Why Cryptocurrency Is Not a Bubble and My Predictions for 2018

With CME Futures approaching, there has been a lot of hype over Bitcoin. One of many characteristics that define a bubble is when the average Joe is asking around and trying to buy into the new hype. That is happening with Bitcoin. I still remember when I first started investing into cryptocurrencies, many people were intrigued - probably on the fact that I'm willing to spend "real" money for virtual pixels - but today, people are literally interested to take the plunge and buy their first BTC. More and more people are asking (I'm sure you're experiencing the same) how and if they should buy BTC, this is a BIG sign of a bubble. Well, at least in the traditional sense.

Bitcoin, or in a broader perspective cryptocurrencies, is not a bubble. It physically can't be. I hear a lot of people comparing cryptocurrencies with the tulip phenomena. This is a COMPLETELY wrong comparison to make. Tulips were not scalable, there weren't divisible, nor were they fungible. Unlike any other "bubbles" we've gone through, there are clear differences that differentiates cryptocurrencies in a whole new "class" of a "bubble".

When there was the property market bubble, how many of you really had the money/assets to leverage yourself into buying your first or second home? How many people were actually exposed to the dotcom bubble? Today, teenagers (TEENAGERS!) and the elderly are investing into cryptocurrencies. We are talking about a whole new level of scalability and exposure.

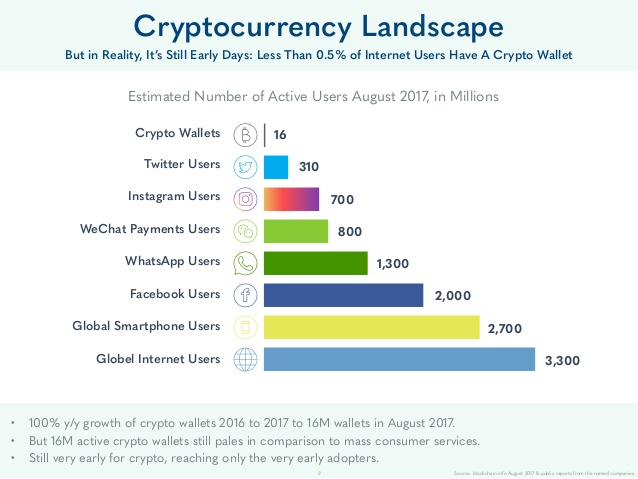

There are many reasons why cryptocurrency is not a bubble and technically even if it were one, it is not due for a crash any time soon. First of all, refer to the image below:

If about 2,000 people are using Facebook, the ratio comparison of people using cryptocurrencies are 16! That means despite the hype, despite the news feeds and despite the next door neighbours pestering you about CoinBase, only a small fraction of people are actually invested and using cryptocurrencies today. Think about that. We are not even in the early phase of a "bubble."

Another reason is that cryptocurrency markets are driven by greed not for the love of tech. Most people who invest (even today) into cryptocurrencies are in it for the money. When I say money, I'm suggesting fiat. The useless toilet paper issued by the governments. The new investors are blinded for quick gains not in for the revolution. But this makes everything so perfect! With Bitcoin and many other cryptocurrencies having a limited number of supply, more and more people are becoming greedy and trying to get in the game, despite the fact that the 10K BTC buy-in wall may seem monumental to them (yes, there are still severely under priced). This is only the beginning.

As more and more people become invested into cryptocurrencies, I believe that their interests will gradually shift away from their attachment to the 'fiat value' but start to understand what the governments and the banks were doing to us. What freedom really means. What it means to have real control over one's finances. Once you're hooked, you're never getting out of the game. I can say this for a fact. People who cash out their cryptocurrency in fiat will perpetually re-invest into the system. It's a never-ending cycle that will only project the crypto market hyperbolically to the moon (as they say).

2018 is going to be a tough yet enjoyable ride in the world of cryptocurrencies.

Bitcoin will rally to its new ATH that we've never dared to say.

Altcoins with real world value will moon.

But there will be more and more regulations and FUD, all orchestrated by the people in power for their own agendas. Like many people, I do agree that many altcoins will see a lot of adoption and acceptance in 2018. However at the same time, I am speculating that many useless altcoins with no specific value (as I would like to call them "Paper coins") will become obsolete. Not in the sense of these altcoins disappearing but they will lose liquidity. They will be dropped by the exchanges, they would lose pairings with BTC or ETH and eventually they will turn obsolete.

My recommendation is to of course stack up your Satoshis but also investing promising altcoins that either add real world value or solve real problems (look up things like Factom, Power Ledger, etc. There are so many of them!) It's going to be on hell of a ride.

Congratulations @tkimdc! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP