How are War fears and China's oil gambit effecting prices? Why dont the experts ever analyze this?

I am like most right now...wondering how low the correction will go before bottom, and what, aside from normal fluctuation, triggers such events. I guess if any of us figure out that riddle, they will never be seen again...because they can buy that private island...

Well crypto is not on an island by itself. While block chain tech is decentralized in general, it is still in its infancy and many exchanges and physical mining operations are located in Asia.

I have YET to hear ANY analysis from any of the crypto experts on HOW geopolitical events and the apparent threat of martial action in the pacific rim, sway the crypto market...

Maybe I am just asking you all...HOW COULD IT NOT?

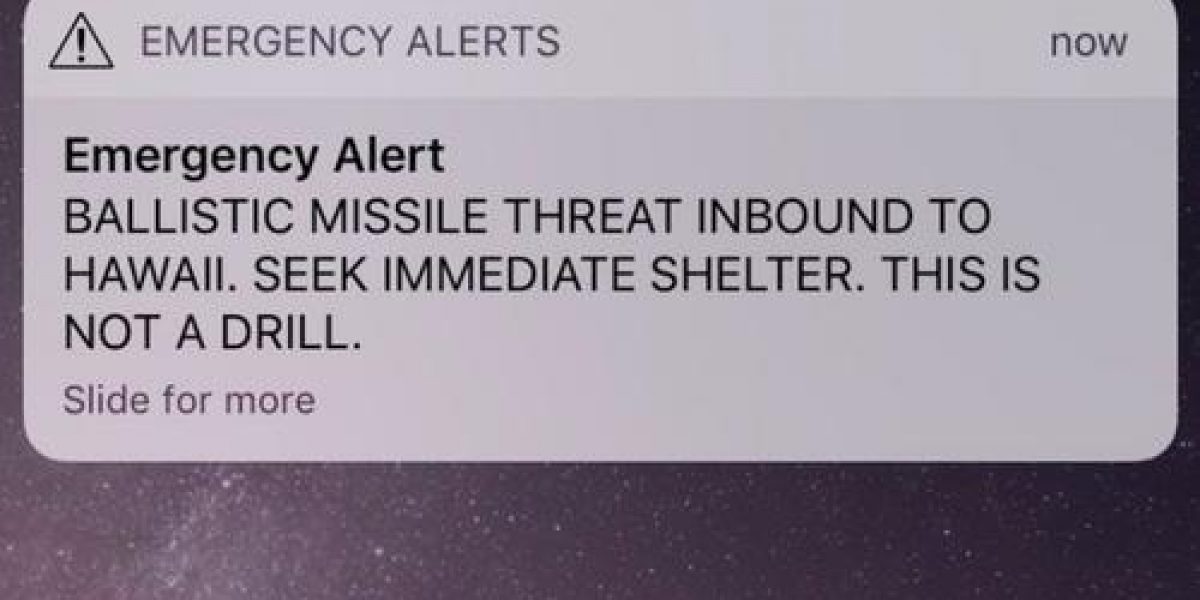

In the past week we have seen "false" alarm warnings of inbound missiles headed to both Hawaii and Japan with the Japanese warning specifically naming North Korea as the attacker.

Considering the importance of Japan to the crypto world....and their enthusiastic attempt to take the lead in many areas...how is it that the elephant in the room is never discussed?

Is the true Crypto bubble the one we are hiding in, in which there is no geopolitical consideration because we can simply move operations?

Well, we have seen an exodus of miners in the past...

We have also seen exchanges move physical location....but until the crypto child is ready to leave the nest and pay his own way in places like Canada, Russia or the US,.. Asia is home.

For example, It is reported that China will launch its Petro Yuan on tomorrow, Jan 18th...

This will be an obvious direct challenge to the US Petro Dollar and a potential cause of some volatile pricing action that can extend across multiple sectors.

What effect, if any, would this have on crypto currencies?

The last question I dare to ask, pertains to economic sanctions imposed by govts and the ability to circumvent enforcement via crypto...as well as countries like North Korea that have been accused of mining/hacking mainly privacy coins like Monero...

Yes this actually has been discussed...but what none care to think about is what a govt such as the US Govt would do if it found its economic weapons no longer effective...would it continue to allow crypto to operate within its borders if it was also tool for a declared enemy?

Could it stop it if it wanted?

How should we be factoring this into our analysis?

Lets me just put it out there...

What happens to crypto if war breaks out in the Pacific theater?

Will we even care...?

Thanks for reading, please feel free to comment