Neither crowdfunding nor ICOs are fully regulated. The first one is fine, but the other one not? Double standards suck.

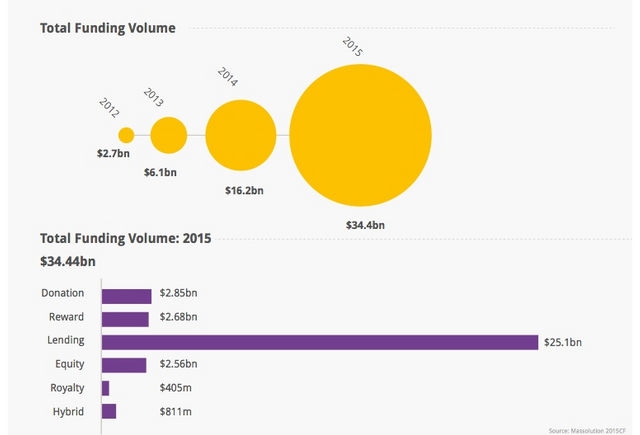

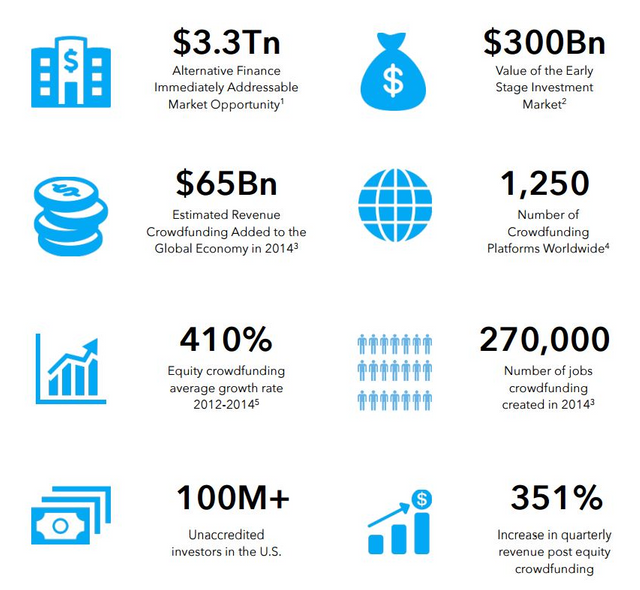

Crowdfunding had been around for a while now. By the end of 2015 there were over 1.250 crowdfunding sites worldwide with a total funding volume of over $34bn.

One of the biggest crowdfunding sites Kickstarter acumulated a total of $3.2bn of funding pledges by end of August 2017. And while Kickstarter might be the leader of the industry there are many other crowdfunding sites not far behind - Indiegogo, GoFundMe, Crowdrise, Crowdfunder, RocketHub, AngelList, InvestedIn - just to name a few.

There are four distinct types of crowdfunding

- Donation-based crowdfunding: You donate for a good cause / charity without expecting anything in return (except for self-respect). The motivation is greater good.

- Reward-based crowdfunding: You give money to support a project in return for non-monetary rewards. You help a team to develop a product you believe in to get that product for an exclusive discount in return.

- Investment-based crowdfunding: You invest in a business to receive a stake (share) in return. The motivation is monetary profit.

- Loan-based crowdfunding: You lend money to individuals (P2P) or businesses (P2B) in return for a set interest rate. The motivation is monetary profit.

There just are no guarantees

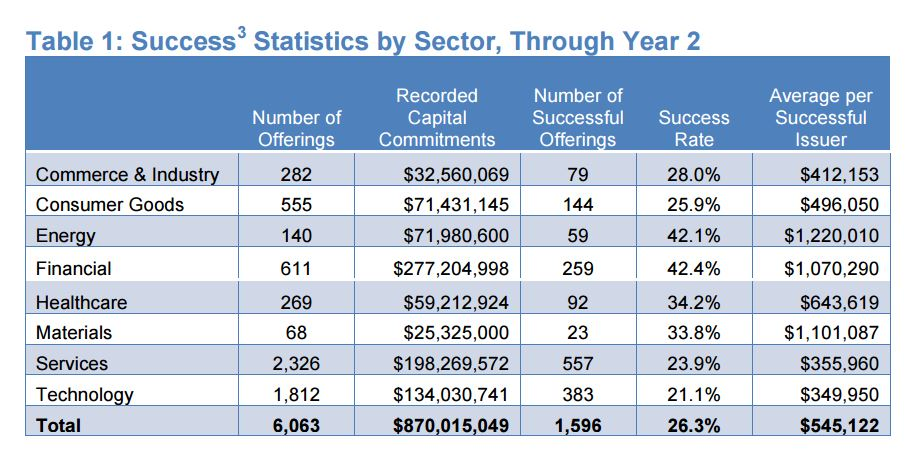

Whilst investment- and loan-based crowdfunding is regulated by financial authorities (like SEC or FCA), neither donation- nor reward-based crowdfunding is. But there are no guarantees still.

- What if the crowdfunding platform goes bust? Your money is gone.

- What if the project / start-up / business you invested in fails? Your money is gone.

- What if the product you got in return is useless? Your money is gone.

- What if the shares you acquired are absolutely unsaleable? Your money is gone.

- What if the loanee you borrowed your money to can't pay you back? Your money is gone.

Neither the platform, nor the financial authority can guarantee your investment to be a success. End of story. You need to do your due diligence yourself. It's your money and it's your responsibility.

So why is crowdfunding still allowed?

That's very simple. The positive impact on the global economy outweights by far the negative. It's as simple as that.

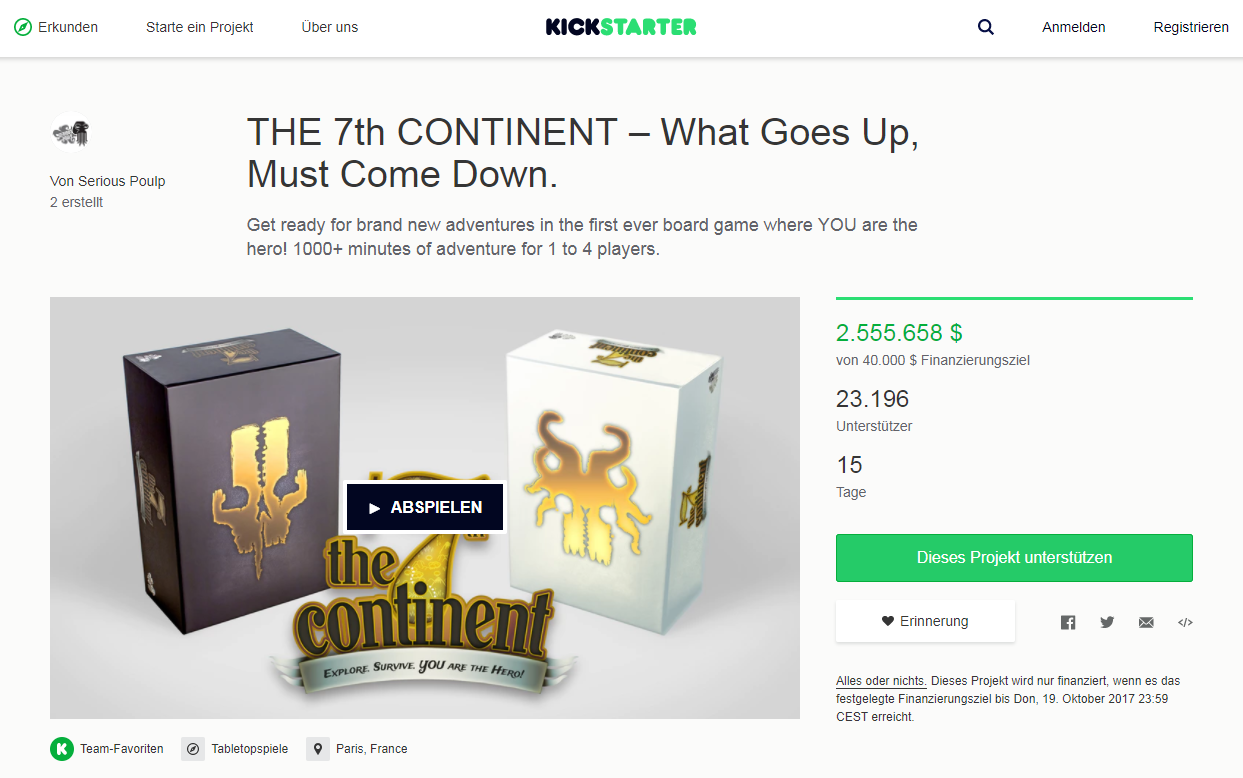

$2.5m for a board game is fine, but $5.8m for a blockchain application platform is a fraud?

Look at this. This start-up raised officially over $2.5m to develop a board game. You heard right - a board game.

And do you remember what astonished headlines Lisk made after raising little over $5m in their ICO? How about Antshares with $3.5m? And Ark's $1m? Have you ever read a headline wondering about the eligibility of the funds raised for the board game development?

How do these projects compare? In relation to what real value they provide?

Just because most people can imagine a board game, but not a smart contract or dApp protocoll - does it make the board game more valid? Not in my head.

What is the difference between crowdfunding and ICO?

There is none.

Especially in the reward-based crowdfunding category where most ICOs fall into. They have a plan for a product they believe is needed on the market. They ask you if you want to support them developing this product.

The first one promises you a board game for your money, the other one gives you a token in return. They both believe in the end you get more for your money than the otherwise.

It's up to you to assess the probability.

YCombinator & Science Incubator entering the ICO world

No, I'm not telling you every ICO out there is a gem. And yes, many if not most of them will fail. But why would you put your money into a project you can't assess properly? Who's fault is it if you lose your money?

But this will get better. ICO-Platforms with sound standards for project-onboarding (like RocketICO) are being developed right now and established experienced player from the venture capital scene are entering the game (like YC or Science). They will help you to tell apart the gems and the scams.

DYOR and stop whining

If you lose your money on Kickstarter because you didn't do your due diligence before investing is no different from losing your money on a hopeless ICO. Just do your own research, use your common sense and stop blaming the world for your own laziness or stupidity.

Sources & Credits

- Edelman Trust Barometer 2017 - Trust in financial services

- Massolution Crowdfunding Industry Report 2015

- Kickstarter Total Amount of US Dollars pledged 2017

- Oxford Faculty of Law - Law, Trust and the Development of Crowdfunding

- Crowdfunding under the Securities Act

- Headline Image: Coinidol

Disclaimer:

I have invested a lot of time into researching and writing this post. If you want to honor this effort please upvote this post and follow me. Thank you!

And always remember - my views outlined in this or any other post do not constitute a financial advise whatsoever. DYOR.

Congratulations @viennablues! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPGreat article you have here. Yeah, the regulation on this ICO's and Crowdfunding campaign which is quite the same is a bit biased. Hahaha. ThanksI read this article of yours since I will be running my own ICO next year and I already reached out those legit looking agency like amazix , www.crowdcreate.us etc. Hope I can find other agencies before the year-end.