Cryptocurrency News for 21 Sep 2017

Cryptocurrency Bounces Back As Trader Sentiment Improves

Cryptocurrencies have enjoyed a nice recovery over the last several days, their total market capitalization (market cap) surging in value as trader sentiment grows stronger.

The total market value of these currencies rose to as much as $141.3 billion earlier today, which represented a 45% increase from the recent low of $97.6 billion that these digital assets hit on September 15, CoinMarketCap data reveals.

When the total market value of these currencies fell below $100 billion earlier this week, it dropped to its lowest since early August, additional CoinMarketCap figures show.

Full story at http://bit.ly/2w8r9G1

Source: Forbes

Bitcoin bulls regroup after last week’s selloff

Bitcoin prices were tilting lower on Tuesday, but the No. 1 digital currency was holding well above last week’s nadir as it attempts to claw out of a hole that saw it shed more than a third of its value.

A single bitcoin BTCUSD, -1.67% was worth about $3,988, compared with its low of $2,951 on Friday, set after J.P. Morgan Chase & Co. JPM, +0.70% CEO Jamie Dimon described the asset earlier in the week as “a fraud” and a bubble. “It’s worse than tulip bulbs and won’t end well,” he said at a banking conference a week ago, referring to the 17th century mania over tulip bulbs that eventually burst.

Dimon’s comments, along with a number of negative statements from other Wall Street investors had put bitcoin on its heels, but it has reclaimed a portion of last week’s ugly losses, which technically put it in bear-market territory, described as a decline of at least 20% from a recent peak at $5,000.

On Tuesday, Ray Dalio, the founder of the world’s largest hedge fund, said bitcoin has all the makings of a bubble based on the firm’s criteria for the market phenomenon.

Full story at http://on.mktw.net/2w8N3IZ

Source: MarketWatch

Satoshi’s Best Kept Secret: Why is There a 1 MB Limit to Bitcoin Block Size

Anybody familiar with Bitcoin is aware of the vexing problem caused by the 1 MB blocksize limit and the controversy that arose over how to scale the network. It’s probably worthwhile to look back on how that limit came to exist, in hopes that future crises can be averted by a solid understanding of the past.

In 2010, when the blocksize limit was introduced, Bitcoin was radically different than today. Theymos, administrator of both the Bitcointalk forum and /r/bitcoin subreddit, said, among other things:

- "No one anticipated pool mining, so we considered all miners to be full nodes and almost all full nodes to be miners.

- I didn't anticipate ASICs, which cause too much mining centralization.

- SPV is weaker than I thought. In reality, without the vast majority of the economy running full nodes, miners have every incentive to collude to break the network's rules in their favor.

- The fee market doesn't actually work as I described and as Satoshi intended for economic reasons that take a few paragraphs to explain."

It seems that late in 2010, Satoshi realized there had to be a maximum block size, otherwise some miners might produce bigger blocks than other miners were willing to accept, and the chain could split. Therefore, Satoshi inserted a 1 MB limit into the code.

And he kept it a secret.

Full story at http://bit.ly/2w8v1GV

Source: CoinTelegraph

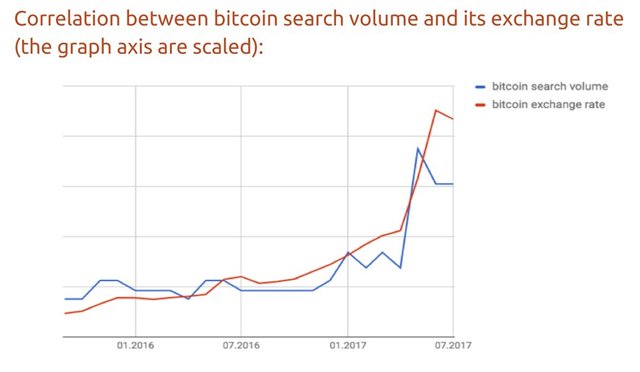

The price of bitcoin has a 91% correlation with Google searches for bitcoin

The current price of bitcoin has a 91% correlation with the volume of Google search requests for bitcoin-related terms, according to a study by SEMrush, a search engine marketing agency.

The study drew from a database of 120 million US keyword searches linked to the cryptocurrency. The overall search volume of bitcoin-related keywords is estimated to be 51.4 million requests over a period of a year. It showed that the price of bitcoin in US dollars rose and fell largely in tandem with the number of search requests for terms like "bitcoin," "bitcoin price," and "bitcoin value."

At one level, the study merely confirms the obvious: As bitcoin becomes more expensive, and thus more exciting, more people search online to find out how it is doing. On the other hand, it is nice to see statistics confirm your hunches. While the study looked at the correlation between searches and prices, it did not - sadly - say whether searches predicted or trailedthe bitcoin/dollar exchange rate.

Bitcoin searches have gone up 450% since April 2017, SEMrush says. The data in the sample is about a week old.

Full story at http://read.bi/2w9GJ3S

Source: Business Insider Nordic

These are the trends affecting the cryptocurrency market in 2017

We live in a dynamic business world, which is constantly evolving with newer innovations and technologies disrupting the traditional methodologies of living our day-to-day lives.

When the world becomes comfortable with one technology, a newer and better technology often comes to play, breaking the routine and bringing about drastic changes.

Be it drones for commercial deliveries, voice paymentsfor businesses, or the use of cryptocurrencies for our daily transactions, ground-breaking innovations are paving the way for the rapidly changing 21st century.

Invention converts into an innovation when it couples with mass commercialization and adoption. Cryptocurrency is the result of an invention, which is now poised to become the next big innovation in the fintech industry.

Full story at http://read.bi/2w9tyQu

Source: Business Insider

China orders Bitcoin exchanges in capital city to close

China is moving forward with plans to shut down Bitcoin exchanges in the country, starting with trading platforms in key cities.

All Bitcoin exchanges in Beijing and Shanghai have been ordered to submit plans for winding down their operations by 20 September.

The move follows the Chinese central bank's decision to ban initial coin offeringsin early September.

Top exchange BTCC said it would stop trading at the end of the month.

Full story at http://bbc.in/2w8N2Vr

Source: BBC News

Advertisement:

Governments and Big Banking are looking how to edge into technology, by tearing down new technology does not indicate open mindedness nor development.

Another nice share thanks @sydesjokes

In 1987 cats overtook dogs as the number one pet in America..gif)

Thank you for your upvotes. Click The Cat Join The SteemThat Movement!

haha how old are these updates? Bear break confirmed this morning. Downtrend continues.

there's still no clarity in the market

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

Thnx @sydesjokes for putting this info all together.

A cat usually has about 12 whiskers on each side of its face..gif)

Thank you for your upvotes. Click The Cat Join The SteemThat Movement!

Upvote & reteem ... follow @lurehound

Upvoted & Resteemed!

Hi Sydesjokes:))) Thank you for the steem! I have just upvoted all of your posts because I value your content. I own a little cryptocurrencies;))) Thanks!