Oh Oh.. The Taxman Cometh

Oh Oh.. The Taxman Cometh

The worst feeling in the world is going on vacation, and the minute you do, everything in the crypto world goes bat shit crazy. Some of you are new to bitcoin and cryptocurrencies, but for those of you that have been around a while, we always expect a little bit of correction here and there throughout the year.

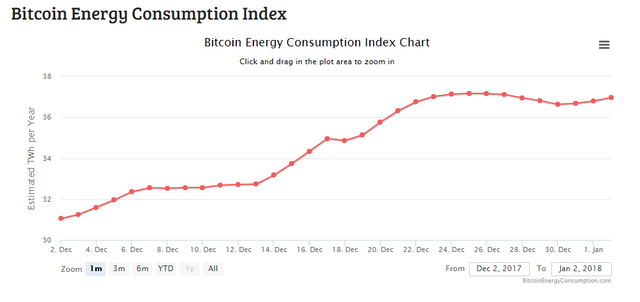

December it seems, was not without its roller coaster of price movement. I know a lot of people were wondering, just why Bitcoin dropped so tremendously, and so fast. In Crypto Plunder: Episode 24, I warned that Bitcoin Cash posed an immediate threat, to not only Bitcoins dominance but also to its mining capacity. And sure enough, bitcoin's mining capacity has started to fluctuate.

So what does this mean for Bitcoin long-term? With other altcoins starting to take their place higher on coinmarketcap, we have to see the flaws that are evident. Bitcoin's transaction speed, will not be able to keep up long-term with other cryptocurrencies. Does that mean I'm bearish on bitcoin? Far from it! it just means I understand that if a utility is going to have long-term appeal, then that system needs to be able to keep up with Enterprise level use cases. We’ve seen that Bitcoin refuses to put itself into position to maintain its dominance because of lack of speed in innovation. If the Bitcoin Foundation continues to flounder on addressing these issues, it's inevitable that another technology will push itself forward. Do I think it's Ripple? Hell to the no! But I'll go into that in another article.

What does this have to do with taxes? Well, Bitcoin is a storage of value, and of course the tax man now wants to charge you for every time you make a purchase not only for Bitcoin, but for any altcoin that you want to possess. Though I can't see how that's even possible, considering that we're not charged taxes via PayPal to exchange for any other currency at time of purchase. There may be fees, but the person converting currencies isn't charged a tax. Funny thing is, I'd like to see how the government's going to keep up with billions if not trillions of transactions. Also, what happens when a user simply just moves their coins off of exchanges based in the United States or any country for that matter?

Tax Articles:

http://fortune.com/2017/12/21/bitcoin-tax/

https://www.forbes.com/sites/robertwood/2017/12/28/loophole-allows-tax-free-bitcoin-exchanges-into-2018/#fa3a0a412fab

https://www.forbes.com/sites/greatspeculations/2018/01/03/what-you-should-know-about-taxation-of-cryptocurrencies/#5161ae781346

https://www.irs.gov/newsroom/like-kind-exchanges-under-irc-code-section-1031

This is just an example, of how the government doesn't quite understand, how to deal with new technology. What happens if I purchase a piece of software called Ethereum that I can program on top of. I wouldn't call Ethereum a cryptocurrency, I would call that a programming language, that happens to have a value field. What if I want to purchase a portion of a Decentralized Exchange? Well I'm not paying for cryptocurrency, I'm now paying for a Decentralized Exchange. What if I wanted to have some Steem? Well Steem is not a cryptocurrency to me, it's a publishing platform. Since the government can't define what a cryptocurrency is, then you can't tax me on something you can't understand.

Now I'm not saying I won't be paying taxes when I convert to Fiat, but what I'm saying is I'm not going to be tracking every single one of my transactions, or the transactions of an automated system just for the amusement of idiots on Capitol Hill. Can you imagine every single crypto miner, with multiple machines, trying to track every single transaction they're receiving to pay taxes on? That's just ridiculous and stupid. It's almost as if they want us as American citizens to fall behind even further, on the world stage, than we already are.

So what are our options? Well it seems like United States based crypto exchanges, are going to see an exodus unlike anything they've seen in the past. Soon trading will not be happening on their platforms, but outside of their platforms in a decentralized manner. How can you tax something you can't see? Unfortunately for some of the people that I've talked to, that have a lot more skin in the game in cryptocurrencies than I do, that's exactly the path that they're going. But how is that any different than taking your money offshore to the Cayman Islands or a Swiss bank account? There's absolutely no difference, and that's exactly what the government is going to force cryptocurrency enthusiasts to do.

In my latest video I go into more issues:

What are your plans to deal with these new tax laws?

Author:

Jay "TrajicK" Jeffrey

Lead Developer

Toxichustle Media

Misc Links:

Chat With Me In The EastCoastCrypto Discord:

http://bit.ly/2CyZfcA

New Crypto Shirts:

https://teespring.com/crypto-plunder

Check Out My Music On Spotify:

http://spoti.fi/2AAVWOj