Ripple explained. How does it function? Is XRP valuable? Is it worth investing?

Recently I have done some research on Ripple and posted a video about it. I think it could be very helpful to people who want to know more on this topic. Also I've made a text version for steemit. Enjoy!

Let’s start from the fact that Ripple is different from other blockchains. Because it’s not quite a blockchain. We don’t have have blocks with transactions in Ripple. Instead we have a ledger which lists all accounts and it’s latest balances. It’s like a big book with all accounts listed in it. And every couple of seconds after some transactions are happened in the network this book is updated. So every couple of seconds we have a new version of this book. And every version of this ledger contains the newest transactions.

Who decides which transactions are valid and prevents double spend? The validator nodes. These nodes are the most trusted nodes of the network and they are chosen by other nodes voluntarily. Validators make proposals about valid transactions. And if 80% of validators reach consensus about valid transactions these transactions are written into the new version of ledger. And process repeats every few seconds.

What reward receive validators? They don’t get anything. So there are no mining.

All Ripple tokens have been issued when the network started and no any of them will be issued anymore.

So, it has been issued 100 billion of Ripple tokens or XRP in one batch. But not all of them went to the market. Part of XRP’s where divided between founders, investors and Ripple labs. Ripple labs is the name of company that develops ripple. And up to now we have 38 billion of XRP on the market and 61 billion holded by Ripple Labs.

The next interesting thing about ripple is gateways. If you are a business and want to use ripple network you can register as a gateway. Then you can create your own issuances. For example you are Wells Fargo Bank and a customer comes to you and brings 1000 dollars in cash and you issue him 1000 of WellsFargo.Dollars on the ripple network. And these WellsFargo.Dollars are sitting now on your account in the Ripple network. And cusomer can transfer them to anybody. And this anybody can come to WellsFargo bank and cash them out. In other words 1000 WellsFargo.Dollars on ripple ledger is liability of WellsFargo to pay real 1000 dollars to a person who wants to cash them out.

Moreover, account on ripple network is “multicurrency” and it can hold a lot of different issuances of different companies. Holder can exchange his currencies inside the network by puting orders.

One more example. Bitstamp issues Bitstamp.bitcoins on ripple network. You change your WellsFargo.dollars for Bitstamp.bitcoins. And then you come to Bitstamp and change it them for real bitcoins. So theoretically any company can become a gateway and create it’s own issuances on the ripple ledger. And people will transfer and exchange these currencies.

Banks even can create its own interface, where you send dollars from your account and recipient in London receives pounds in different bank. And transfer goes through the Ripple network in seconds, automatically exchanging to another currency on the way. And you even wouldn’t notice that you just have used Ripple network.

So why we need XRP token then? The main use of XRP is to pay transaction fees. They are very small (about 0.003XRP is average now). And when you pay the fee these XRP are burnt and destroyed. So total number of XRP’s existing becomes smalller every day.

And the second use of XRP beside transaction fees is to be a liquid asset of the network, so the most exchange contracts will go through XRP. For example, if you change your WellsFargo.Dollars to Bitstamp.Bitcoins you change’em to XRP first and then buy BItstamp.Bitcoins.

Now I would like to go through pros and cons of Ripple network and XRP.

Talking about technological side of Ripple, we have a review of ripple protocol made by Bitcoin Core developer Peter Todd in may 2015.

He describes various possible attacks on the network and their probability of success. I will mention only the most important issues from my point of view.

First is a high risk of a consensus split between different versions of protocol which can be caused by errors in code. Errors and bugs can be easily made when critical parts of the code are not separated from non-critical. And in ripple case we have the very complex protocol and to complicate it more all it’s functionality implemented into it. Fortunately, consensus split can be spotted and fixed within hours.

Second, the main problem, is coersion of validators, in other words they collude to not put valid transactions into the ledger or provide malicious transactions. Imagine I want to block all transaction of my enemy or competitor. And freezing of all his transactions could be done by just controlling 20% of the validator nodes (remember 80% needed for consensus).

So, the most important part of the network are the validators. They have to be trusted by others and don’t collude and don’t act in a malicious way. And they don’t get any reward for doing their work cause there is no mining and block rewards. Validators are not incetivized by the network to act honest. They must be trusted authorities and they have to be world spread so the network can become global.

Who are they now?

We’ve got an article dated July 17, 2017 which mentions some names in the list of validators, like WorldLink, Telindus-Proximus Group and so on. Also previously was announced validators such as Microsoft, MIT and CGI.

Let’s look at the current state of validators. In the picture is only top of the list, to see all of them just visit the link.

What we see is a list of validator addresses and domains. A lot of them are unidentified, we don’t see here Microsoft or CGI and MIT is unconfirmed. It’s where the words are not confirmed by the evidence. All main nodes are owned by Ripple labs.

In my opinion validators are the backbone of ripple. And they must be incentivized someway. Even though we haven’t witnessed any consensus problems yet, they are reasonably possible and have to be considered.

My second concern is about XRP value. Actually you can use ripple network without using XRP except for paying small transaction fees. And fees are so small that even if you are large business 10 dollars in XRP will cover your transaction fees for a year. If large banks or corporations implement ripple and use it why do they need to use xrp as their transfer asset? They have been using dollars or euros and they will continue to use dollars or euros in their transfers. Moreover, they do the accounting and pay taxes in real money currencies. And I don’t see a lot of reason for XRP become the main transfer currency unless real money currencies lose it’s trust or inflation becomes big or some global consensus about XRP is reached.

Some people are concern about Ripple labs holding 61 billion or XRP and uncertanty about them selling it one day.

We have an article about plans of Ripple labs to sell 1 billion of XRP every month for 55 month straight. What this numbers do mean. They mean that 12 billions of XRP will be added to market supply every year. It’s somewhat similar to mining. And 12 billion is 31% of total coins that are on the market right now. Though it’s going to be relatively less every next year. And it’s a big number. To compare we have new bitcoins created at the rate of 3 to 4 percent yearly. And price of XRP not to drop we must have a large demand for XRP in the near future. So I think if Ripple labs go with these plans, the price of XRP has not very big chances to grow for the first year or two. Unless something happens with the demand.

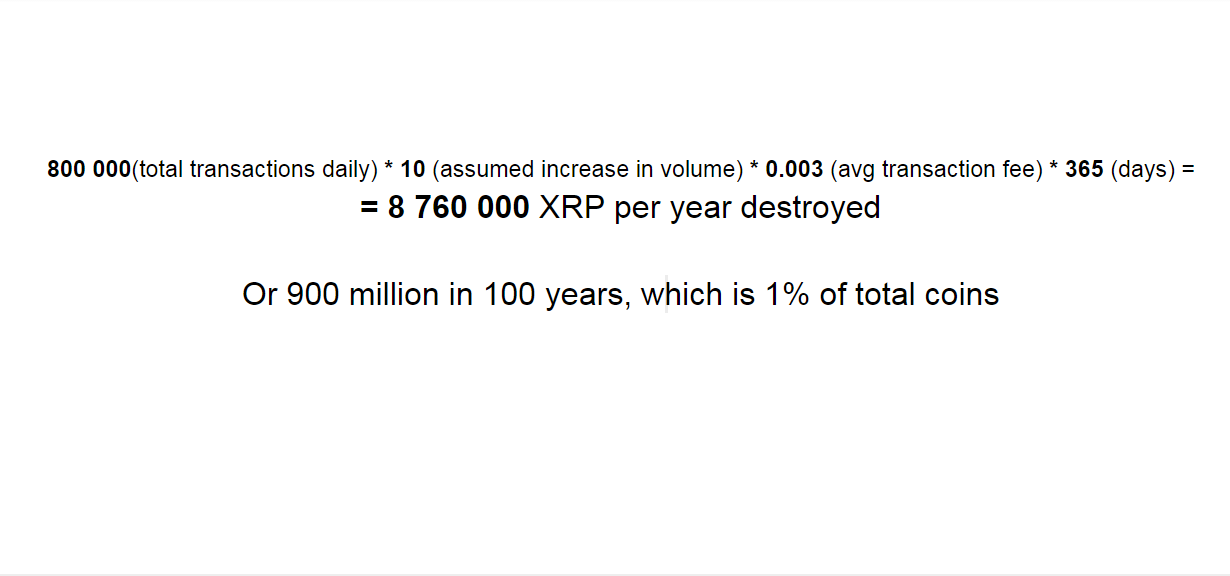

I heard some opinions about increasing value of XRP while supply of XRP tokens is decreasing because they are burnt as transaction fees. I think it can be discarded. We have now 800 thousand of transactions daily. Let’s assume this number increases by 10 times with future adoption. We have average transaction fee of 0.003 XRP now. Transaction fee doesn’t increase when the network grows as said by ripple docs it even decreases. So after a simple calculation about 9m xrp will be destroyed every year.

And in 100 years we destroy 900m and its less than 1%. This is 1% deflation for 100 years. It’s a very small number. Many more coins will be destroyed meanwhile by losing the keys to the accounts.

One more concern is recent hype around anonymity. Ripple is the opposite. Every gateway must follow anti-money laundering policies and gather info on their customers (KYC policies). So for those trying to hide yourself under the ripple ledger you guys will be disappointed.

One more issue: in his video on Ripple Tone Vays talks about scam with Mt.Gox exchange. And he connects this scam with Jed McCaleb, the founder of Ripple.

I my view Jed McCaleb has left Ripple in 2014, most likely sold his 9b XRP tokens or the major portion of it and now he hasn't much to do with current Ripple project. Moreover the trial on Mt.Gox hasn’t been finished yet.

What positive we can say about Ripple? It’s ledger works for couple of years now. And now it handles 30 thousand transactions per hour which is 2.5 times more than in Bitcoin network.

Big companies have shown it’s support for Ripple: some banks, financial institutions. We don’t know their real intentions. But the fact alone that Ripple interested some big financial institutions is surely positive one.

Conclusions! I think ripple has very reasonable chances to succeed with providing international payment services to the banks. Some obstacles are on the way like problem with choosing trusted validators. Even though if banks start using Ripple network, they can show no interest in Ripple token because of it’s unstable price. If you transfer large amounts of money with XRP as middle currency, and XRP’s price changes by 1% during transaction. It’s huge difference if you transfer a million.

So to invest in XRP and expect it’s price rise long term we need three conditions:

- Ripple network solve validators problem,

- banks use this network

- and use XRP as a liquidity asset.

It would help a lot if banks become validators themselves.

I think this conditions have reasonable chances to happen. But it’s a long way to go.

Investing in XRP I would consider a gamble for these conditions to happen and it’s sure a long term gamble.

Hope this research and my thoughts were helpfull! Share, subscribe, leave your comments!

Congratulations @taras-decrypting! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP