Could trust as a service be the next big thing in Blockchains?

Introduction

With it being so close to Christmas many of us are making online purchases. Right now it is mostly using conventional means of payment.

At a future time this will likely shift to greater blockchain payments and this may bring up the issue of trust.

For example if you are making low value purchases from an established merchant (e.g. Amazon) you probably don't need them to guarantee trust because they have been around long enough that you just trust them implicitly.

They are well established enough for you as a consumer to feel protected and to trust that they will send you the item when you make your payment even if that payment is in cryptocurrency.

This is backed by the years of experience that other consumers have and that you have yourself.

They have "brand" based reputation that grants them trust.

Unfortunately most established merchants don't accept these forms of payment.

Consumer Risk

The risk for you as a consumer comes when you are buying from a peer or a new merchant whom you have not established trust with.

That is usually the situation you find yourself in when using a cryptocurrency to purchase an item or service.

Once you have sent your BTC (for example) then there is no way for you to be certain that they will actually send you what you ordered and there is no recourse for you to get your money back if they don't.

Right now there are informal escrow services being provided by individuals and small companies but again we come down to the issue of trust.

I feel there is a gap in the market for a large company to establish themselves in the blockchain "trust" business.

This could be both to provide trust to the consumer and alternatively to provide trust in the consumer which I will explain below.

The First Step of Trust Dilemma

A new organisation selling trust has a number of issues to overcome but the main one is how do they prove they are trustworthy when you have never used them before and they are not a famous or established business?

To be honest I don't have an easy solution for this. If a new company can come up with a way to do this in a satisfactory way then it would give them a massive head-start.

One way for a new company to do this would be to team up with a company that already has established "trust" credentials e.g. Amazon.

That is not an ideal solution though as it is simply using someone else's trust. Further why would they (i.e. Amazon) not just roll out such a service themselves?

A business which is already established in the field of retail, money or finance (e.g. Amazon, Apple Pay or Google Wallet) would therefore potentially have a massive advantage in entering this field since people would already be trusting them with their money.

I would love to hear everyone's thoughts on this so please let me know what ideas you have. Can you think of an alternative to get around the "First Step" dilemma?

Anyway let's move on to looking at the use cases in a bit more detail:

The Main Situations Where You Might Need to Buy Trust Services

These are the main areas I can think of right now but please suggest any cases that I may have missed in the comments:

- Buying from a stranger who is not an established merchant in a peer to peer situation. This will be the most common use initially.

- High value purchases from established merchants who might require some credentials from the purchaser e.g. cars, houses etc. - these are done through trusted merchants currently and those merchants may require greater verification for legal reasons/AML etc.

- High risk purchases that have legal implications e.g. chemicals, medications, fertiliser. For obvious reasons these have legal restrictions on trade and are likely to be something that becomes more important as blockchains mature as payment and settlement structures within established industries.

- Obtaining legal documents such as passports, driving licenses etc. - also probably more of a long-term thing as these are often provided by government.

Potential Trust Based Services

This is by no means an exhaustive list but these are the main ones I can think of:

Secured and Insured Escrow. This is the initial use case. Right now finding a trusted Escrow is a question of asking other people in places such as Bitcointalk. You need to trust in order to find someone to trust which is problematic. Whilst a private company would require some blind trust initially over time it's size and reputation should eventually help to improve this. Further there could be some sort of insurance involved.

ID and reputation management. Your trust provider could be your single point of providing proof of who you are and managing your reputation for payment - the equivalent of your passport/driver's license with a sort of credit reference agency. This could involve different levels of trust and identity verification (1 vs 2 vs 3 factor authentication) depending on the transaction level.

Digital CVs and legal documents. This is really an extension of point 2. Blockchains provide a means of storing information with redundancy in a distributed database of sorts. They can also provide a degree of verification that a particular document was created at a particular point in time. This could offer an added protection against fraud (although it is not perfect). There are also potential ways of improving legitimacy by cross linking and referencing other documents which may eventually also be stored on blockchains. Envision a situation where your CV/resume references your qualifications by linking to your actual degree certificates which are digitally signed by the appropriate qualifications body. Similar situations could occur with legal documents such company registrations, deeds to land etc.

Arbitration and Dispute Resolution. This will become more important as blockchain use cases expand, whenever you have human beings involved disputes will arise. Arbitration could be a useful tool in these situations and a trusted third party would be required. A company that already has a reputation and infrastructure for providing trust would be in a prime situation to also offer these kinds of services.

Established Companies Have a Big Advantage

I think this is unfortunately a situation where large established organisations will have a big advantage. Like it or not people already trust them with so much information and I think there are two large types of companies which could take advantage of this:

- Companies which already manage our online personas and finances e.g. Google, Apple, Facebook etc.

- Banks and Insurance Companies - obviously they already have our money and information.

Why do these organisations have an advantage?

- They have huge resources and capital.

- They have access to government and legal structures due to point 1. in a way that a new company would not.

- They have massive existing infrastructure and human resources with the ability to deploy it.

- They are existing brands that the public already trust (as previously mentioned).

What is against them

- There is growing discontent with their actions - e.g. distrust of banks since the financial crises of recent times, discomfort with privacy policies of online companies etc.

- They tend to be expensive (particularly in the case of banks) whether in terms of actual money or what they require from you in return (e.g. selling your privacy).

- As large organisations they are slow to act and have the potential to be left behind when it comes to new developments.

Conclusions

I think trust will likely become a greater need as we move forward with blockchain based payments and services. There are notable problems which must be overcome for a new company trying to provide trust based solutions.

The most notable one in my opinion is the "First Step Dilemma".

If a new company can overcome this issue then there is a huge potential for profit.

Unfortunately this also grants established companies a huge advantage.

What do you think?

Thank you for reading.

If you like my work please follow me and check out my blog - @thecryptofiend

All uncredited photos are taken from my personal Thinkstock Photography account. More information can be provided on request.

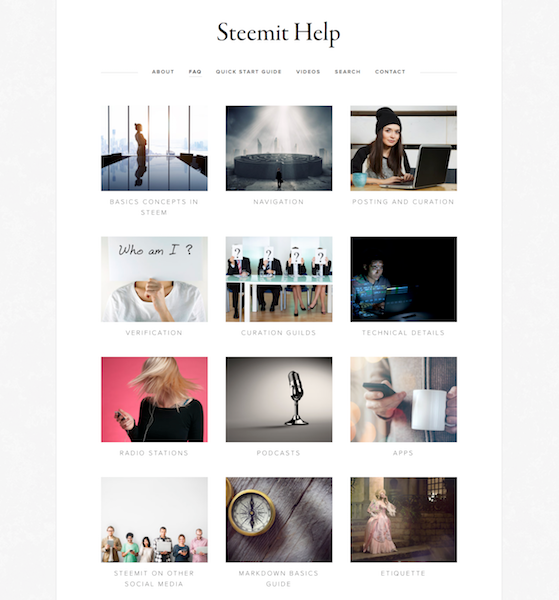

Are you new to Steemit and Looking for Answers? - Try https://www.steemithelp.net.

I think the answer to the first obstacle would be to recruit folks like Dan Price, CEO of Gravity Payments who have already proven they're trustworthy AND, more to the point, who've established that their motives are trustworthy, to integrate that facet of blockchain development. That's a tough combo to find.

Thanks I was not aware of that service:)

You're welcome. You may remember when the company made the news a while back... he made his employees' minimum wage $70k a year by taking a paycut himself. They've done so well, the employees chipped in a got him a Tesla. Somebody ought to get this guy on board with Steem.

I suspect he would probably be busy with his own company but it would be great if it could be done:)

Another good analysis. As for the "First Step Dilemma", folks will solve it in the same way they solve other everyday-life Catch-22s: iteratively. Just like the person with no experience who relies on references, trustworthy folks will start off by providing trust services to people they know and who know them.

Sry for being a Gloomy Gus, but big corps will always have a huge advantage - particularly if they're the first one that takes off in a certain sector. I don't quite know why, but ordinary folks tend to trust "big" and "standardized."

Great points. Sad but true.

Thanks. And yes, it is sad but true. Thankfully, there are "New Frontiers" in tech - we're in one now! - that gives the little folks a much less tilted playing field.

In a very real way, the "cryptocurrency frontier" is a lot like a frontier town destined to become a big city. We're like the pioneers and early settlers, and we've put our stamp on this "town" In a generation or so, we'll enjoy the wry experience of seeing a bunch of suits using our words! They prolly won't live up to 'em, but they sure will pay a lot of lip service.

Yes definitely:)

There is a Decentralized Community doing something along those lines, some of it will be ready shortly.

Which one specifically - is it ethereum?

It's not Ethereum I was referring too, but who knows they might be doing something in the back ground also.

I was referring to @adsactly it's still being all put together.

OK my default assumption is normally ethereum!

No worries

I've been thinking about this alot lately.

Yes, I think you're right about trust being what is next, to large extent. Right now Amazon has a monopoly on trust and very easy payments. I think OpenBazzar or a decentralized market could compete, with companies of trust being faciliators on such a decentralized marketplace. Amazon, Apple, Google, eBay or any company/user could become facilitators and sell their trust to merchants. They may even create web access points (like steemit.com) to the decentralized marketplace. That way Amazon is selling their amazing trust,tools and facilities instead of running the marketplace themselves.

I thought about contacting eBay and convincing them to create such a decentralized marketplace and/or working with OpenBazzar.

If I were important or had money, I might create a start-up based upon these very ideas.

You might be interested to know I've been writing about 3rd-party identity verification for a year now.

Great points. I think I probably default to using Amazon a lot for that same reason.

Me too:)

Great post. Keep up the good work!

Thanks:)

Great post! Lots of interesting points to chew on.

I think I'm a little less confident than others on here that trust services will be dominated by the big, incumbent institutions. Think of how important PayPal was in establishing a trust layer in the early days of e-commerce. True, big institutions have a lot of resources, but point 3 under "What is Against Them" is a big deal. Big institutions develop institutional knowledge around a certain way of doing things. When I was at a bank, people were so specialized that it would be very hard to pivot to something as radical as blockchain-based escrow or something. And even companies that have strong development chops (e.g., Google) might not be proficient at some of these trust functions (see Google's failed car insurance experiment). What's more, the small and relatively infrequent transactions we're talking about here may not generate enough profits for a big company to want to pursue them (what Clayton Christensen might call "assymetric motivation" vis a vis the upstarts).

Clayton Christensen's "Innovators Solution" and the 1990 Henderson-Clark article "Architectural Innovation" might provide some good models of how to think about this industry evolution.

I hope you are right:) We need a change from the banks IMO. I would rather a smaller company with better ethics took that role.

Quality post... upvoted!

Thank you:)

Great article, helped me get more of a shape on some ideas I'm thinking about too. In fact I was just talking to someone yesterday about the ID and reputation aspect of trust services you mentioned, but I was missing some of the terminology.

This is something I'd love to see. In particular I'm interested in the idea of being able to revoke access to information at will. So for example, say you open a bank account. They need to know who you are (it is actually a common legal requirement) in order to operate your account. You agree with your trust service to allow them access to certain parts of your identity data, on request. At no point do they store your data. In that case, you could have more control over your personal data, in particular making sure that it is not sold, used unethically or to track you with third party identity building companies.

Then when you business arrangement is concluded, access is revoked and they no longer have it. Obviously this wouldn't stop someone from copying your data, and so it would need to be supported by a law forbidding unauthorized data storage. Sounds far fetched probably, but it's not without precedent for a type of service to become indispensable.

So if a trust service was used to establish identity, for the purpose of authentication, there'd be no need for a business to hold on to personal data. What do you think?

Great points - I absolutely agree. There is a potential use case for tokens/signatures that expire after a certain period of time or after a particular transaction is complete. This could be a potential way of using smart contracts (although they would actually not need to be very smart). Thank you:)

The first step dilemma is a reality. You start at 0 customers, and have to grow. How? People trust you, that other people trust, etc. As a business, you need to network, and word of mouth from people you know can spread in your community since people do know you, and will vouch for your honesty.

But trying to start big without a user base won't work, so you need to grow from the ground up, and the best place is the local community or online community of people who already do trust you, and can vouch for you. It doesn't need to be a corporation to lend trust to you. There is also reviews and authentication of reviews from a third party site, whereby people who use your trust service, can review your service. Just an idea.

Great points:)

Interesting posts - lots to think about re security. Also your Steemit Help post is excellent and a comprehensive guide. Thanks for putting it together. I've bookmarked it to review. I'm still learning so this will be helpful.

Thanks. Glad you find it useful:)