Cryptocurrency News for 1 Oct 2017

Japan has taken a key step to cement its position as a leader for cryptocurrencies

China is moving forward with a plan to crack down on cryptocurrencies, but Japan is singing a different tune.

Japan's Financial Services Agency on Friday granted 11 cryptocurrency exchanges licenses to legally operate in the country, according to reporting by The Wall Street Journal's Paul Vigna and Gregor Stuart Hunter. The news comes amid a crackdown on digital currencies by Japan's neighbors.

China banned initial coin offerings, a red-hot cryptocurrency-based fundraising method, earlier in September, and since then there have been numerous reports of a wide-ranging crackdown on exchanges. On Friday, South Korea joined China in banning ICOs.

Licensed exchanges, according to The Journal, will be required to conform to some rules to maintain their status.

Full story at http://read.bi/2wr9No0

Source: Business Insider Nordic

The Guy Who Called Bitcoin a Bubble Now Wants to Help You Store It

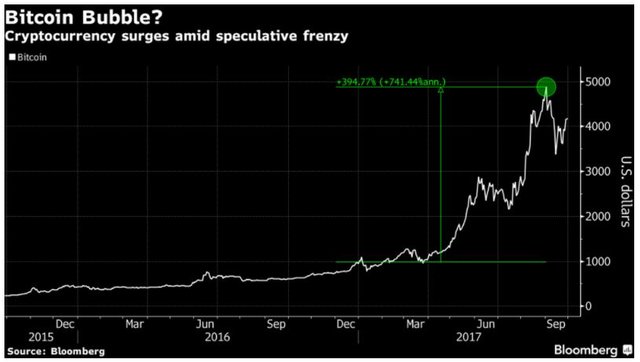

Back in the spring, Roy Sebag’s precious metals investment firm Goldmoney Inc. dumped millions of dollars in bitcoins, calling the digital money a bubble. Now he wants to sell you cryptocurrency trading and storage services.

Sebag, who had originally named his Toronto-based company BitGold Inc.when it was founded in 2014, claims he’s not back-tracking. He’s bearish because he expects regulation to weigh on prices as the market matures. Cryptocurrencies fell in overnight trading after South Korea banned initial coin offerings.

“For the industry to succeed, it needs to be regulated, and once it is, prices won’t go up like this anymore,” Sebag said in an interview. “What we’re saying is, you guys want this industry to grow up? Then it needs to have standards, it’s got to be auditable and insurable. What I’m excited about is moving the industry in the right direction.”

Bitcoin’s meteoric rise this year is attracting tons of attention, but most institutional investors are staying on the sidelines as cryptocurrencies are too volatile and don’t have the safeguards that most financial assets do. Some companies are stepping up efforts to bring the market to the mainstream, opening regulated exchanges, creating futures contracts, and attempting to list exchange traded funds. Goldmoney’s is the latest in these forays.

Full story at https://bloom.bg/2wqts7n

Source: Bloomberg

Virtual Currencies Expected to be Regulated in China on October 1st

Jinse has reported that the General Principles of the Civil Law of the People’s Republic of China, which is expected to come into effect on October 1st, will see Chinese cryptocurrency regulations implemented for the first time. The Jinse report suggests that cryptocurrencies will be treated as “virtual property” under Chinese law. Chinese academic, Professor Deng Jianpeng, stated that “bitcoin, [crypto]currency, etc. can be classified as virtual assets.”

The incorporation of virtual currencies into China’s “General Principles of the Civil Law” legislation suggests that China’s recent crackdown on virtual currency exchanges will not be expanded into a nationwide prohibition on the use and possession of cryptocurrencies. Jinse reinforces this inference, stating that “regulators have never mentioned the issue of prohibiting bitcoin from beginning to end, that is to say, the government level does not think that there is a problem with the bitcoin itself”- according to a Google translation.

Jinse asserts that the crackdown on exchanges was motivated by “small platform[s]… not seriously implement[ing] anti-money laundering and KYC policy” requirements. The publication also cites the decision to allow China’s major cryptocurrency exchanges to reopen following PBOC investigations, implying that the recent crackdown on cryptocurrency exchanges is temporary, and should not be interpreted as a general prohibition on cryptocurrency.

Full story at http://bit.ly/2wqtpbH

Source: Bitcoin News

IMF's Lagarde: Ignoring Cryptocurrencies 'May Not Be Wise'

The head of the International Monetary Fund (IMF) believes that cryptocurrencies may give traditional government-issued ones a "run for their money."

Speaking at a conference in London, IMF chief Christine Lagarde told attendees that she thinks "it may not be wise to dismiss virtual currencies."

Notably, she outlined possible scenarios in which a country – particularly those with "weak institutions and unstable national currencies" might actually embrace one more directly.

"Instead of adopting the currency of another country – such as the U.S. dollar – some of these economies might see a growing use of virtual currencies. Call it dollarization 2.0," she said.

Full story at http://bit.ly/2wr9Os4

Source: CoinDesk

Cryptocurrency Speculators Watch Nervously as South Korea Bans ICOs

The cryptocurrency market is having another rocky morning as South Korean authorities announced a ban on initial coin offerings (ICOs). While countries like the US and the UK have warned investors to exercise caution before becoming involved with such projects, China has completely banned the fundraising method, and Taiwan could be next.

Reuters reports:

The Financial Services Commission said all kinds of initial coin offerings (ICO) will be banned as trading of virtual currencies needs to be tightly controlled and monitored ...

“Stern penalties” will be issued on financial institutions and any parties involved in issuing of ICOs, the statement added, without elaborating further on the details of those penalties.

Full story at http://bit.ly/2wr9MjW

Source: https://gizmodo.com

Japan Endorses 11 Different Crypto Exchanges, Turns Into Friendliest Asian Bitcoin Market

One of the exchanges the FSA endorsed was Bitflyer, which is the largest Bitcoin Japan Endorses 11 Exchanges, Turns Into Friendliest Asian Bitcoin Marketexchange in Japan. This is momentous news for trading volume and Bitcoin adoption in the country. In a press release, Bitfyler CEO Yuzo Kano, elaborated on the situation:

“Japan has been exploding with demand for both Bitcoin trading as well as virtual currency services. The FSA’s approval for bitFlyer to operate as a Registered Virtual Currency Exchange, and the agency’s openness and forward thinking regulation could not come at a better time for the Blockchain space.”

The bitFlyer press release stated the company will continue to leverage its 800,000 strong user base to grow the Bitcoin ecosystem in Japan and around the world.

Full story at http://bit.ly/2wr9PfC

Source: Bitcoin News

Originally post at: http://sydesjokes.blogspot.com/2017/10/cryptocurrency-news-for-1-oct-2017.html

Advertisement:

Problems is there's going to be another Jamie Dimon spreading fuds...

Upvoted and Resteemed

Upvote & resteem.. follow @lurehound

Way to go Japan.

Nice post

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

Good post, nice to have all recent crypto news in one spot. I gave you a follow. :)

This is very informative Upvoted .Please check and upvote my blogs

A summary of such reports in one place is a great idea

It's curious watching the different ways the different Asian countries are addressing crypto.