Cryptocurrency vs Gold & Silver vs Fiat money

Today I am going to pen down my views about the cryptocurrencies, gold, silver and fiat money. These are just my personal thoughts and I hope that it would provoke people to think deeper and get you all to be prepared for what is coming.

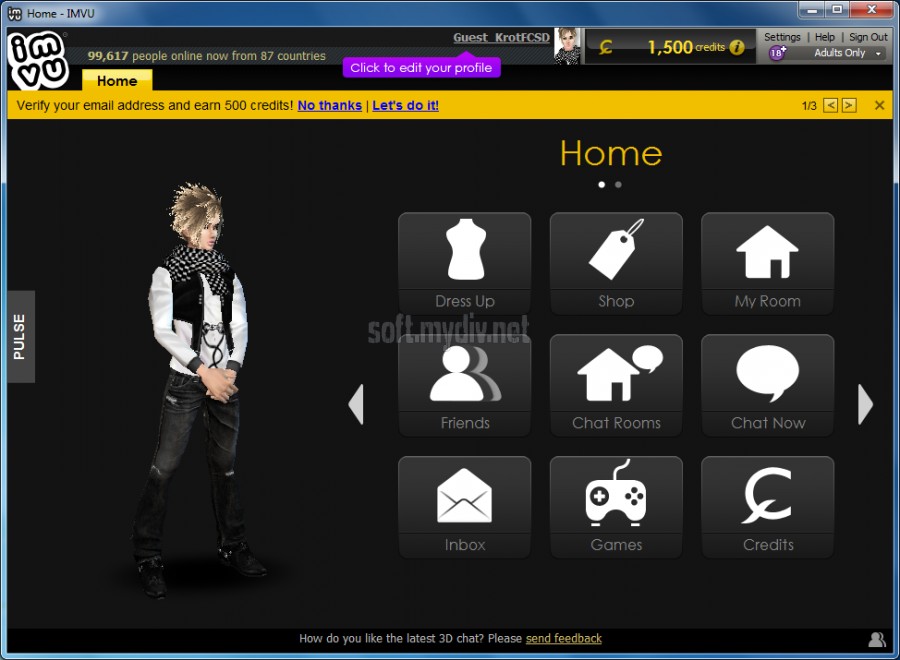

I think many people might not know that there might be other cryptocurrencies that existed in the form of game currencies before bitcoin was invented. Many people will know the popular virtual 3D chat platform IMVU or Secondlife and they had their own game currency for people to buy stuff in the games. I was trading games credits on fistmetaexchange during the early days and I manage to turn a small investment of USD$1k into USD$10K within a year and I knew content creators who made millions in these game platform. That was 2006 to 2007 when credit was cheap and it seems like everybody had unlimited budget to spend.

Then came the 2008 meltdown and I started my financial learning journey. During that time i had an investment was a fund which I brought in 2006 from a local bank that invested in the US market and the first 2 years were doing great but there is a catch, I cannot cash out or sell my fund within 6 years or else I would lose more then 1/2 of my capital and when the 2008 financial crisis hit, I lost more then half of what I had invested and if I had taken out the money I would lose even more. So this kind of investment was, heads they win, tail you lose and that was my first lesson, never trust others to help you make money do it yourself and learn.

I started looking online for an answer on what caused the meltdown and is there any other way to protect what little saving I had because I saw that inflation was eating away my purchasing power and the irony of all was that I was working in Singapore's Ministry of Finance at that time and I had no understanding of how money was created. Only after I stated to follow Max Kasier on youtube that was I able to educate myself more about the world's financial system and from there I went into gold and silver stacking. I think Max Kasier started talking about bitcoin back in 2009 or 2010 and I was looking at bitcoin where there wasn't any exchanges online yet.

If I knew that bitcoin was going to prices like these today, I would had pumped all my profit from IMVU credit trading into this and made out like a bandit but I knew that there was a fatal flaw in cryptocurrency and I would like to point it out. For the concept of crytpocurrency to work, it must be really usable by everybody, even those without a smart phone, computer and internet but I doubt it could happen. I have been to third world countries and the people there even do not have enough to eat, let alone have smartphone or are able to subscribe to the internet. Even if they do have the means on getting on the internet, they might not have the level of education to understand how this cryptocurrency works. It will take years or even decades to be able to educate those at the bottom of societies up to a level for them to even understand the cryptos before they can use it and provided that they have the means to use it. Another fatal flaw of cryptocurrency is that it must depend on the internet to get the preserve value. Let me give you an example, if today I brought a bitcoin for USD$3000.00 but I went to somewhere without internet for a few days and something major happened to bitcoin and the value crash to USD$3.00, I still have the bitcoin but lost the value that it was suppose to hold and just thinking of that makes me sleepless sometimes at night. Don't get me wrong I do own some cryptocurrencies but they are more for speculation and when I can make a profit out of them, I will convert them into something tangible like gold or silver. Many people in the world are not like us here reading this blog on steemit because not all humans are born equal.

Next up is gold and silver, let me share my prospective on what gives gold and silver its value. Many people look at gold and silver for its' store of value and its uses to derives the value but for me, I look it in another prospective of how many humans' life are lost and what environment is damage or energy spent to get that 1 oz of gold. Many people only heard about the prospectors who strike it rich after discovering some gold or silver vent but many do not know of the ten of thousands who lost their life during the exploration and mining of these metal. Even if big mining companies uses modern technology to help with the mining, it comes at a very great cost to the environment especially in third world countries. And what is the energy cost to move all the dirt just to get that 1 oz of gold, I think youtube has many short documentaries about gold mining from how big mining companies conduct their mining to small time miners who goes into the forest of Indonesia to seek the profit in gold.

I had been to the largest gold refinery's bunch in Singapore, saw how they operated and came to relies that gold will still be the ultimate currency in a event of a financial collapse because of the recycling and refining that I saw in the plant. I can take any of my gold coins and go over to any country and find a jewelry or pawnshop to cash in the gold.

Silver in some extent might be use as a currency for daily transaction because gold value would be too high this kind of transaction but silver still not that recognize in alot of countries so I am still abit heavy on my gold position in term of dollar value.

Fiat paper money I feel will still have its place in the financial system because the poor and uneducated will still need a medium of exchange in order for them to get food and basic necessity. Take a look at India, recently Prime minister outlaw the 500 and 1000 rupees to force India citizen into the banking system which I think he wanted them to go cashless but the effect seems to be in-vain because after the citizen got their money, they went back to be using cash.

So my conclusion for this post is that I will change the old saying

Gold is the money of Kings

Silver is the money of Gentleman

Debt is the money of Slave

into

Gold is the money of a country and the rich

Crypto is the money for the educate and the rich

Silver will play second fiddle to gold

Fiat will be for the poor and uneducated but fiat might be back by certain percentage in gold and silver.

If you find this post interesting, please give a upvote and resteem it 😄Thanks

Very well written, and I like your point of views.

Your right, silver and gold come at a large expense and will always hold value.

Crypto is where you can become very rich or poor, depending on which one you buy. It's why we have to invest in physical silver and gold in my opinion , and crypto just because I don't think it's going away.

I was very skeptical about crypto and still is but I have already secured my core position in the metals so I'm taking out some play money to see if I can make a profit from it ☺️

Super Post @thecoolplayer :)

Thanks. It took me awhile to get all the thoughts together.

Crypto is no. 1!

Haha Crypto is no 1 for people who has excess to it my friend 😂 I had a hard time trying to figure out how to buy my first crypto and I still consider myself quite computer savvy. If they can make trading and usage of a crypto like a 1 or 2 step transaction, then that time I think crypto will surely fly.

Silver and Gold will always be my first choice for wealth preservation. And although I'm still a little skeptical about Cryptos in general, I welcome them to the fight! The FED will now have to face opposition on multiple sides!

^^Upvoted^^

Gold is the money of Kings

Silver is the money of Gentleman

Debt is the money of Slave

I guess that make me a Kingly Gentleman.......or a Gentlemanly King!

Haha that means u have a mountain of gold and silver under ur bed 🤣