Analysis of Global Cryptocurrency Market

Cryptocurrency is a special type of digital currency that used for modern payment, and global network investment transactions. It become more and more popular with recent five years. Because it is decentralized and not controlled by Central Bank, and any other governmental institutions, Cryptocurrency is very flexible, and can be used anonymously all over the world. This feature helps Cryptocurrency win a large number of customers, and achieved a big outbreak in the foreign exchange market.

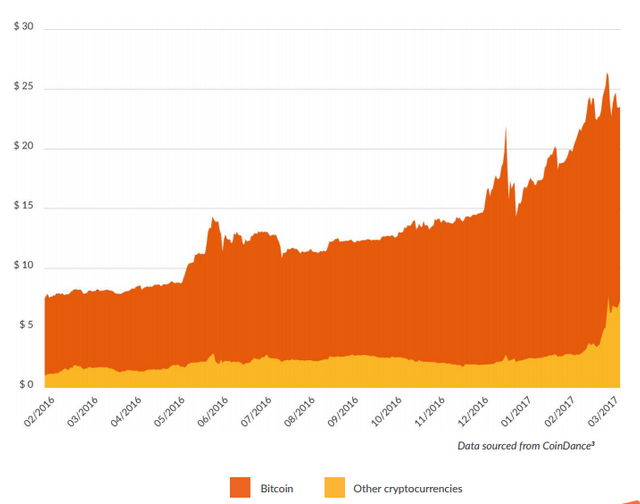

Since the beginning of 2016, the capitalization of Cryptocurrency market has increased more than three times and reached nearly $ 25 billion in March 2017. Bitcoin, as the most popular Cryptocurrency, broke through the $ 60 million mark in China in the first week of March 2016, and become one of the most popular methods of foreign exchange transactions.

(Unit: billion)

(Figure 1)

Background analysis

The first Cryptocurrency is called "b-money", which was released in 1998. Shortly thereafter, a variety of Cryptocurrencies have emerged. Bitcoin is the most famous, and widely used currency in this market. Bitcoin was originally published in 2009 with an initial price of 6 cents per bit, which is much cheaper than the price now - more than $2,500. By 2017/6/29 the Bitcoin market capitalization is $ 42,292,880,48, which is about 70 percent of the total market capitalization of the Cryptocurrencies.

With the continuous development of Cryptocurrencies market, there is a new currency, which is called "Ethereum", became the second largest Cryptocurrency in the foreign exchange market, and has a good performance till now.

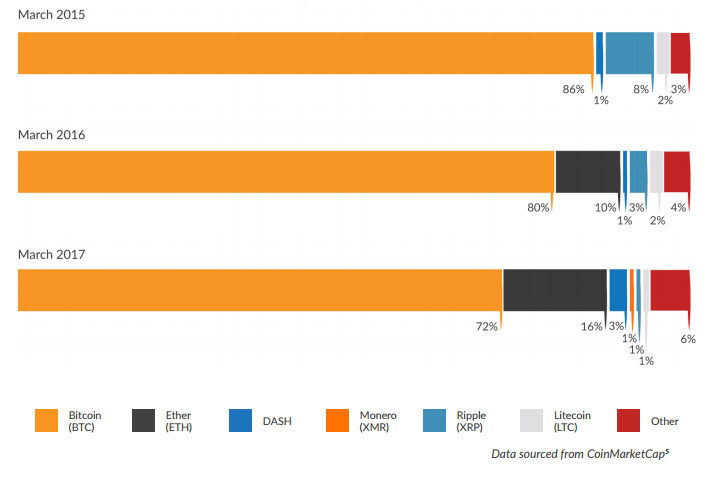

The figure below shows the percentage of market share of all types of Cryptocurrencies. From the figure we can see that although bitcoin (BTC) has been dominated by the dominant position from March 2015 to March 2017, the market share has decreased year by year due to the rapid development of the entire Cryptocurrencies market. Ethereum(ETH) as a dark horse, occupied 10% of the total market from March 2015 to March 2016, and it took only 2 years to take 16% of the market.

(Figure 2)

Market analysis

The rapid growth of the Cryptocurrecy industry is caused by growing demand of decentralized money, demand of reliable and fast electronic money, which can be transferred at much lower fee (0.1- 0.25% fee) and general interest in blockchain technology. Every Cryptocurrecy has special technological platform behind it. There are four key industry sections of Cryptocurrecy, which are: exchange, wallet, payment and mining.

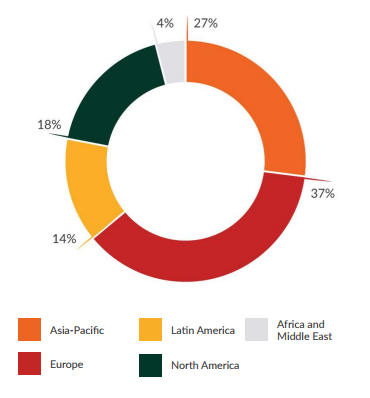

Exchange is the trading heart of cryptocurrency. It is used to buy and sell Cryptocurrencies, which is similar to the stock market. Nowadays, Europe and Asia-Pacific have the most number of exchanges in the Cryptocurrencies market.

(Figure 3)

Wallet is a storage of currency, which is generally used by companies, miners and cryptocurrency traders. Wallet can be stored online, on special websites, on USB or computers. It can be also printed on the paper. Wallet consist of two parts: public key and private key. Public key – represents wallet ID, and used for currency transactions, similar to account and route numbers in the bank. Private key gives access to the wallet. Starting 2017, Ledger Wallets became very popular among cryptocurrency investors. It’s a special device that stores wallets. Company which produces these devices is located in France.

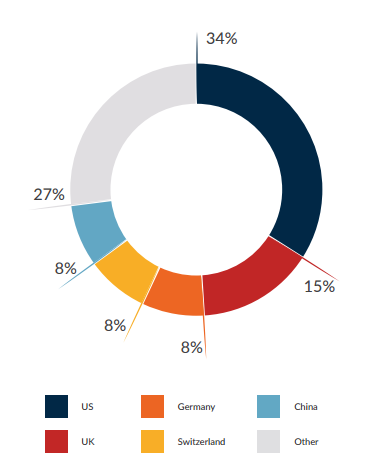

Overall, 81% of online wallet providers located in North America and Europe. (The figure below shows the percentage of the global providers’ who come from different counties)

(Figure 4)

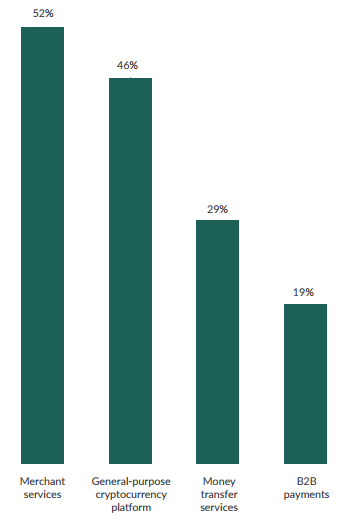

Payment as a new method of transaction, and it can be used for the purchase of real goods, and mostly used in B2B, B2C and C2B business model. The Cryptocurrency can be converted into cash for use, used as a commercial trading currency or used to purchase different daily supplies, such as pizza or beer. Cryptocurrecy ATM machines are set up in the United States, Australia and other regions. It all became available for the past three years, and allows to buy Cryptocurrey and withdraw money at any time.

(Figure 5)

Mining means using computers and other facilities to make cryptocurrecy. Computers are used to process cryptocurrency transactions, that happen in the form of mathematical encrypted algorithm. Individuals and companies can produce different cryptocurrencies through two main computer parts: central processing unit and graphic processing unit. Many producers of Graphic Processing Units had to increase their production due to sudden increase in demand. The revenue and profits of mining industry have significantly grown over the years. From 2010 to 2016, the revenue of Bitcoin Mining industry is from $ 0.2 million soared to $ 2073 million, which get nearly 10,000 times of the increase. However, the instability of the market, and high electricity costs of the mining process make this industry become more risky. In this position, many mining companies choose to mining two or more kinds of cryptocurrencies at the same time to prevent the risk of a single currency manufacturing.

Suggestions

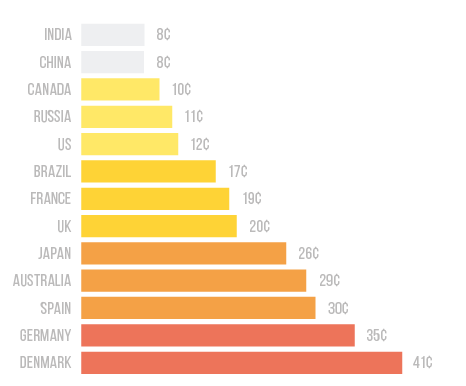

Due to the low cost of labor, hydropower resources and electricity costs, Chinese market has a great potential and high chances in future to become leader in cryptocurrency market. The figure below shows the global average electricity price (US cent / Kwh):

(Figure 6)

Compared to Europe and the United States, China has a big advantage in the production of cryptomoney. Cryptocurrency mining requires large number of computer resources and places with naturally lower temperatures, because mining process produces heat. Northwestern China has a natural low-temperature climate and low-cost factories, which can is a huge advantage and it is a perfect mining palace for cryptocurrency.

Compare to the markets in US and EU, Chinese cryptocurrency market is still behind. However, China has the biggest mining facilities in the world. Several days ago, a new cryptocurrency, which called "Antshare", was launched after rebranding, and has been approved for use by Central Bank of China. This is a huge improvement of the Chinese cryptocurrency market. The governor of China central bank, Zhou Xiaochuan, said that Chinese government encourages scientific and technological innovation in the financial area. This is a positive signal for cryptocurrency in Chinese market.

For years, Bitcoin was mostly used for online drug-trade, and money laundering, since it’s almost impossible to track down the owner of the wallet, and all money transactions happen anonymously. But more and more Bitcoin is getting used as normal currency and changing its reputation, which attracts large financial investors from US and Europe. In addition, media plays an important role. Different reports would cause different fluctuations in the cryptocurrency market. If the media reports positive news, cryptocurrency will be more socially acceptable and will have a rapid development.

In the next few years, cryptocurrency has potential to become one of the most popular trading method in the world, and potentially, blockchain technology will replace current banking money transaction system in the next decade.

加密货币作为现代支付手段及全球网络投资交易方式,受欢迎程度不断增加。由于不受任何和公司和央行的控制,加密货币可以在全球范围流动。这个特性使加密货币赢得了大量的客户,从而在外汇货币市场上实现了大爆发。自2016年初以来,加密货币总体市值增长了3倍以上,2017年3月达到近250亿美元。比特币作为加密货币的老大,在2016年三月的第一周内在中国的交易额就突破了6000万元大关,成为最受欢迎的外汇交易方式之一。

背景分析

加密货币的最初版本名为“b-money”,在1998发行。此后不久,各种各样的加密货币继而涌现。如今最受欢迎的加密货币非比特币莫属。比特币最初发行于2009年,最初发行价值为每枚比特币6美分,而如今每枚比特币价格暴涨至2500美元。其市值为$42,292,880,48(数据截止至2017/6/29),约占加密货币总市值的百分之七十。

随着加密货币市场的不断发展,目前名为“以太币”的货币成为继比特币后的第二大加密货币,并在整个外汇市场上有着良好表现。

从各类加密货币的市场份额百分比情况图中我们可以看出,虽然比特币(BTC)从2015年3月至2017年3月一直占据霸主地位,由于整个加密货币市场的飞速发展,其市场份额逐年减少;而“以太币”(ETH)作为黑马,从2015年3月至2016年三月,一年间占据了市场总额的10%,而其由默默无闻到占据市场的16% 份额,只用了2年时间。

市场分析

加密货币产业的迅速增长由于其智能和科技的发展与普及。每种加密货币背后都有代表性的科技和其融资的市场。加密货币的4个主要领域为:exchange, wallet, payment和mining.

Exchange为单纯的买卖交易货币,类似于股票市场。从加密货币的交易次数来看,欧洲和亚洲占据主导地位。

Wallets是货币的存储,一般用于与公司,矿工和加密货币交易商有关的业务。电子钱包可以在线存储、在特殊网站上存储,或是在USB和电脑上存储。电子钱包由公钥和私钥两部分组成。公钥代表钱包ID,用于货币交易,类似于银行的帐号和路线号码。私钥可以访问钱包。从2017年开始,Ledger钱包作为储存钱包的专用设备,在隐私投资者中变得非常受欢迎。生产这些设备的公司位于法国。

目前有81%的wallet使用者分布在北美和欧洲。这也代表了加密货币在美国和欧洲发展迅速于其他地区,许多公司现已投入使用。

payment作为新型的支付手段,可以用于实质商品的购买,且多存在于B2B,B2C及C2B的商业模式中。加密货币可以兑换成现金使用,作为商业交易货币或是购买日常消费品。日前,苹果商城也加入了比特币和ETH等手机支付客户端,使得加密货币的流通更加方便。在美国,澳大利亚等地区设立了加密货币的ATM机,可以提供随时存取或提现的服务。

mining译为挖矿,也是供需关系的供应方。个人及公司均可以通过不同的电脑系统生产出不同的加密货币。挖矿行业的收入和利润几年来明显增长。从2010年至2016年,比特币挖矿行业年收入从$0.2million暴涨至$2073million,有着近10000倍的涨幅。然而市场本身的不稳定和大量成本的花费给挖矿过程带来了不小的风险。这使得挖矿企业大多选择同时制造两种或更多种的加密货币,以防止单一货币制造带来的风险。

形势分析及建议

由于拥有着低价劳力和水电资源,中国市场有着巨大的潜力发展加密货币。相比于欧洲和美国,中国在生产加密货币的电力资源上有着绝对优势。并且在生产加密货币的过程中需要大量的电脑和大面积的厂房,制造过程中产生的热量也需要处理。中国西北部区有着天然的低气温气候和低价的产房租赁费用,有着生产加密货币的巨大优势。

相比较于美国和欧洲市场的成熟,中国的加密货币市场仍在发展中。目前一种名为“Antshare”的货币刚刚举行发布会并且得到了央行的准许并使用。这是加密货币在中国市场的一次巨大进步。中国央行行长周小川表示中国政府鼓励在金融领域的科技创新。这对于加密货币市场在中国继而发展是个积极地信号。

多年来,比特币主要用于在线药物贸易和洗钱,因为几乎不可能记录钱包的所有者,所有的货币交易均为匿名发生。但是,越来越多的比特币被用于正常货币,这是其改变了声誉,并且吸引了大批来自美国和欧洲的大型金融投资者。媒体在舆论导向上扮演了重要的角色,不同的报道使得加密货币市场有着不同的波动。若媒体报道积极方面的新闻,相信加密货币会更容易被社会接受并且会有更加迅猛的发展。

也许在未来的几年以内,加密货币会成为最新型和普遍的交易方式,方便人们的生活。

资料来源:

BitConnect (n.d.). How do people give value to cryptocurrency and how is the price of cryptocurrency defined? | Bitconnect. Retrieved from https://bitconnect.co/bitcoin-information/10/how-is-the-price-of-cryptocurrency-defined

Bitcoin (BTC) price, charts, market cap, and other metrics | CoinMarketCap. (n.d.). Retrieved from https://coinmarketcap.com/currencies/bitcoin/

Cryptocurrency. (n. d.). Retrieved from: https://en.wikipedia.org/wiki/Cryptocurrency

Hileman, G. & Rauchs, M. (2017). Global Cryptocurrency Benchmarking Study. Retrieved from: https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf

History of Bitcoin (n. d.). Retrieved from: https://en.wikipedia.org/wiki/History_of_bitcoin

OvO energy (n. d.). Average electricity prices around the world: $/kWh. Retrieved from: https://www.ovoenergy.com/guides/energy-guides/average-electricity-prices-kwh.html

Surowiecki, J. (2011, Sep). Cryptocurrency. Technology Review, 114, 106-107. Retrieved from https://login.iris.etsu.edu:3443/login?url=https://search-proquest-com.iris.etsu.edu:3443/docview/928060920?accountid=10771

best analysis I've seen maaaaan

c000000l

Very impressive @variag! I also read how you turned your ETH into thousands in profits!! Would like to see more as your quality is A1! I also think it would be beneficial for you to join the Minnowsupport community! You will get the attention you deserve. Have a wonderful day!