Cryptocurrencies: The revolution will not be televised! It will be Steemed!

Governments do not react well to threats to their center of control. There are almost 1140 cryptocurrencies with a market capitalisation of roughly $140 Billion of which Bitcoin and Ethereum make up about 68%. So, it is no surprise that governments are becoming more vocal and putting together tasks forces on how to deal with it.

Even more worried are the bankers. They don’t take kindly to non centralised competitors moving in on their turf. After all, they wield an enormous amount of influence and make staggering amounts of profits.

As cryptocurrencies are now gaining more exposure and interest among the general public, bankers are now becoming more fond of government regulators. It is the hope of the bankers that the government will try and regulate the cryptocurrencies out of existence should they become too menacing.

Even before his last outbreak two weeks ago calling Bitcoin a "fraud" and likening it to the "Tulip bubble", Dimon was already on record for saying this: “Virtual currency, where it’s called a bitcoin vs. a U.S. dollar, that’s going to be stopped,” said Dimon. “No government will ever support a virtual currency that goes around borders and doesn’t have the same controls. It’s not going to happen.” - JPMorgan CEO Jamie Dimon

He is an intelligent guy, but obviously he does not have an objective or neutral opinion.

If the the US government, or any other government wanted to take on Bitcoin, Monero, Steemit or any of the large number of cryptocurrencies to try and stop them, what could they actually do? (Aside from getting top bankers like Dimon to raise FUD?)

Any cryptocurrency or alternative currency for that matter is at risk of being made illegal by any government. Owning and operating a money transmitter service in the U.S. is “illegal” unless it is registered with State agencies. This is also true if one uses Bitcoin or any other cryptocurrency to exchange for fiat currency. Bitcoin is not immune from State or Federal laws regulating the flow of money, and agents can track bitcoin transfers over the blockchain. (Note: Incredible to see the effect of China's looming ban on cryptocurrency exchanges, with China up until recently had 50% of global trading volumes, caused merely a slight dip in the market from which as of this writing the market has already recovered)

Regulation to date has been minimal, but history tells us that governments rarely preference light regulation – it just takes them a while to catch up with technology. There are a large number of issues that any government could regulate when it comes to cryptocurrency use among the public. In 2013, the U.S. Senate held the first hearings on Bitcoin. In that same year, FinCEN released the first announcement by any government agency related to the technology. The IRS was also the first tax agency in the world to clarify the tax treatment of Bitcoin and other digital currencies. Additionally, BitLicense in New York was the first licensing regime in the world directed at digital currencies.

Cryptocurrencies do work with an exchange rate, therefore, governments could manipulate the exchange rate of bitcoin, ethereum or other. This is by no means unfamiliar territory for most.

It’s not difficult to imagine the US or the European Union coming up with a new definition for cryptocurrencies as, say, an investment, with all net gains taxed at 30 per cent. For example, the U.S. tax authority, the IRS, has classified cryptocurrencies as “property” for the purpose of federal taxation, whereas the Treasury Department’s FinCEN has classified cryptocurrencies as “value” for the purpose of AML/CFT (Anti-Money Laundering and Countering Financing of Terrorism Act) obligations.Other jurisdictions have taken a different approach, avoiding a formal classification and focusing instead on the nature or type of transaction being conducted.

Governments could exploit the transparency of the blockchain and punish people for holding cryptocurrencies at all. This has been seen in the past as in the case of Gold.

The NSA or some other entity with both the budget and experience create a VLSI (Very Large Scale Integration) project to both develop and deploy an ASIC (application-specific integrated circuit) design that would result in a 51% attack.

International regulation could be developed that significantly inhibits one's ability to exchange Bitcoins, or other, for local currencies. Essentially forcing the cryptocurrencies underground like a drug cartel thereby adding to de-legitimisation.

It is possible for a mathematician to gain government support in finding a way to break ECDSA (Elliptic Curve Digital Signature Algorithm or ECDSA is a cryptographic algorithm used by Bitcoin to ensure that funds can only be spent by their rightful owners). However, it is very unlikely that this would happen.

The media alongside a covert multi-government effort could conduct several propaganda campaigns to sway public opinion that the cryptocurrencies are either a massive scam or somehow bad. This has already been seen in the example of IMF, government and banking representatives conditioning the public to equate cryptocurrencies with fraud, terrorism financing, money laundering etc.

Regulations could be adopted to monitor and control the crypto exchanges. A government has the purchasing power to buy up large quantities, drive the price up then sell and collapse it, thereby massively increasing volatility. These market fluctuations could be aggravated by a covert government programme of destructive funding and public disinformation. This would make doing business in any cryptocurrency more difficult.

The Treasury Inspector General for Tax Administration commissioned a report last year to study their options. The overall objective of the review was to evaluate the IRS’s strategy for addressing income produced through virtual currencies. It included the following recommendations:

IRS management needs to develop an overall strategy to address taxpayer use of virtual currencies as property and as currency.

The Deputy Commissioner for Services and Enforcement should request the Large Business and International Division, the Small Business/Self-Employed Division, and Criminal Investigation to develop a coordinated virtual currency strategy that includes outcome goals, a description of how the agency intends to achieve those goals, and an action plan with a timeline for implementation. In addition, the strategy should use the tools available to the IRS and identify how the IRS is going to meet its BSA, criminal investigation, and tax enforcement obligations as related to virtual currencies as well as identify how actions will be monitored and the methodologies used to measure the actions taken.

The Deputy Commissioner for Services and Enforcement should take action to provide updated guidance to reflect the documentation requirements and tax treatments needed for the various uses of virtual currencies.

The Deputy Commissioner for Services and Enforcement should revise third-party information reporting documents to identify the amounts of virtual currency used in taxable transactions.

So the US IRS is now on the prowl, as I imagine many other international government bodies. Nobody should forget that Bitcoin and all cryptocurrencies are still an experiment. Nobody really knows how this will play out in the future. If governments over react they may miss out on an economic revolution and the opportunity to remain relevant in a new world order - so we will probably see some odd combinations of strange balancing acts of regulatory oversight in conjunction with promotional efforts (for example a canton in Switzerland allowing a portion of taxes to be paid in Bitcoin).

In any event, this revolution will not be televised, but it will be Steemed and blasted on the media channels of our new economy. Stay tuned!

Very interesting post!

Thank you.

WE DO!

You have collected your daily Power Up! This post received an upvote worth of 1.27$.

Learn how to Power Up Smart here!

IN VERY SHORT :) THEY CAN BAN IT IN INDIA THEY CAN BAN IT IN CHINA, BUT THEY CAN NOT BAN PEOPLE ACCEPTING COINS :)

#ADOPTCRYPTOGOD

https://steemit.com/cryptogods/@mfg/l316uu4d

#CRYPTOCARTOONS

#CRYPTOWORLD

https://steemit.com/bitcoin/@mfg/blockchain-technology-in-near-future-deep-analize-of-humanity-fate-and-will-must-read-bitcoin-cryptotities-cryptokitties

haha yeah steemit is the future, all social networks are compromised, steemit is where people will find free spech

Right on!

GO STEEEM!!!

Great article. The IRS is one of my biggest petpeeves, lol ! :)

Certainly, there will be obstacles, resistance, and regulation (when possible) of cryptocurrencies, but those hindrances will not be able to stop the growth and adoption of cryptos.

As Roger Ver always says re bitcoin, "There's nothing they can do to stop it." They may be able to slow it, regulate certain aspects of it, ban certain activities related to it, and get "respected" spokesmen such as Jamie Dimon to make pronouncement that strike FUD into the hearts of the people. But they will not stop it.

Thanks for the excellent article and the great read. You cover some salient points, and the writing is very clear and focused.

Let's continue steeming the revolution!

Create FUD and False flags.. most all they can (try) to do.

Thanks for reading @majes.tytyty .... I actually was not aware of Roger Ver thanks for the reference, just did a little googling... interesting character indeed. Not sure what the episode about his selling explosives on eBay was about, but things are not always what they appear.

They call him "Bitcoin Jesus," cuz he was one of the first ones who began to avidly evangelize about bitcoin. That was back in the dawn of (crypto) history.

As for the "explosives" issue, I don't know a lot either, but I believe the story is that he may have been framed, simply because he was too vocal re his non-government leanings.

(Also, he was one of the guys behind the bitcoin fork in early August, the fork that created Bitcoin Cash. According to him, Satoshi's original ideal of a purely peer-to-peer currency is being compromised with recent developments in bitcoin, and he and a few other players forked to Bitcoin cash, which is intended to remain true to the ideal of being peer-to-peer.

One major point to consider in that regard is that Bitcoin already has 8 years of infrastructure built to suppor it. Bitcoin Cash has none.)

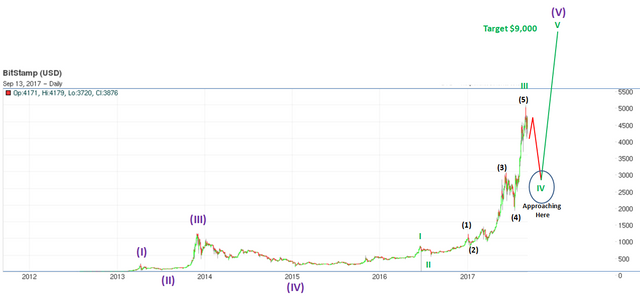

Bitcoin's pathway to $9,000, here is my analysis:

Thanks @haejin, your chart is a bit small to read (or maybe I just need glasses and to learn how to zoom better on my laptop). Are you basing your analysis on fibonacci levels or something else? I suspect it will be a bit bumpier before jumping right to $9k and that might night be until sometime in 2018.

Elliott Waves and Chart Pattern analysis. If you wuld, kindly check out my blogs! Thanks!

What's you take on investing in alts then too. Are 100% btc? What is a good alt/btc weighting? Even more complicated with BCH. ...

I am diversified. 30% Bitcoin and rest in Alts like ZEN, ZEC, DASH, NEO, EOS, XVG, BTS, etc.

Ah, I just did, yes a bit easier to read and see there, thank you :)

@originalworks

The @OriginalWorks bot has determined this post by @thehutchreport to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

The revolution will not be televised! Love that reference!

There will be governments that will try to regulate and there will be others that will be neutral as swiss banks try to cover their customers from laws.

Very nice article

Thank you.

Super Cool Post