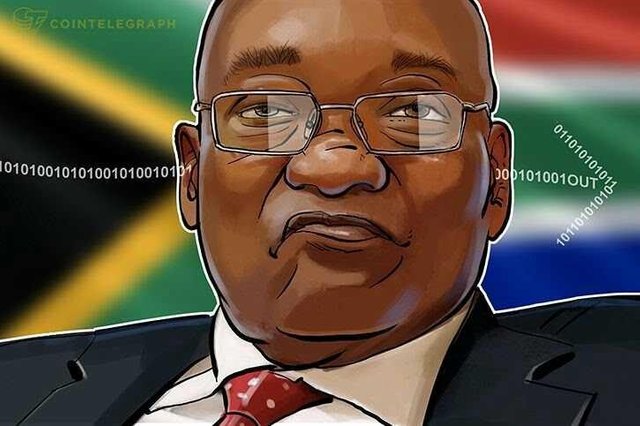

South African President Steps Down as Banks Embrace Blockchain Technology

South Africa’s president Jacob Zuma announced that he was stepping down Feb. 14 after leaders of African National Congress vowed to force him from office. On the same day the police raided the home of South Africa’s wealthiest Gupta family. Zuma became president in 2009. His controversial corruption scandal linked to the Gupta brothers; Atul, Rajesh and Ajay, was labeled “Zupta”, and was one of the reasons he was forced to resign, as it inflicted severe damage on one of Africa’s biggest economies.

Zupta is reported to have drained-off billions of Rands from government institutions by orchestrating the awarding of government contracts into offshore shell companies. Said companies funneled these funds into various concealed bank accounts around the world. Zupta’s squandering of public funds and property eventually caught the attention of world regulators triggering a wave of multijurisdictional corruption investigations of individuals, multinational companies, and banks with suspicious cash flows from banks in South Africa, UAE, China, India, the US, and Canada.

These banks; including ABSA, Bank of Baroda’s South African Branch, followed by the State Bank of India, were forced to shutdown Zupta linked bank accounts, in domino effect, to mitigate money laundering related legal problems.

South African Banks Adopt Blockchain Technology

As a result of the Zupta scandal, several South African financial institutions have embraced blockchain technology called Springblock, which they hope to adopt for all financial transactions, explained Farzam Ehsani, chair of the South African Financial Blockchain Consortium. The State Bank of India, which is India’s largest bank also implicated in the Zupta scandal, announced that it would be implementing Bankchain’s blockchain in collaboration with Primechain Technologies in several areas of the bank including Know Your Customer /Anti-Money Laundering (KYC/AML), syndication of loans/consortium lending, trade finance, asset registry & asset re-hypothecation, secure documents, cross border payments, peer-to-peer payments, and blockchain security controls.

“Primechain Technologies is a blockchain startup in India. Bankchain is a member driven — thirty-two banks— the community with no separate legal existence. All member fees are collected by Primechain Technologies to develop blockchain technologies for member banks to lower overhead costs, process transactions more quickly, provide the security of the banking system, use specialized and highly optimized permissioned blockchains to facilitate information sharing among the banking institutions that are members of the network” explained Rohas Nagpal, Chief Blockchain Architect at Primechain Technologies.

Ron Quaranta, Chairman of the Wall Street Blockchain Alliance, foresees blockchain technology being widely used in the global financial industry. “In the future, virtually every function in global financial markets will be impacted by the advent of blockchain technology”, he believes.

South African Reserve Bank is testing blockchain

The South African Reserve Bank (SARB) has established the Financial Technology Program, whose primary goals are to track and analyze developments and to assist policymakers in formulating frameworks in response to these emerging innovations. The program also intends to review the SARB’s position on private cryptocurrencies to inform an appropriate policy framework and regulatory regime. Additionally, it will launch Project Khokha, which will experiment with Ethereum based distributed ledger technologies in partnership with ConsenSys to replicate interbank transfers on Quorum, a platform built by JP Morgan.

South Africa has been relatively progressive on the subject of cryptocurrencies. The SARB issued a 2014 position paper on cryptocurrencies and in July of 2017 began to work with Bankymoon, a blockchain-based solutions provider, on creating a “balanced” approach to cryptocurrency regulation. There are currently no specific laws or regulations that deal with the use of crypto-currencies, which are not recognized as legal tender.

"The lack of AML/CFT regulation of virtual currency providers worldwide greatly exacerbates virtual currency's illicit financing risks,” said U.S. Department of the Treasury Under Secretary Sigal Mandelker at the Securities Industry and Financial Markets Association Anti-Money Laundering and Financial Crimes Conference. “Currently, we are one of the only major countries in the world, along with Japan and Australia that regulate these activities for AML/CFT purposes. But we need many more countries to follow suit, and have made this a priority in our international outreach," he added.

Although the South African Revenue Service (SARS) has indicated it intends track and tax cryptocurrency trades, without any court ruling or directives that focus on the tax treatment of cryptocurrency transactions, it will be difficult for the taxman to hold individuals accountable.