Crypto Market Update: 3 Coins to Keep an Eye On.

Hi investors, let's talk about 3 coins that we think can make excellent picks for the next market cycle.

Crypto Markets.

With Bitcoin playing possum pending its next move...

Some of the market's best projects have hit accumulation and look ripe for the picking, let's take a tour of our favorite projects.

Decred.

The hybrid POS/POW currency project has received support from Chris Burniske and Joel Monegro's Placeholder Fund which released a very interesting investment thesis.

Decred’s killer feature is good governance, and with good governance, you can have any feature you want.

.png)

ZCash.

The best privacy tech in the world will activate its much anticipated Sapling upgrade sometimes towards the end of this month. We did an analysis of why we like ZCash as an investment.

Tezos.

Tezos' self amending smart contract platform has just launched and has a long way to go to threaten the incumbent. The technicals on the coin are particularly interesting though, Tezos has been in accumulation for a while now and hasn't been through a proper market cycle yet, making it a speculative but interesting choice for a long term swing trade.

What do you think about our selection? What coins would you add to this list?

Trade carefully.

FØx.

This content is for informational purposes only and does not constitute financial advice.

If you liked this article, make sure to show some love by up-voting or following the blog. You can also follow us on Twitter at F0xSociety.

Buy Digital Assets: Coinbase

Buy Digital Assets: Coinbase

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Published on

by FØx

Interesting picks you have, I know you are bullish on zcash, and have thought about that one... Don't know much about the other two... What's your take on.xml now that they have a working product and good partners? Cheers!

Hey @etka, good to hear from you mate, how have you been? I like Stellar a lot, fast blockchain, their new StellarX exchange is a great product, not sure if it's worth it as an investment though, I am saying this because I am not familiar with their tokenomics and I am not sure how their token could accrue value given its fast velocity.

PS: this list should also include Bitcoin and Ethereum as long term investment.

Hi,

A private coin is certainly going to be big in the coming future, it is just a question of awareness in the general public of how important this feature is for individual liberty. Will it be Zcash (the case is certainly compelling), Monero (a historic heavy weight with fanatic pursuit of state of the art privacy over marketing or hype), improvements on bitcoin (which are on the way with schnorr signatures on the main chain and added features on the lightning network), or another one... it is hard to tell. So if the general principle of the soundness of investing in a private coin is solid, choosing the right pick is quite tricky. And I say THE right pick because I doubt that there are going to have more than one (or maybe two) blockchains in this niche on the long term.

As for promising coins for 2019, I try to gauge their potential in the likeliness for them to build huge ecosystems, and that comes for me at the crossroads of having a rather unique tech/niche, a solid developer's base and meaningful partnerships. So my picks will probably not bring you a lambo in a few months or maybe even a few years, but over many other possibilities, if I had to bet who is going to be still relevant in two years time (a century in blockchain time), I would currently go with IOTA and ICON.

IOTA : I have never seen a coin that has endured more disinformation and belittling campaigns as this one. The tech is still young and to be honest a bit buggy and far away from the whitepaper promises, but massive progress is being made each months (the tangle is stabilizing and the coordinator should be removed in a matter of months, smart contracts are coming on top with Qubic...), massive partnerships for large scale real uses cases are secured (Fujitsu, Bosch, Volkswagen) and there is just no other competitor worldwide to power the incoming IOT... After losing 90% of it's value from ATH, I think there is definitively some potential here.

ICON : Whatever great the concept of any project is, without massive adoption, it is not worth much. As the leading Korean smart contract ecosystem, I believe ICON is in one of the best positions in the world to become significant. The west clearly lags behind in terms of public awareness and involvement in blockchain. Korea is one of the most regulatory friendly countries in the world and openly pushes for blockchain development, its population is the most involved in the world in trading crypto, and ICON is spawn from an established tech consortium which secured huge partnerships (Samsung, LINE...).

Wow, that's quite an answer, you seem to be very up to date with what's happening in the space so props for that.

I am extremely unfamiliar with both your picks, I heard IOTA had buggy technology and unclear use cases but that's about it, as for ICON I really don't know enough about the project to make informed comments.

Sadly I think that in the long run the Bitcoin network will eventually end up having most of the features that make altcoins different, thus rendering most of them redundant including privacy coins.

We're seeing huge progress in Rootstock for example and it's looking like Bitcoin will be able to have turing-complete sidechains and do ICOs and do IOT payments ala IOTA via the Lightning network.

Really the only problem with Bitcoin is its governance so maybe there is a case to be made for investing in coins that have a baked in governance system like Tezos or Decred.

@blacksad

I really like your articles and I think you deserve people trying to back up a little bit their comments. keep up with doing this terrific job :)

I am just vaguely familiar with decred, so I am not going to make any comment on that.

As for Tezos, it's fun, but even if I have no contact at all with him currently (and quite frankly no desire to make any contact either), I actually know quite well Arthur Breitman. He was a fellow student at university. We graduated the same year :) I don't like his character, but I have to recognize that the guy is intellectually brilliant. That's why I was considering investing in the ICO back in 2007. Very glad I kept my eth at the time though, because boy was the launch of this blockchain as mess ! Even if they seem to have normalized things, I am very skeptical that Tezos is going to do anything meaningful and I am floored by the current valuation : to me, it seems that they came to late to the party implementing a second generation blockchain with no ecosystem around it, little perspective of being as powerful as newer blockchains (EOS, Stellar...) and with very little differentiation (the coding language is supposed to be better to audit smart contracts and making them airtight, yeah okay - and this onchain governance : seriously is any layman really going to use this feature ?)

As I wrote, IOTA is the "blockchain" (actually a DAG) that has been the target of the most insane FUD I have ever seen : in itself, I take it as a rather positive sign that some people (bitcoin whales ?) are shit scared that it could meet its promises (we are still far from that but the team is insane, so there is a solid chance that they can pull this off and I don't see Volkswagen implementing a hardware solution running on IOTA for its cars due in early 2019 if there was not a good chance that they could pull it off).

As for bitcoin, I agree with you that with second and third layers it could encompass many features of many altcoins. The only thing that bugs me is its POW... In a world concerned with energy consumption, is it really going to resist a better more ecofriendly alternative ?

And one more thing on Bitcoin : with the lighting network making steady progress, it seams feasible that bitcoin could be a platform suited for daily payments and even micropayements. The execution speed could be reduced to an acceptable time and the fees could be cut to the minimum. However, I don't believe it could be ever suited for IOT on a massive scale. Clearly the consensus emerging, for many technical reasons I am not going to detail here, is that for IOT, the right underlying structure is a DAG and not a blockchain.

Fair points all around @blacksad, I agree it's going to be an uphill battle for Tezos and their governance model could very well end up in yet another plutocracy a la Lisk.

Have you looked into Hashgraph which, as I understand it, is also similar to a DAG ?

I had just heard about hashgraph, but not paid much attention to it yet. As you are asking, I read the whitepaper to better understand the project.

They are quite secretive about the structure of the data : they run a pattented algorithm as it seems. Anyway, I don't think it is a DAG, as there are 49 consensus nodes that put timestamps on each transaction and seem thus to order them in a kind of chain. I have no particular opinion on whether this is a good project or not : it strives to be an efficient platform for dapps and could be a contender for EOS in that regard. They don't make any comments on IOT and I don't think it is well suited for IOT anyway.

The core value proposition of a DAG is that each new transaction validates two previous ones (and makes some little POW to counter spamming), thus avoiding the need of any consensus node and more importantly of any fee. This property is key for IOT to make business models relying on gazillions of transactions of very little value possible.

The only other project I know of with an ambition to be a general protocol layer for IOT is IOT Chain (ICT) a chinese competitor of IOTA (they use a DAG and anchor some states on a BFT blockchain). Pretty tiny today as for market cap but they work closely with hardware startups in China, have a solid team and are rushing to put their solution to market before IOTA becomes an indisputable standard (Fujitsu wants to make of IOTA the standard protocol worldwide for IOT... It could fail, but that speaks volumes about the soundness of the project)

hi @blacksad

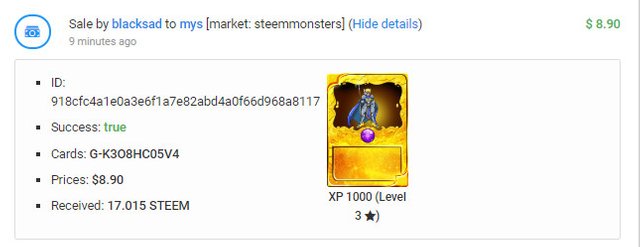

Recently you sold this card under market price

current price 1 card = 14.98 $ ( alpha )

sold = 8.90$

you lost over. 14.98 - 8.90 $ = 6.08 $

this bot bought your card - @mys

it's an a mistake and you want to claim or report

please contact @mys or report about this bot here https://discord.gg/CAFJRjY

Hop hop :)