Hard Fork Event Bitcoin Core VS Bitcoin Unlimited: What is it?

For you Bitcoin and Blockchain lovers, it would be no stranger to hear the word 'hard fork' which lately keep popping up on the news and become a heated debate among users. But how far is your understanding of the vulnerable Hard Fork events happening in the Cryptocurrency world? Let's read the explanation below.

Rather than giving an elusive definition, perhaps we should study directly through the Bitcoin case study. Have you recently felt a Bitcoin transaction for a long time to get 1 confirmation? You have given a standard miner fee that is relatively high, ie 0.0005 BTC in your transaction. Supposedly, your transaction will get 1 confirmation within 10-30 minutes. But now 1 hour has passed, and your Bitcoin transaction has not been confirmed by Blockchain network yet. Why does this happen?

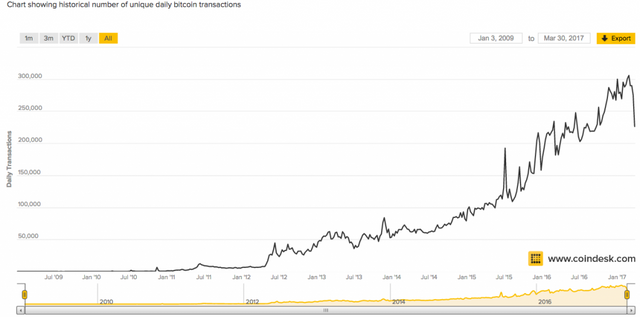

You know how much Bitcoin transactions are happening lately. In mid-2009, there were only about 100 Bitcoin transactions processed per day. From the chart you can see how rapidly the increase in the number of transactions from year to year. On March 2, 2017, the number of Bitcoin transactions even touched the number 329,428 in 1 day. But what's the problem?

The problem is 1 block, which appears every 10 minutes, can only accommodate Bitcoin transactions up to 1 MB, which means there are only about 3 transactions that can be processed every second. When we count, meaning within 10 minutes until the next block is created, there are 1,800 transactions that can be processed. But keep in mind not necessarily in one block can actually load 1,800 transactions. Sometimes a block contains fewer number of transactions because the capacity of each transaction data entered into the block is greater than the average. So maybe, one block can only contain 1,500 transactions, not 1,800 transactions.

Currently, every 10 minutes there are about 2,300 transactions queuing up for processing. Since a block can only contain 1,800 transactions, there are 500 transactions that are still queuing up to the next block to get 1 confirmation. When the next block appears, the number of transactions that have queued 3,000 transactions and the new block can only accommodate 1,800 transactions. That means there are now 1,200 transactions queuing up and so on. The transaction to be prioritized for entry into blocks is a high feer miner transaction. So if your Bitcoin transaction has a 0.0005 BTC miner fee, while 1,000 other transactions miner feenya reach 0.0009 BTC, then you will wait until many hours until your transaction is processed and put into block.

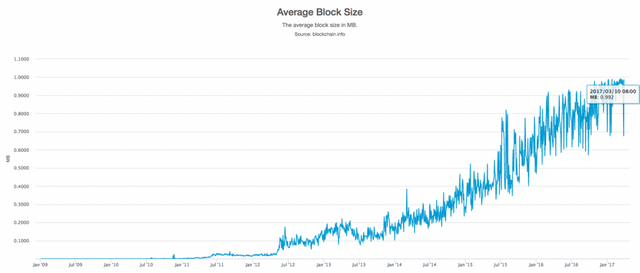

The graph above shows the average number of blocks created from the Bitcoin network since the first time Bitcoin appears to date. In the middle of 2009, a large block of Bitcoin reached only 0.001 MB, but on March 10, 2017 yesterday, the big one block reached 0.992 MB-almost 1 MB! Over time, Bitcoin transactions will increase. What happens in the future when just now the maximum capacity of the block is almost fulfilled? As more and more transactions are queuing up for blocking, more transactions need to be confirmed, and miner fees will be more expensive. Bitcoin will lose the properties that make it much better than the current bank or financial system, namely: the speed of transactions and the low cost of remittances.

So what to do?

Simple. You just have to upgrade it.

Unfortunately, the 'upgrade' process is not as easy as imagined. Bitcoin, since it is not controlled by a country, government, or any other party, relies on a consensus system for upgrading the system. If the size of the Bitcoin block is to be converted from 1 MB to, say, 10 MB, then there must be at least 51% of the miners worldwide (who run Bitcoin technology) that agree with the change. Convincing 51% of the hundreds of thousands of miners in the world is certainly not something easy. Even if 51% of them agree, it does not mean Bitcoin upgrade process has been successful without any problems. If 51% of the miners agree, there will be a new Bitcoin network whose capacity of each block is 10 MB. But 49% of other miners are also able to keep running an old Bitcoin network whose capacity of each block remains 1 MB. If 49% of these miners do not agree to upgrade to the new Bitcoin network, and still choose to run the old Bitcoin network, there will be two Bitcoin networks running at the same time. This is called Hard Fork, where the Bitcoin network becomes branched, like the tip of a fork.

Means there will be two different coins.

Remember the Ethereum case that split into Ethereum and Ethereum Classic? Yes, this case can also happen to Bitcoin.

Currently there are two camps that are arguing for this Block Size Bitcoin problem, Bitcoin Core and Bitcoin Unlimited. Bitcoin Core is the Bitcoin network we use today, represented by the BTC symbol. Broadly speaking, Bitcoin Unlimited has the same concept but its block capacity is different, no longer 1 MB like the one in Bitcoin Core. Bitcoin Unlimited came up with a reason to fix the shortcomings in the Bitcoin Core network so that Bitcoin transactions could become even more quickly confirmed. Think of it in the Bitcoin Unlimited network, one block capacity of 16 MB, meaning a block can contain up to 28,800 transactions! Much more than Bitcoin Core that can only process a maximum of 1,800 transactions per 10 minutes.

But unfortunately, not everyone considers Bitcoin Unlimited as the best solution. Many are debating the negative side of Bitcoin Unlimited. For example, many assume that to create large block capacity will require a large computing resource as well, so there will only be a few miners who can do it. This will lead to centralization in the Bitcoin network. In addition, still had several times found a bug during testing Bitcoin Unlimited which certainly makes some parties hesitate to upgrade. Not to mention if we think the risk of Bitcoin is split into two coins after Hard Fork occurs. Unlike in the case of ordinary forking where forking time has been planned before, Bitcoin Unlimited network activation can occur at any time without predictable. There are opportunities where the separation of the two coins does not go completely.

Until now the debate is still running and there is no certainty whether Bitcoin will experience Hard Fork or not in the near future, and the possibility for Hard Fork is actually still fairly small. But if the Hard Fork case happens, at least this time you already understand what is meant by the Hard Fork event and why it is needed.