Price Analysis Jan.11: Bitcoin, Ethereum, Bitcoin Cash, Ripple, IOTA

On Jan 9, the photography goliath Kodak reported a dispatch of its digital money KodakCoin planned before the month's over. This news prompted a spike in Kodak stock costs. However it's erratic whether it will help the organization's capitalization, yet at any rate the organization has been brisk in embracing the innovation without bounds.

The hop in Kodak's stock costs focuses to the crypto furor tainting even customary financial specialists. In the previous couple of days, they have slurped up loads of the organizations that have associated with Blockchain or digital currency.

Indeed, even JPMorgan Chase CEO Jamie Dimon, in a current elite meeting to Fox Business, expressed that he laments calling Bitcoin a cheat.

As merchants, our advantage is to purchase the digital forms of money that will offer us greatest benefits. How about we check whether we can discover any purchase setups.

BTC/USD

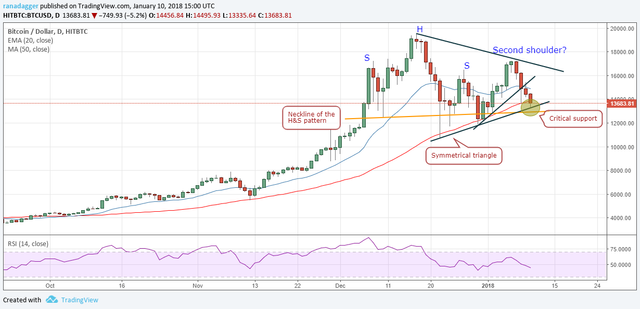

On Jan. 8, however the bulls obtained the tumble to the 50-day SMA, they couldn't profit by the increases. Recuperation endeavors confronted protection at the downtrend line and the 20-day EMA. Subsequently, Bitcoin has again tumbled to the 50-day SMA.

Bitcoin is right now exchanging at basic help levels, where it has bolster from the 50-day SMA, the trendline support of the symmetrical triangle and the neck area of the head and shoulders design.

On the off chance that this help holds, the digital money is probably going to keep on trading inside the symmetrical triangle.

However, in the event that the value separates of this basic help zone, a tumble to $8,000 is likely, with minor help at $10,705 levels.

Our bearish view will be negated if the BTC/USD match turns up and breaks over the $17,200 level. In any case, we think there are little odds of that event.

ETH/USD

Ethereum has broken above $1,310 levels, which was the target objective as mentioned in our previous analysis.

We trust that the digital money will think that its hard to break out of the overhead protection zone amongst $1,310 and $1,434. Accordingly, dealers who have entered long positions at bring down levels can book incomplete benefits in this protection zone.

We expect the ETH/USD match to enter a time of rectification/solidification for the following couple of days.

In a drop, the protection line of the climbing channel will be the main help. On the off chance that this holds, we can expect a couple of days of range-bound exchanging.

All things considered, we can see a tumble to the 20-day EMA if the bears prevail with regards to driving costs over into the channel.

**BCH/USD **

Bitcoin Cash keeps on exchanging the $2,291 - $2,770 territory. The endeavor to separate bombed on Jan. 8.

At present, the digital money has solid purchasing support. On the off chance that the value breaks out of the upper end of the range, it might move to $3,249. Over this level, a retest of the highs is additionally conceivable.

Nonetheless, if the bulls neglect to do that and manage over the range, extend bound activity is probably going to proceed for a couple of more days. Exchanging will be unpredictable inside this range.

The following pattern will begin once the BCH/USD combine separates out or breaks. On the drawback, the $2,000 to $2,291 bolster zone is vital, in light of the fact that on the off chance that it breaks, a slide to $1,733 and from there on to $1,200 is likely.

XRP/USD

The bulls are attempting to guard the uptrend line and the 20-day EMA. After more than 50 percent rectification inside seven days, we may see an endeavor to ricochet. In any case, we trust that any recuperation will confront firm protection amongst $2.46 and $2.80.

On the off chance that the bulls are unsuccessful in holding the trendline bolster, a slide to $1.40 is conceivable, which should hold.

We expect a couple of days of the range bound activity in the XRP/USD combine.

IOTA/USD

In the medium term, IOTA is go bound amongst $3.03 and $5.59. Be that as it may, temporarily, the range has contracted to $3.03-$4.34.

The lower end of the range has held for over a month. Thusly, we trust that the bulls will keep on defending this level and the digital currency will continuously recoup to $4.34 and from there on to $5.59 levels.

The IOTA/USD combine may wind up noticeably bearish and slide towards $1.70 if this level breaks. Be that as it may, it is very impossible.