Momentum trading cryptocurrency: How to use Harvard and Yale researched investment techniques to beat the market.

Financial disclaimer: This is not financial advice. Cryptocurrency is very risky and you should only invest what you’re comfortably able to lose. Also, don’t just read an internet article then make up your mind. When it comes to money you should always do your own research and seek the guidance of professionals.

When my friend first told me about momentum trading 6 months ago, I blew it off. The word “trading” brought up images of some beat-down Dad gambling away his life savings trying to compete against JP Morgan’s supercomputer AI bot by looking at some triangle shapes on a chart. Trading on technical indicators is a loser’s game and more akin to gambling than strategic buying and selling. Not to say there aren’t people that have been successful, but in my personal experience, it usually ends in the red, rather than the green.

A few months went by and my friend contacted me again. “You really have to read this book Muscular Portfolios by Brian Livingstone,” he said, “it teaches you about how re-adjusting your portfolio to the best investments each month can help you perform better than the market average.”

I was intrigued and began researching. I was pleasantly surprised to learn that this was a legitimate and mathematically-tested theory devised by financial academics and used at Harvard and Yale to build wealth.

The main Muscular Portfolios strategy ‘The Papa Bear’ essentially works like this: From the 13 distinct asset classes listed here, you re-adjust your portfolio once a month to the 3 classes that have the best average growth based on 3, 6, and 12 month figures.

Of course, this is based on traditional assets, but the research in the book shows that it’s historically possible to beat the average of the market using this technique.

I immediately looked at my dwindling portfolio of digital currencies and assets and wondered, “could this work with cryptos too?” Perhaps.

A quick Google and a few clicks later and I came across this research paper in the academic journal Economic Letters. In it the authors found that momentum trading in crypto does produce positive results but only if you reduce the growth period and your re-adjustments periods to 1 week (instead of 3,6 & 12 month average). The authors state that this could be due to the higher level of volatility in the crypto markets traded against the USD.

So essentially, if you took the highest growing cryptos for the week, and invested in the top 3, held for a week, then reinvested in the new top 3, you’d be getting some decent growth. In fact, the researchers found a 19% weekly return using this method.

But as mentioned above, this is all trading with USD pairs. What about if you’ve got some Bitcoin sitting there and you’d like to grow it by investing in other coins and tokens?

Trading with BTC pairs

Trading cryptocurrencies with bitcoin is volatile, but if you look at the volatility compared with trading with USD as your base currency, it becomes less so.

For example, ETH/USD pair is more volatile than a ETH/BTC pair historically. The volatility of ETH/BTC reduced by more than half over the last 1–2 years. The assets appear to be getting more stable and less volatile.

Which leads me to my (untested) theory. With the reduced volatility of trading against BTC pairs, and the further reduction in recent years of maturation of the market, it’s time to relook at the original momentum trading theory in Muscular Portfolios and apply it to crypto.

Of course, the volatility in crypto is still well beyond anything seen in traditional assets, so any strategy in crypto would need to incorporate aspects of both the Papa Bear as well as the strategy in Economic Letters.

3 Crypto Momentum Trading Strategies

So that’s when I started brain-storming… There was so many ways to incorporate the lessons of both strategies but what are some example ways that a crypto momentum trading strategy might work?

This is what I came up with — three theories incorporating different aspects of each of the above two momentum trading strategies.

The following examples are being live-tested using the Shrimpy platform (affiliate link) and while it’s too early to tell, I’ll be sure to update as things progress.

‘Slow And Grow’ Momentum Trading Strategy

This strategy extracts the essentials from the tried and tested Papa Bear strategy from Muscular Portfolios while adding a little more diversity of assets.

The steps are easy:

- Go to Fucc.io, change the currency to BTC, then click the ‘Change Avg’ column to sort.

- Take the top 5 highest growth assets and allocate 20% of your portfolio to each.

Note: In the case of a bear market and any or all of your top 5 assets are in negative growth, keep this portion in Bitcoin. For example, there’s only 2 assets with positive growth, then you’d allocate 20% to each of them and keep 60% in Bitcoin until the following 2 week period. - Repeat and re-adjust your portfolio every 2 weeks.

‘Fast Lane’ Momentum Trading Strategy

This strategy takes the winning components of the aforementioned research article while taking some additional cautions.

The steps are easy:

- Go to CoinGecko, change the currency to BTC and click ‘7d’ to sort.

- Find the top 3 assets but omit any crypto assets that don’t have a positive 3m growth on Fucc.io.

- Allocate a third of your portfolio to each asset.

- Repeat and re-adjust your portfolio every week.

‘Best Of Both’ Momentum Trading Strategy

This strategy combines the tried and tested Papa Bear strategy from Muscular Portfolios with the insights from the research article mentioned above.

The steps are easy:

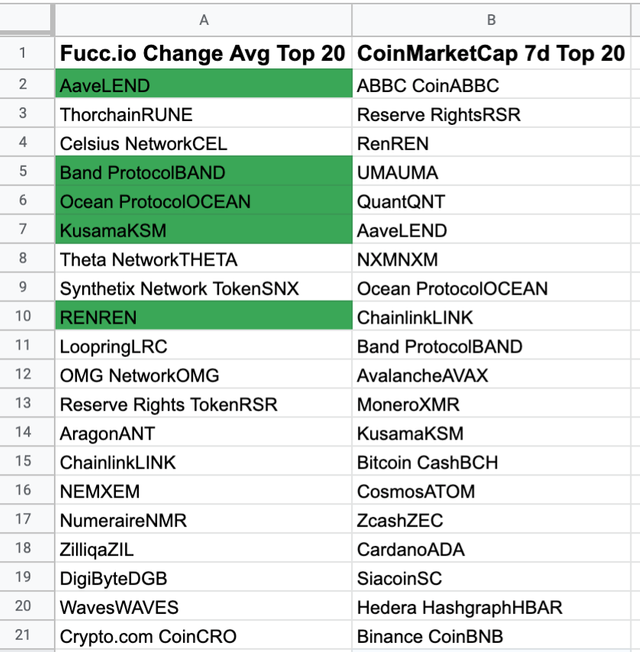

- Go to Fucc.io, change the currency to BTC, then click ‘Change Avg’ to sort. Take the top 20 highest growth and note down in a spreadsheet in Column A,

- Go to CoinGecko, change the currency to BTC and click ‘7d’ to sort. Take the top 20 highest growth and note down in the same sheet.

- Starting from the top of the Fucc.io list, highlight any crypto assets that are also on the CoinMarketCap top 20 list until you have 5 assets only, then stop.

You should have a sheet that looks roughly like this:

- Allocate 20% of your portfolio to each of those in green.

Note: If you don’t get to 5 because the last week has been down, fill the remainder of your 5 cryptocurrencies with the unhighlighted assets in the Fucc.io column, (starting from the top). - Repeat and re-adjust your portfolio every 2 weeks.

Conclusion

Whether you use the above strategies or whether you devise your own using the basic concepts described above, momentum trading has the potential to accelerate your investment growth. I’m interested to hear from readers as to what other momentum investing strategies are out there in crypto land, so leave a comment.

Also, just a reminder that theses strategies are theoretical — and while I’m currently testing them, you shouldn’t engage in any investment where you haven’t done your own independent research.

Author’s disclaimer: I was involved in the creation of the website fucc.io which I created for the purpose of providing an ad-free resource to use for momentum trading strategies. It’s secure, simple and I don’t make any money off it other than from member donations.