The MunnyPot #2: Haven Protocol (XHV) -- Stay Far Away from This One

Why I am Encouraging Everyone to Stay Far Away from this Project

| Currency: | |

|---|---|

| Current Price: | |

| Website: | |

| WhitePaper: | |

| Block Explorer: | |

| Announcement: | |

| Wallet(s): | |

| Algorithm: | |

| Best Programs to Mine XHV: | |

| Exchange Listings: | |

| Novel Features: |

Introduction

We've been seeing a lot of privacy coins popping up lately. Each of them boasts a unique feature or two, others (and we're seeing more of these, as well) are carbon-copies of existing coins, down to money supply, block time, block size, and other metrics. The Haven Protocol advertises itself as a viable alternative to offshore accounts, boasting a feature within the offshore accounts that actually preserves the value of Haven Protocol coins at a fixed level of fiat currency. To clarify: They plan to achieve this through a burning and minting protocol for their coins, that burns the coins as they are deposited into the "offshore" account... and re-mints an equivalent value of coins as you attempt to withdraw your funds. According to their whitepaper, that breaks down to mean: An account owner (we'll call them A) deposits $200 worth of Haven into their "offshore account" on October 5th. XHV is worth $2.00/XHV on October 5th. So, A deposits 100 XHV. On April 5th, Owner A returns and desires to withdraw what funds were deposited into storage. On April 5th, XHV is worth $4.00/XHV. When Owner A receives back what they placed into storage, he receives 50 XHV which is now the equivalent to $200, the original fiat value of the deposited funds. The 50 XHV is minted before being back to Owner A. This transaction is enabled using "smart contracts".

What a magnificent idea!

But, I thought... wouldn't minting more coins decrease the value of the coin?! Well, reassuringly, the whitepaper addressed my concerns next.

(Spoiler: That thought didn't actually cross my mind. The whitepaper did not address my concerns adequately. )

Haven Protocol Impressed Me

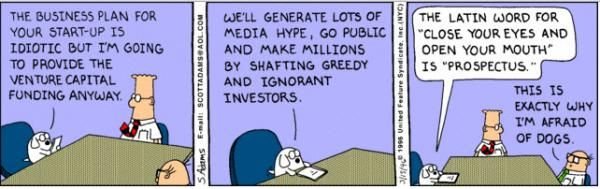

A common practice within the cryptocurrency market is to generate value with huge plans and abundant speculation before delivering on such value. That practice is one I do not disagree with, really -- If something big is planned, and transparency reveals that to the public, typically value increases in anticipation of its delivery. That's reasonable, I feel. I think that kind of behavior among consumers is a big part of what has allowed innovative technology to flourish and impact our lives positively. As it turns out, that practice not only benefits the company who is innovating, but it benefits those who invest earliest in their vision... sometimes as abundantly as the innovator. Without bad actors, that system works phenomenally. Need Proof? Look no further than Angel Investors and Venture Capitalist groups. If you are not familiar with either of those phrases, these groups are effectively sources of primary funding to actualize an idea that does not have the ability to fund itself. In exchange for the funding, the investment firm is typically given an amount of equity/stake in the company itself through shares or similar holdings. In order to minimize risk, these companies often serve as an "incubator" for the start-up and its vision, providing different resources to the companies which they invest in -- this can include on-site facilities, advisement, exposure opportunities, and more.

A increasing amount of accessibility is emerging within the cryptocurrency market for individuals seeking to get into trading. It's easier than ever to buy into any number of projects. As that accessibility becomes larger, more investors are going to enter the market. This, unfortunately, opens the door for more bad actors just as well. I think a large part of what we have seen with the near-constant publishing of new coins (especially those with a privacy focus), is -- in part -- due to just that fact. The presence of bad actors requires investors to have an affinity for accurate discernment of value. In order for proper judgment to occur, with respect to worthwhile vs poor investments, Angel Investors or VC firms require those seeking funding to submit a detailed business plan and clearly delineate the where's, why's, and how's of their uniquely generated value (Think Shark Tank on television).

I'm no venture capitalist. But I ask a fair amount of questions that I expect a project to answer. I hardly feel that "proof" is too difficult of a requirement to fulfill. So when someone expects me to believe my time/money is a fair bargain for anything they are selling... You better have something to back that opinion up. Hopefully, that's more than hearsay and biased testimonial.

In Haven's case -- I'm not sure it even classifies as that. But I must say: Haven impressed me. A first look replies with a clean-looking website and distinct marketing ability. It looks great at a glance. It's using an ASIC-resistant variant of a proven algorithm for mining... The project offers up some unique concepts for design and it speaks to a very relevant, shadowy audience involved in borderline behaviors. Let's not forget -- this market got its start in anonymity, thriving alongside the idea of a shaded economy, enabled through an uncensored medium. Chainanalysis, in a recent study, found that, at time of publishing, approximately 1% of bitcoin transactions involved darkweb activity... That number is down by 30% from the year 2012, according to wired.com. Those conducting transactions likely haven't gone away. They've probably opted out and switched to a superior solution for their use-case and threat model. So, if you ask me... the market always been primed for a coin like Haven to surface. It's perfect! I thought to myself... and well... then I tried to answer the question "how?"

Walk With Me For a Moment... (Haven Couldn't)

For this portion of the the article, I'm going to ask that you open the whitepaper (I'm cringing as I'm calling it that) and follow along as we fail to find a single claim that's backed up with facts, but manage to find some things that I'll dare to call outright lies. Before you get defensive of Haven, understand that I didn't pick up writing these articles to make friends. More appropriately, I came to find and share quality solutions that contribute value. I can't stand by circular logic and nonsense, if I can instead repel others toward more suitable prospects. Keep in mind they are profiting from the costs in a trade-off of potentially tons of your time and/or money, with no assurance of a return of value. Just words. And surprisingly, not very many of them. Such is not typical of bullshit -- So I guess I can thank Haven Protocol for that, at least.

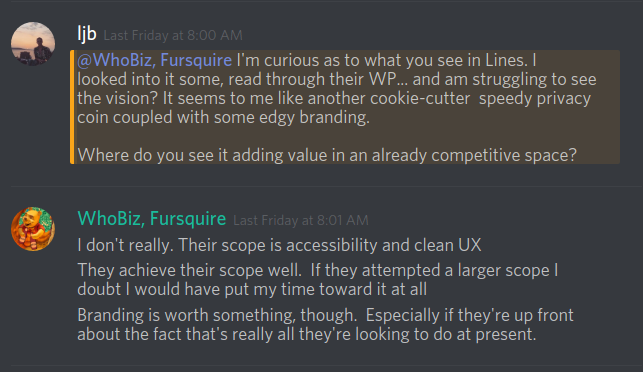

I had initially listed this coin on my Twitter as a coin that was one to watch. While I stand by that initial assessment, because I believe branding is worth something... for that marketing to be selling junk entirely and lying about its ability to fulfill a use-case... well, I can't and won't stand by that. A member of our Discord Server recently asked me a great question about a currency I had also included as a "coin to watch" recently, called Lines (LNS)... You can read his question below, as well as my answer.

I think the above serves as a fair example of objective evaluation, and at the same time, exemplifies the kind of questions I love answering. The idea with these discussions is to debate value. I want you to critique and challenge my work. That's the only way we figure out if it's worth anything. So, onward to the gloom and doom bit. Open your whitepapers, everyone.

What's a Whitepaper, Anyway?

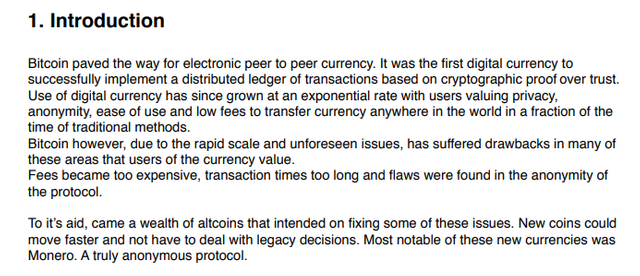

Section 1

First impression: Opener is somewhat as expected. Obligatory bitcoin reference.

Second Impression: Damn, that's a decent run-on sentence... and the line breaks aren't uniform. Is proofreading a thing? Bad sign, but moving on....

Quick sidenote: whoever first called Bitcoin anonymous needs to buy a dictionary (see: pseudonymity)

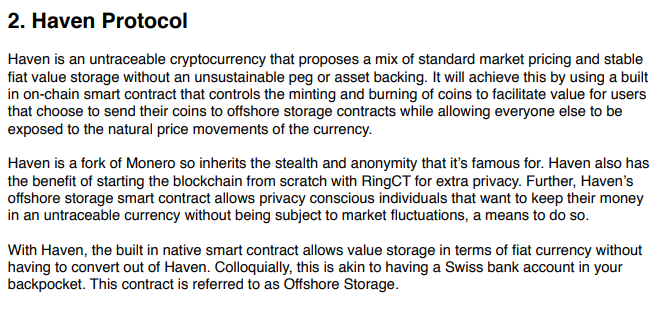

Section 2

"...without an unsustainable peg or asset backing."

Great, so we're just like the good old USD. Who said collateral backing for a currency is necessary? The USD is "stable" and hasn't been backed by anything other than consensus since 1928.

"It will achieve this by using a built in on-chain smart contract that controls the minting and burning of coins to facilitate value for users that choose to send their coins to offshore storage contracts while allowing everyone else to be

exposed to the natural price movements of the currency. "

Wait, what? Hold on a minute. So the smart contract that's built into the blockchain controls minting and burning coins? And that facilitates value? How?

This is a lot to say in a single sentence. We've got A.) Built in smart contracts... B.) Burning and minting function for simulated storage .... C.) Facilitation of value....

I had to look elsewhere to find answers for that single question above (code audit on github). To answer all of A, B, and C, at once... A.)There are none. B.) There is no such code. And finally, C.) Facilitation is the wrong word here... maybe they didn't use "retain" because they didn't foresee there being value in the first place? Surely, it gets better... Right?

Haven is a fork of Monero so inherits the stealth and anonymity that it’s famous for. Haven also has the benefit of starting the blockchain from scratch with RingCT for extra privacy. Further, Haven’s offshore storage smart contract allows privacy conscious individuals that want to keep their money in an untraceable currency without being subject to market fluctuations, a means to do so.

This paragraph is at least honest about the fact that they just took monero's current code and started the blockchain at zero. Next sentence doesn't even make sense, despite me knowing what they mean to say...I think. For the record, I'm not the grammar police, but that's three subordinate clauses in the middle of a sentence that portrays a make-believe "offshore," non-existent smart contract. That, pretend, non-thing, idea is going to allow privacy conscious individuals a means completely insulate themselves from all forces acting on value over time. Time value of money, inflation, supply, market conditions -- all of it -- by burning your coins.

"With Haven, the built in native smart contract allows value storage in terms of fiat currency without having to convert out of Haven. Colloquially, this is akin to having a Swiss bank account in your backpocket. This contract is referred to as Offshore Storage."

Okay -- now the invisible unicorn that burns money is the same as an internationally neutral financial institution. I don't know if this is a metaphor or a joke. Either way, that relationship isn't real or funny. I'm completely bewildered. We officially are in the realm of non-reality. Someone had to be maniacally laughing as they wrote this.

Section 2.1

I'm not gonna bother with the screenshot of the whole thing. Skip the explanation of offshore. You learned how to multiply and divide by 2 in grade school, and I explained this at the beginning of my post.... Or take your time and read it carefully..... Is anyone else getting hungry?

At first, minting new coins may make you think the value of the coin would decrease as the total money supply has increased. In practice, this operates a little different.

No, I didn't think that at all. I thought that if the price was increasing, and you had to cash out these funds to account holders who put them in "storage," then you'd be minting less coins than you burned. Actually, that would still make supply go up. Burning them would always make the supply decrease. A net increase in coins (in excess of the amount being mined) would only happen if the coin value was depreciating while each end-user had their coins in storage.

This ’mint and burn’ method draws on the quantity theory of money described in monetary economics in order to avoid inflation and changes in currency valuation based on the movements in the total supply. The theory states that MV = PT

This equation is thrown around a lot in the cryptosphere. I'll attack this theory another day. But, it's worth noting that the Federal Bank in the US stopped using this model a long time ago. It doesn't work in the short run because it relies on two of those variables being constants, as Haven agrees. They help approximate the supply of money and price in the long-run, but not over short time periods. Which brings me to my next point...

"An increase in the money supply should . . . cause an increase in the price level (inflation)."

That is not the definition of inflation -- Haven is missing half of it. Inflation requires that the purchasing value of money also decreases while prices are rising.

"The problem with this is that the money supply of Haven will always be unknown."

Not true... I give up. Haven, I'm really sorry for this review being resoundingly scathing as it has been. But where one cannot explain things with logic, he cannot substitute circular logic...

Haven, you're attempting to adjust money supply to affect price stability, but won't know what that supply is? I'll leave alone the fact that you will know what the supply is, until this chain hits tail emission. Even afterwards, supply could be determined the same way that the blockchain is determining who receives what quantity of coins. I'm just not sure where all of these assumptions are coming from, and "impossible" is a bold term to throw around with assumptions. The other threat models (for ethereum, NEO) insulate against even the most unlikely network-sized threats. Determining supply with some statistical calculations, within bounds, would be possible. Especially if the blockchain is required to keep a running tally.

"Offshore Storage contracts will be implemented once the network reaches a mature stage with enough exchange support to allow redundancy and accuracy of prices."

This "maturity" is at 18,400,000 XHV ... or once all blocks in the emission lifecycle are mined. For Monero, this will happen in May 2022. That is roughly 4300 days after into XMR's lifecycle.

I repeat... that means to say no delivery on any novel concept until all coins are mined. Once we get there, I wouldn't count on the invisible unicorn storing your money effectively after it burns it. Better yet, I would stay far away from the Haven Protocol. Maybe try cigarettes, or something. They're probably a better investment.

**EDIT: I've been informed since the writing of this, that the developers have voiced an intent to implement offshore contracts in Q4 of 2018. Until I see some proof of the mathematical and/or economic skills necessary to implement something this massive, I wouldn't count on it.

Conclusion

Really do your research. I pride myself on being critical of the projects I look at, and knowing the difference between good and bad. Haven, you almost got me. Hopefully this isn't half as exhausting to read as it was to write. Good luck, and steer clear of this one, or any unicorns you might see burning people's money. Don't let them feed you mints, either.

HEY! LOOK! BEARS! ON COMPUTERS!

Follow The Banned Bears on Twitter

WhoBiz: @BizMunny

Koozi: @TheBannedBear

Follow & Re-Steem!

Join the Banned Bears on:

Discord: https://discord.gg/RaxAjXp

Now featuring GRIZZLYBOT and commands for TA & Custom Charts!

Telegram: https://t.me/bannedbears

Congratulations @whobiz! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP