Managing your hard-earned money: Leading a financially-responsible lifestyle

ORCA Alliance continues on the path to helping with tips how to effectively keep track, manage and improve savings without making significant shifts in behaviour. It’s just a hint about what our Smart AI will automatically offer platform users. Once the platform is running, ORCA users will have the ability to define their financial goals and have machine learning algorithms ping with notifications once a strategic decision is required.

On our last publication, we have heard the key principles of managing personal finances.

Find previous article discussing tips for personal finance management.

This time, we’re tuning our speakers to a set of lifestyle tips for the financially-responsible. Glamorous, ugly, frugal and expensive — we’ll cover the most overlooked aspects of it. Buckle up for the bumpy, yet money-saving road.

Choose show-off toys that appreciate value

There’s no shame in admitting that once in a while you want a taste of that luxurious life. But if you’re going to spend it on the bling, go for the one that makes the most financial sense.

Art can be a very good investment, if you have the money. Art Market Research Developments has showed that beating the S&P 500, can be a mere joke for some art categories, which soared up to 9 times faster than the famous index in the past ten years.

Also, spending your extra on Vintage collectibles, first edition modern books, whiskey, or Japanese motorcycle can all amount to a great investment and a pleasure.

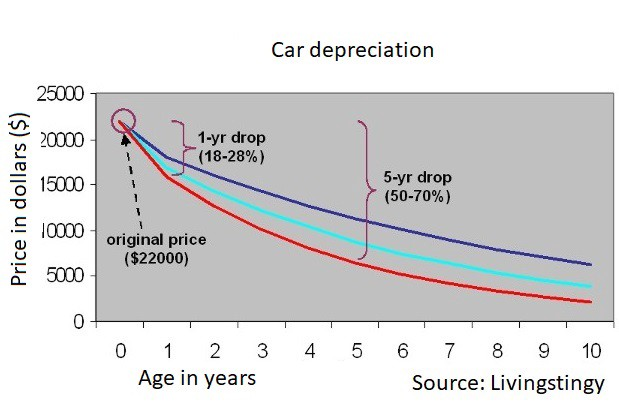

Splurging out on a new car every couple of years, however, is a particularly wasteful dream. This is hugely because of something called “Car Depreciation” — most new cars lose up to 50% of their value after the first three years of use. In reality, your best financial bet is to purchase a used vehicle from a private owner.

Don’t be afraid of debt

Not all debt is out to get you. Debt is reasonable whenever it is used invest in something of increasing value. Thus, taking on obligations makes perfect sense when starting a business or expanding the current one. Student loan also can be a form of good debt — provided your degree does not revolve around the studies of the philosophy of Homer Simpson. Also, it’s unlikely you’re ever going to sponge up enough cash to buy a home in a reasonable time-frame without a mortgage.

But do remember to keep a healthy debt-to-credit ratio, to not let your credit score slip too far. Otherwise better sleep with one eye open.

Manage your banking expenses

A common mistake of a frugal lifestyle: Don’t pay the minimum on your credit card bill. Temporary month-long relief comes at a high price. Prolonged duration means that paying minimum each month will result in maximum interest charged.

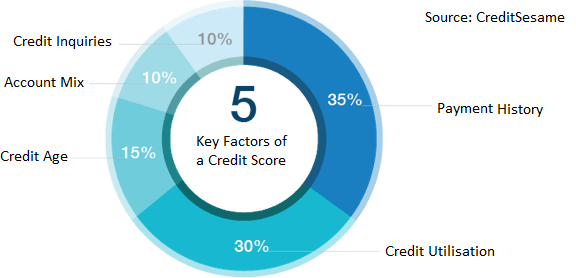

Keep your credit score high by paying your bills on time — you never know when you’ll need to take out a loan. Length of credit history matters as well. Up your score by keeping a credit line open for as long as possible. Don’t close the credit card if you’ve paid it off. Your credit score is higher if you have a mix of accounts on your credit report.

Also, consider using FinTech (Financial Technology) provided services to cut down on the banking expenses. Keenly prices foreign exchanges, cash transfer and peer-to-peer lending services are all on offer at reduces rates. Smart apps can help you keep a track of your spending and even allows you to swing crypto, if you wish to do so.

Don’t scale up your condo too quickly

Your current living conditions might not be great, but they are, after all, manageable. It’s important to recognize that whenever you get a raise or that new job with bloated salary, you don’t need to go out and spend the difference. A fancier apartment, new car, expensive gadgets or any other life upgrades require serious thought.

Succumbing to this temptation, however, is so common that it even has a name — “lifestyle inflation”. Don’t get it wrong, it’s okay to move up, but consider adding extra to your long-term savings first. Most likely you were “Okay” living on a smaller budget either way.

Guard your health and time

At the end of the day, it all winds down to what portion of your life you’re willing to dedicate to money-earning. Theoretically, anyone can be a millionaire in a lifetime; requirements only amount to radical diligence and a minimum-paying job with overtime and night shift bonuses. Of course, not only is this kind of lifestyle going to damage your health, it is by no means the standard you should set for yourself.

Finally

As important as it is to learn to manage personal finances, there’s no need to restrain yourself from occasional guilt-free spending. If you’ve put the money away for an emergency fund, continue to make payments into your retirement, and don’t have any outstanding credit card debt, make sure to spice up your day.

Remember, it’s not wise to lead a frugal lifestyle just for the sake of saving money — saving, prioritizing and managing is only justified if there’s a reward behind it. As cliché as it sounds, the goal is to spend more on what you value.

ORCA Alliance token sale starts on August 6th. Do not miss the chance and lock your extra bonus NOW. Visit www.orcaalliance.eu to whitenlist.

Twitter | Facebook | Instagram| Reddit | LinkedIn | Website | Github |