the network.

Merchants, especially those who do not accept credit card or FIAT currencies, require a reliable and business-critical payment system which will not cause revenue loss during downtime or congestion.

Merchants require a fast, fluid and highly scalable blockchain network which will not only cope with present demands but also is able to be scaled to undertake future’s demand.

It is becoming increasingly CLEAR that Bitcoin will not be able to address this specific use case.

Bitcoin: Digital Gold

Also, the market perception of Bitcoin has been shifting.

I perceive bitcoin as a kind of digital gold. And I think a lot of people also think more or less like that. — Alexander Borodich, Universa CEO

Gold has the characteristics of being stable as well as its inflexibility to be used in day-to-day transactions. Bitcoin is exactly moving towards that direction.There are other alternatives to Bitcoin that are optimised to be used as Payment Rails or Micropayments.New Economy Movement (NEM) is one such example.

NEM is a Java-based cryptocurrency announced in 2014 and launched in 2015. It introduced a new consensus mechanism called Proof of Importance (PoI), designed to reward users’ contribution to the NEM community. (Smith + Crown)

New Economy Movement (NEM, $XEM)

More background information on NEM can be found on Lexy Jeong article, “What is NEM”

Catapult, the latest version of NEM due to be released 2018 (this year) is designed to run up to 4,000 transactions per second.

This is 1000 times the amount of transactions that Bitcoin handles at this moment.

2) Lengthy Block Time

Bitcoin has an average block time of 10 minutes. Most retailers on the Bitcoin network would confirm the transaction after receiving at least 3 confirmations. This means that it would take an minimum of up to 30 minutes to confirm even a minor transaction (paying for a cup of coffee).

Important to Note: Accepting unconfirmed transactions means that double-spending of coins have not been verified.

Having a lengthy confirmation time puts the customer off. The customer will refrain from paying via this method in the future or would even boycott the store due to this bad experience!

NEM has an average block time of just 60 seconds. With retailers on the NEM network being able to confirm the transaction after receiving a confirmation, the customer experience would be extremely slick.

3) Transaction Fees

As the Bitcoin network is less scalable, the demand for a faster confirmation transaction drives up the mining fees required. The chart below indicates that the Average Cost per Transaction of a Bitcoin Transaction maxed out at 120 USD during its peak. This amount is so much more than the cost it was set out to save in the first place. This is also one big reason why it is not suitable for Merchant use.

Cost per Transaction on Bitcoin Network (blockchain.info)

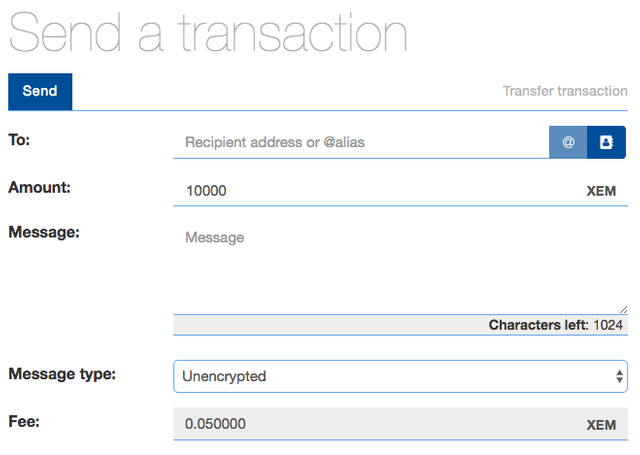

For NEM, transactions 10k XEM and below (~4,000 USD and below) are sent with a transaction fee of 0.05 XEM (0.02 USD) that’s 0.0005% for transaction fees for a transaction confirmed within a minute!

Sending XEM on NEM Nanowallet

4) Poor Divisibility

As the Market Cap of a Coin increases, the Divisibility of the coin reduces as the Circulation and Inflation Rate of the Coin are mostly controlled. Currently Bitcoin has a Circulating Coin Supply of 16,997,937 BTC.

Bitcoin is designed to have a divisibility of 8 decimal places. This was not a problem as Bitcoin prices was lower in the past. Price Indicators were showing USD / BTC. At maximum levels in December 2017, 1 Bitcoin would be equivalent to 20,000 USD. Hence 1 Satoshi (the smallest possible unit for Bitcoin) would be 0.0002 USD. While this may seem borderline acceptable currently, there is not alot of room to scale.

NEM is designed to have a divisibility of 6 decimal places. While this number is smaller, the number of NEM’s Circulating Coin Supply is 8,999,999,999 XEM. This is more than 100x compared to Bitcoin. This means that when XEM is scaled to similar market cap as Bitcoin it will be more divisible.

At this point NEM is valued at 0.40 USD each. This means that the smallest divisible unit 0.000001 XEM is 0.0000004 USD. Hence, there is alot of room to scale on the NEM blockchain.

5) Support for Smart Contracts

Bitcoin is considered a Store of Value making it suited for Payments for Goods and Services. On the other hand, Blockchain development brought smart contracts and the peer to peer data and information exchange into the picture through the Ethereum project.

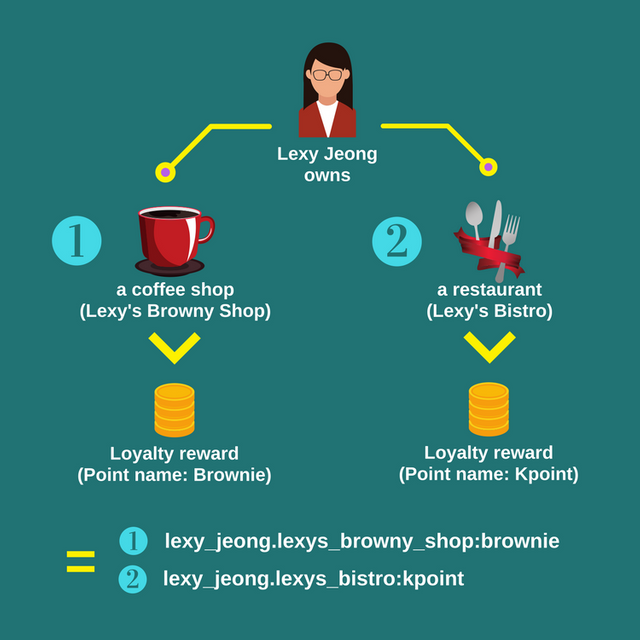

NEM’s blockchain characteristics enables it to be utilised for both as a form of making micropayment and also as a network to track and account for ownerships and rights of land or intellectual properties. NEM features enables the user to create Mosaic (an asset) tying it to a Namespace (a Domain).

Merchant Example Credits Lexy Jeong

For example, an online retailer is running a special promotion on all NEM payments made to its NEM address. The retailer is able to set a smart contract that automatically resends Reward Points, in the form of Mosaic, to the Sender Address. This amount of Reward Points correspond to the amount of Payment made and customers are able to send the Reward Points back to the Wallet Address in order to “redeem” the Reward Points.

The programming of this smart contracts can be done in popular programming languages such as C++ or Javascript. This lowers the barrier of entry as many developers are familiar with programming on these languages.

This reward scheme not only appeals to the customers but also convert them into frequent customers as the mosaic is not physical but digitally stored on the same wallet address which they frequently use. This is what makes NEM very applicable to Merchants. More information on Creating Mosaic can be found here.

6) UI and UX Optimised

Bitcoin does not have a Native wallet that is lightweight to sit on a smartphone. It needs to rely on 3rd party online wallets such as Jaxx or Exodus. This makes the transaction of Bitcoin not user friendly as 3rd party wallets will include additional fees to be included during transactions.The user interface, user experience and standards are also inconsistent. This has led to the creation of many wallets of which the private keys are withheld from the users. This means that coins transferred to the wallet isn't actually attributed to the user. This could indicate a certain risk to the Merchant utilising this 3rd party wallet.

Screen Capture on NEM Nano Wallet Dashboard

With NEM’s Native Nano Wallet, the Merchant is in control. First of all, the Nano Wallet is accessible on a laptop, desktop or a mobile device. This is possible without requiring to download the entire historical blockchain information. This enables a very lightweight wallet to be developed providing API connectivity to the NEM Nodes.

Having a Native-built Wallet is important, it ensures that all the features and operations of the wallet are backed and supported by the development of the NEM Blockchain.

The User Interface Design (as witnessed above) is very sleek with User Menu iconised and simplified. The design of the wallet is very consistent providing a superior User Experience over other 3rd Party wallets in the market.

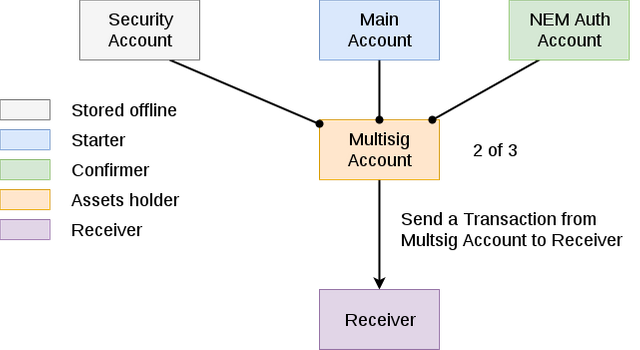

Multi-Signature Feature on NEM (Credits Aleix Morgadas)

The second applicable feature supported on the NEM Blockchain is Multi-signature Account. In this case, since Merchants only utilise wallets to collect payments. Merchants are able to configure all outgoing transactions on the wallet needs to be validated by another managerial staff in a 2 out of 3 signature transaction. This will ensures the security of the assets on the wallet.

7) Well-Governance

Bitcoin’s political struggle in achieving Governance and a singularly focused growth strategy has been no secret. These differences in development direction has resulted in multiple forks (Bitcoin Cash, Bitcoin Gold, Bitcoin Private, etc.) that has diluted the branding of Bitcoin.

NEM’s consensus algorithm (Proof of Importance, POI) is the way that NEM prioritises the relevance of the users. Its difference from others is that transactions are confirmed not by nodes that have highest computing power, but by nodes with highest Importance in network. Importance is defined not only by how much coins the node has, but by how much transactions the owner of node makes, and how useful are this transactions. This means that those, who produce value for network, get rewarded and have higher weightage in voting and other processes.

Recently, NEM President Lon Wong transited out of NEM to focus on a Project providing a Service Layer on the NEM Blockchain. This smooth transition of leadership only highlights the strong consensus within the NEM Leadership Team. For more information, you may read Interim President, Kristof Van de Reck’s letter to the community.

Now What Should I Do?

For Merchants, accepting cryptocurrencies as a form of payment is a form of art. It is all about maximising the benefits while limiting the potential issues which may arise with implementation. This can be limited through a refined selection of cryptocurrencies to support.

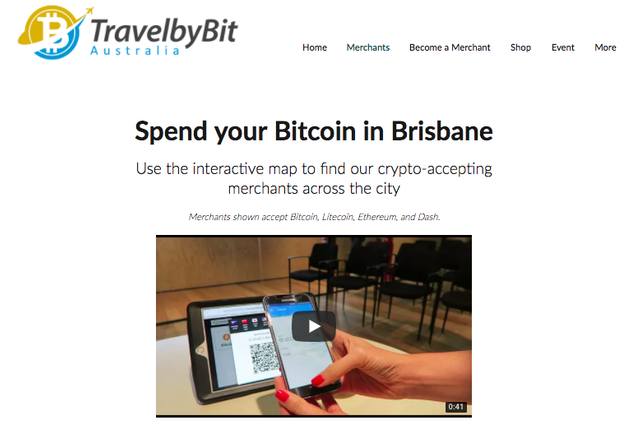

Using a Payment Service Provider (TravelbyBit)

While Bitcoin has the largest market cap (currently) and amount of market penetration, it is always important to support other selected cryptocurrencies. This can be performed easily with integration with Payment Service Providers such as BitPay, Coinpayments and Pundi X. Or a Merchant can also perform fee collection from a multi-asset wallet such as Exodus or the Project’s native wallet like Nano Wallet.

Why NEM?

NEM satisfy ALL of the Requirements that a Merchant would need. This has been discussed extensively above.

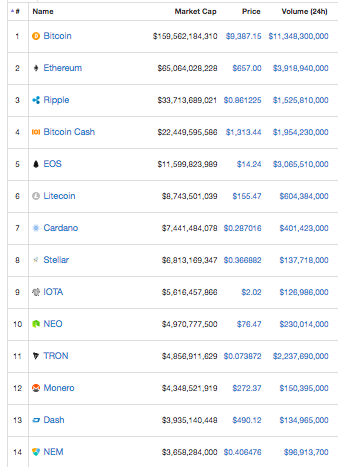

NEM is the consistently in the TOP 20 of the Market Cap.NEM boast a working and developing network that is supported by many users in many countries.With large exchanges support like Upbit, Zaif, Binance and Bittrex. NEM can be purchased or exchanged easily meaning that it is liquid and consumers are able to access NEM easily.

So why hesitate?

Start accepting cryptocurrency payments now!

$XEM Donations: NDM4X6CJ3XSHWD4DHFP3AFBSSZX4W6ZO3NFS2DPM

$BTC Donations: 3BymqCeVec5spPPZX2cWcNf4e6baDpqKhW

Congratulations @yeesypeasy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @yeesypeasy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP