Wancahin Analysis For Hodl and long term investor.

Wan$$$

$WAN There is huge demand from USA, China and S.Korea as they were not allowed to participate.

The main ICO ran out in less than a minute. Officially people estimate 4-10 minutes. However, it was much less. I sent my transaction on the first second but it was confirmed 4 minutes later. There were comments of people who sent on 50th second and missed out. This was perhaps the fastest ICO to sell out ever or a very close second to BAT which sold out in 35 seconds.

Unlike BAT, individual caps means there were no whales who could pick up large quantities of WAN, therefore, it is very difficult for whales to suppress/manipulate the price. Being evenly distributed is important to avoid pump and dumps in the short term.

This is not another ERC-20 token. Wanchain is it's own protocol and hence has a much higher value than most ICOs this year. You can see on Coinmarketcap, majority of top coins are protocols not tokens. In addition to this, there is no inflation, low circulating supply of 100M and POS means circulating supply will be reduced even more. Coins with POS or masternodes perform extremely well, just look at Dash.

Wanchain is ETH XMR & XRP all in one. In theory, it is superior to all of them. Firstly, it is a fork of ETH so has smart contract capability but already has POS and private transactions. It is better than XMR because it generates a new one time address for private transactions everytime. Lastly it is better than XRP because it is actually decentralised and can allow banks (and normal people) to not only do settlements but also provide credit and lending facilities. The icing on the cake is that Wanchain connects all blockchains with its interoperability features.

This isn't a typical ICO which released a whitepaper after 1 day and ran it's ICO 2 weeks later. This has been in development for 2 years now and has a world class team behind it. They have experience in successful crypto projects and know what it takes to deliver.

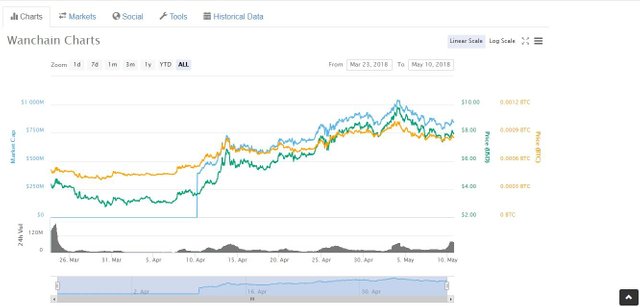

The team are not greedy. They didn't aim to raise hundreds of millions. They set a fair and realistic cap which therefore allows incredible returns for ICO investors or those who buy in the first few days of being listed on exchange. You would be crazy to sell at even 100x ico price (around $3.5B or $35) unless you are hoping to buy back in cheaper. The value for this project if they deliver on roadmap is at least 35b to 70b marketcap which would be $350-$700. I expect this to be achieved within 12-24 months.

Wanchain's target market is huge. There are billions of unbanked people worldwide who could benefit from using Wanchain banking facilities.

Corporate clients and govt. organisations can also benefit immensely from utilising Wanchain's private chains. Think of how companies, hospitals, schools etc... have their own intranets only for their internal employees. However, they can still access websites on the internet. This can be done on Wanchain as well.

If you have made it this far, I want to stress the last but easily THE most important point. Wanchain is by far the best ICO to date from a regulatory standpoint. Even though it is frustrating to have a 3 month lockup of your ETH. They chose to not allow erc-20 tokens to be tradable in order to avoid any scrutiny from regulators. Anyone who is familiar with securities laws knows that regulators mainly look the ICO and what was done before and right after. When cryptocurrencies become regulated (this is inevitable guys, whether you like it or not). Each project will be heavily scrutinised by regulators and many will be deemed securities. Some governments will not care, but surely countries like U.S, Canada, China etc... Will set explicit laws that prohibit their citizens from buying certain coins and exchanges from offering them. Sure, there will be decentralised exchanges and a lot of crypto projects will survive because naturally cryptos are censorship resistant. However, there will still be a need for a legitimate blockchain that is approved for investment and utility for retail and institutional investors.

if they deliver on roadmap is at least 35b to 70b marketcap which would be $350-$700. I expect this to be achieved within 12-24 months..🔥