Bitcoin Quietly Bullish Pending ETF Decision.

Hi traders, let's talk about Bitcoin.

Bitcoin.

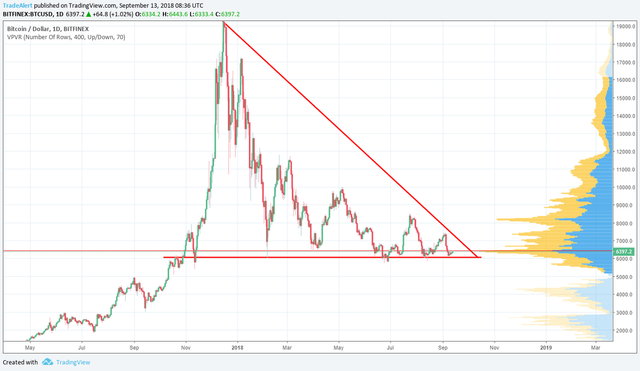

On the largest time-frame, Bitcoin can be seen trading inside this huge bearish descending triangle.

However the price has been making higher lows ever since hitting $5755 (Bitfinex USD/BTC) on June 24th, first to $5876 on August 14th (Bitfinex USD/BTC) then on September 8th at $6119 (Bitfinex USD/BTC).

After losing close to 70% and bankrupting droves of speculators, the price has (so far) proved unable to gather enough selling momentum to break through this huge volume well (large red ellipsis in the chart below).

We're now looking quite established over $6000, where the current balance (yellow/blue indicator) shows historical market interest for prices above $6000 (green range).

On the smaller time frame we're looking at the bulls trading up into the current balance (yellow/blue indicator), forming a bear flag which could suggests a retest of $6100 sometimes towards the end of the week.

The bear flag's volume profile shows that there is not a lot of volume above $6500 which means that only a short squeeze or some fundamentally bullish news could allow us to break out of this range.

Strategy.

Despite the bearish descending triangle, I doubt we'll go lower than $6000 which has proved to be a solid floor on 5 different occasions.

There simply doesn't seem to be enough selling pressure to take us under that huge volume well and the price has shown some slight bullish momentum since bottoming at $5755.

I believe the market is in waiting mode for SEC (or another, non-american, regulatory entity) to decide on the fate of a Bitcoin ETF.

A Bitcoin ETF is a massive deal for the space and would open the door for anybody, all around the world, to invest in Bitcoin.

It's been announced that SEC would give his decision by October 1rst.

How likely is SEC to green-light CBOE's ETF at this point? Let me know your opinions in the comments

Until then...

FØx.

If you liked this article, make sure to show some love by up-voting or following yours truly. You can also follow me on Twitter at F0xSociety and join my Discord Community for daily live updates Monday to Friday.

Recommended Exchange:

Recommended Exchange:

Coinbase

Radar Relay

Kyber Network

Hardware Wallet:

Hardware Wallet:

LEDGER NANO S

May the FØx be with you.

Published on

by FØx

Great analysis, which website you use for your TA?

Posted using Partiko Android

Thanks @chesatoshi, I use Trading Views (Pro Membership) with Volume Profile and Stoch RSI as indicators.

I plan to start seriously doing more crypto trading in the coming weeks for generating another stream of income. What is your best source of info, tools, education platform you use personally?

You are very knowledgeable on the TA part. :)

I'd suggest you take the trading mastery course from Skill Incubator:

https://courses.skillincubator.com/

The membership is a bit pricey but their lead trader/mentor is one of the best in the space.

If you're looking for a cheaper option, I am working on a course which should launch sometimes towards the end of the year.

Great as usual ;)

Posted using Partiko iOS

Cheers!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by tradealert from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.