Special Feature: Interview With Ethereum Millionaire Dan Conway

I had the pleasure of chatting with Dan Conway, one of the rare few who escaped the corporate fishbowl thanks to cryptocurrency.

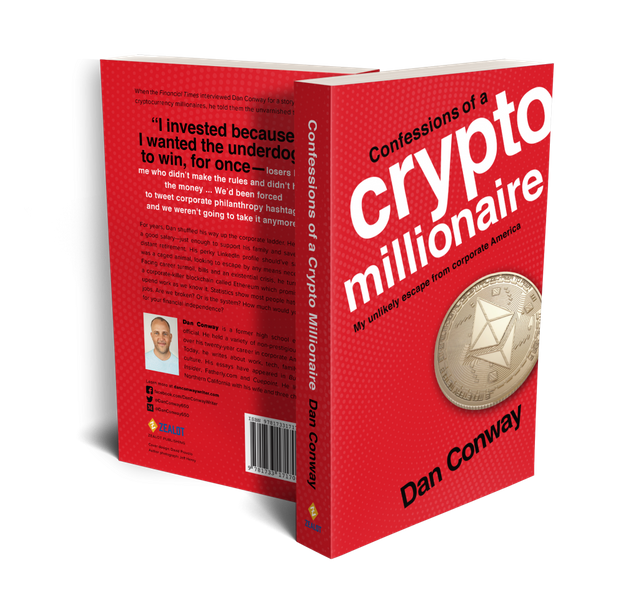

His new book, Confessions of a Crypto Millionaire: My Unlikely Escape from Corporate America, just hit bookstores. It now sits on my Reading List because it’s a totally relatable, well-written memoir, and a quintessentially crypto story. It’s The Office meets Silicon Valley meets Forrest Gump.

Imagine you were a recovering drug addict who was sick of your job and discovered a technology that could liberate you from the drudgery of corporate politics and soul-crushing bureaucracy—and maybe make you wealthy as fuck, too.

That’s Dan’s story. He put his life savings into Ethereum when it was $12 and made millions.

What really stands out is how he got to the point where he was willing to take such a risk. Instead of spending a hundred dollars to fix a nagging dent in the door of his aging minivan, Dan spent a hundred thousand dollars on magic internet money.

That’s some hard-core crypto shit.

But I was more interested in the psychology behind that decision—his battle with drug addiction and recovery, his hatred of corporate culture and phony relationships, his dream of financial freedom, his experiences moving back and forth between “the real world” and the cryptosphere, and his struggle with money and depression.

While our lives took very different paths, I see parallels between Dan’s experiences in corporate America with my own experiences in politics. I also share his vision for a more authentic, genuine world.

If you can get the book, I highly recommend it.

Enjoy our conversation. I’ve edited it down for clarity and length.

You say you hit the jackpot twice—once for buying Ethereum in 2016 and again for having a great story to tell. What motivated you to publish this book?

It came from this big idea I had when I was failing out of a centralized corporation at the same time I was becoming obsessed with the idea of decentralization. I saw two themes fitting together – the big gamble and this different way to organize economic activity through decentralized blockchains.

I know truly decentralized organizations are down the road. It remains to be seen how far down. I knew instinctively that the money was the thing people wanted to read about, that it would entice people, allowing me to talk about the big concept in the process.

And you felt you needed to get that story out there?

Yes. I’m an introspective guy and I’ve had some serious ups and downs in my life. I’ve never before blogged about the depression or the addictions. I saw a way to fit those into the story. Those things played a part, too—as well as the various chips on my shoulder. It all played a part in how far I went [putting my family’s savings into Ethereum in 2016].

The book is an answer, not a rebuttal to those who say “you got lucky.” The book explains all the component pieces of how that crazy thing happened. It goes into my history and the timing and all that—how I got to a place in life where I could risk everything on Ethereum.

How did it feel to put yourself out there like that? You went through some rough stuff.

I already had some practice through blogging and twelve-step meetings. I don’t mind talking about it. In my relationship with my wife, I’m the one who likes to talk it out, which goes against type. But I generally have been excited about the book. Five percent nervous, not about people judging me, but from exposing myself and taking some attacks from trolls that I might be tempted to respond to, which is never a good thing.

How did it feel living through the 2017 mania?

It was like living in a movie. Especially with the amount I had at stake. There was way more euphoria and magical thinking than fear and despair. But when it did drop and the few times I thought I got hacked, or when I was having conflicts with my wife about what we would do with that money, the contrast between the euphoria and the feelings of despair was extreme. Even though it was amazing, I wouldn’t want to live through it again. There was so much at stake. And then I had to relive it when I wrote the book, so I feel like I’ve gone through it twice. It was amazing but I’m glad I’ve moved on from it.

It’s interesting you say that because what struck me about the book is how that time period was a fairly small part of the book. Everybody thinks cryptocurrency was about these guys who put a few hundred bucks in and ended up with millions. But that wasn’t your story. You got to that situation because of a series of events and choices you made. There’s a whole mindset that’s important for your average person to understand.

Yes. People talk about going down the rabbit hole, and people outside of crypto think we’re just obsessed with the price, because they don’t get the whole idea behind it. It goes beyond the money. It’s more than the money.

In titling the book Confessions of a Crypto Millionaire, I worked with a firm to test different titles. “Decent Money” was my first title because it can mean a few things—decent money like it’s a lot of money, or I made it in a decent way, or like DECENTralized money, but nobody got it but me. It was too clever. “Corporate Hack” was my second choice because I’m a corporate hack and blockchains are a hack of corporations.

My goal is that this book will be read by a mainstream audience. The money is the candy, the inducement for people to learn a little more about a guy who’s struggled in his career and how I approached it at the time. I learned through early readers that a lot of people can relate to that. It wasn’t “put it all on red.” Instead it was about what cryptocurrency represents for the future.

People talk about how the market cycles repeat themselves in crypto. If you listen to them, we’re kind of in that 2016-ish period when you got into crypto. What are your thoughts about the cryptocurrency landscape right now?

I just heard a report this morning about development in blockchain. It’s up 15% over last year, despite this horrific bear market. Bitcoin and Ethereum are gaining lots of developers and some smaller chains are gaining developers, too. It really does seem like the end of 2016 when there was so much good news in crypto, but the price was stagnant. Whether it’s custodial solutions or partnerships with mainstream organizations or number of transactions or progress towards scaling, crypto is maturing before our eyes.

In 2016, there was similar progress and the price was stagnating, even going down. I’m a true believer, I believe it’s going to pop again. I’m not putting a timeline on it because I’m not sure, but if somebody put a gun to my head and made me decide whether crypto’s going to be in another bear market for two more years or whether it’s going to pop in the next two years, I would say it will pop because of all that development happening. I don’t see a lessening of enthusiasm where I’m at. Do you?

Well, it’s interesting because I see a lot of enthusiasm from people who are already in this space. And there’s so much going on. Projects are popping up everywhere, lots of them still in beta, and nobody’s even heard of them yet. Plus all the established projects that are really moving forward. There are projects that were white papers in 2017 that have actual mainnets and development communities and all sorts of amazing stuff going on. But outside of the cryptosphere, it’s crickets. Nobody cares. Sometimes it feels schizophrenic because I spend so much of my time in the real world, and then I have this little part of my life in the cryptosphere and they’re so separate and totally different. But then the other day, a consultant for my government agency told me he saw something in the news about cryptocurrency and it sounds like a lot of good things are going on. That’s how I know we’re right at that precipice. I don’t know if it’s going to be in a few months [but] I don’t think it’s going to be more than a few years before we really see that public interest again. We need that public interest. Developers will keep developing but if they’re just doing this for themselves, none of this work is going to amount to anything. Whether it’s a great idea you want to get off the ground, or you want to get rich speculating on this stuff, or you just think there are a lot of solutions that could make the world better, you need other people interested in seeing that, too.

Yes. And I always thought the public would jump aboard over some niche application [based on blockchain or cryptocurrency] that you hear from your kids. Like Pokemon Go—when it came out, all of a sudden everyone had it. That was a big platform.

It doesn’t need to be that pronounced, but I always thought it’d be that one thing you could only do on a decentralized network. Cryptokitties was kind of like that, but it was too early because Ethereum couldn’t scale. I always thought it’d be something like that. Some little teeny thing that would blow up into something bigger.

But the next boom, for better or worse, could be a speculative spark like 2017—just a boom in the price. Or Ethereum moving to proof-of-stake and the ensuing block reward reduction. Or a bitcoin ETF getting approved. Or Libra moving forward—which is years away, or never. Something like that. I never saw that coming in 2017—that it wouldn’t be based on new development, it would be based on mania.

You’re right though, that’s one of the signs. When people outside of our world notice little things, like “hmmm.” They don’t remember 2017 but they do think it was just a fad that was everywhere and then just disappeared.

What would your advice be for people going through this now, in this time period?

I’m not a financial advisor. No lawyer told me to say that but everybody says it, so I’d better say that. Always buy at your own risk.

But I do see public blockchains playing an exponentially greater role in the economy and having exponentially greater value over the next few years. Certainly in the next ten years. As an investor, if you have the right risk tolerance—like somebody who goes 90% stocks—you have to look at putting 5-10% of your portfolio into this.

Yes, it’s risky, but you also have to look at the reward. Some of these other risky assets are not going to 10x like crypto could. That’s huge and it also gives you a reason to watch this space.

Big institutions like Goldman Sachs and JP Morgan, they know it’s not going away. And if it doesn’t go away, it’s hard to imagine it just stays static [in price]. It’s hard to see an emerging asset that everybody says will stick around, not to at some point have explosive growth. And I believe in the use cases behind it, too, even though they might take years or decades. They’re coming, that’s my conviction.

I agree. What’s next for you?

Good question.

I spent two years obsessed with crypto and two years obsessed with writing a book. I want to write more books. I want to find good stories to tell. And then I want to give back in some way. I’ve been very focused on myself for four years and when you write a book about yourself, you get sick of yourself.

At the micro-level, I want to hang out with more friends. I’ve been so head-down with this book and obsessed with this. At the macro-level, I want to get involved with non-profits and the community. I have a few big causes that I’m not ready to talk about yet that I want to contribute to.

And write more books, but it will be hard to match this story.

I hope you enjoyed reading our conversation. Pick up Confessions of a Crypto Millionaire and let me know what you think after you read it.

Get more information about the book at danconwaywriter.com.

Relax and enjoy the ride!

—

Mark Helfman is a cryptocurrency commentator and author of Consensusland, a Readers’ Favorite 5-star book about a country that runs on cryptocurrency. You can also catch him on Medium. He publishes every Friday.

Posted from my blog with SteemPress : https://markhelfman.com/2019/09/06/special-feature-interview-with-ethereum-millionaire-dan-conway/

Interesting hmm hoping I can get hold of his book@vdux

Posted using Partiko Android

If you do, I'd love to hear your thoughts, too. Good to hear from you! I'll have to get back to haiku contests one day...

What's new?

Looking forward to join your new haiku contest...

Posted using Partiko Android

OMG I wish, I hope at some point. Running a contest takes more time than you think! I am now sapped for time -- still have full time job and kids, now my book and my blog are starting to pick up.

Wow! where can I read your book and the blog..it is elsewhere or here in Steemit?

Posted using Partiko Android

Start with my website, I’m not sure who sells books where you are.

https://markhelfman.com/books/

If you have any problems let me know, I have some tricks up my sleeve 😃

I put my blog posts directly on Steemit.

Posted using Partiko iOS

Congratulations @vdux! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!