Why Jamie Dimon is Wrong: "Bitcoin is a fraud" Says Very Worried Man for the Second Time This Year

Jamie Dimon is wrong, plain and simple. Governments cannot control the use of Bitcoin or even outlaw it, that would be impossible. In his interview with Fortune, Dimon appeared smug and unafraid of the implications that Bitcoin and other cryptocurrencies bear for the banking industry, even stating ‘the technology will be used’. However, underneath what is most likely a facade, it is possible that he and other banking CEOs are afraid of Bitcoin, and the alternative it presents to the current financial system. Many of you already know this, and we are currently seeing many large institutions dipping their toes in the water of cryptocurrencies.

It is quite possible that Jamie Dimon himself knows he is wrong, a possibility that must not be dismissed. I could list to you all the times that ‘establishment’ organisations and talking heads have said bitcoin is a ‘fraud', or that it is a 'failed experiment', but this list would make this article too long to read. Many previously sceptical figures have warmed to the idea of Bitcoin in the past year as its popularity and value have grown. Others, such as John Mcafee have even predicted the price of Bitcoin to rise to $500,000 USD in three years.

Why is he wrong? Because Bitcoin is here to stay, and it is going to crush Jamie Dimon and JPMorgan underfoot as it continues its unstoppable march into the future. Bitcoin, when first created in 2008 by Satoshi Nakamoto, was a revolution against the prevailing world financial order. In my previous article I stated that Nakamoto had accomplished something similar to Martin Luther in 1517, however, this time instead of the democratisation of the Christian faith, it was the democratisation of money which Nakamoto had achieved. Nakamoto had created an alternative to the bank, something Mr Dimon is terribly afraid of. For the first time in history, people could store value outside of the banking system, without the risks presented by fiat currency and even gold. Perhaps, the beginning of the end for controlled International Finance had begun?

(Previous article)

https://steemit.com/cryptocurrency/@stevg/the-cryptocurrency-reformation-comparing-martin-luther-and-satoshi-nakamoto

Bitcoin is more reliable and less vulnerable than banks, and yes, that includes JP Morgan. Bitcoin has something which JP Morgan does not yet have - distributed ledger technology. Arguably, this is the most important factor in any argument against Dimon’s statements. It would take an awesome amount of computing power to hack the Bitcoin Network, meaning governments could not simply outlaw it and ‘put you in jail’ for being ‘against the law of the United States’ as Mr Dimon said. Every transaction ever made on the network is publicly recorded on millions of computers worldwide, which just happen to lay outside of US borders, and therefore, jurisdiction.

Furthermore, there is an almost infinite number of wallet addresses all of which are all but impossible to guess, making Bitcoin incredibly secure from hackers and the Department of Justice. In comparison to JP Morgan’s computer network, which is much more centralised, the Bitcoin network is immensely more secure. Just this week we saw the chaos hackers can cause in private organisations computer networks, with Equifax having 400,000 UK customers data at risk.

The recent kerfuffle with Chinese exchanges will be a great test of Bitcoin’s resilience in the face of a government clampdown. However, ultimately, the Chinese government cannot eliminate the use of bitcoin entirely and is making moves to utilise the technology behind Bitcoin for its own ends. The Chinese attempt to limit the use of cryptocurrency may be an indicator of what is to come in the West. The US government may very well step in if Bitcoin becomes a large thorn in its side, however, although this may impact the market, and limit access to it, Bitcoin will not disappear as Mr Dimon so boldly predicts.

In fact, Mr Dimon's words more accurately reflect the Dollar and the fiat money system which are backed by central banks and the Federal Reserve, which can create money out of thin air through quantitative easing. Murmurs are beginning to grow around the sustainability of the current world financial system, which is mainly built upon debt. Mr Dimon has further thrown a spotlight on the new cryptocurrency battlefield and the war between the monolith of International Finance and those who wish to challenge it.

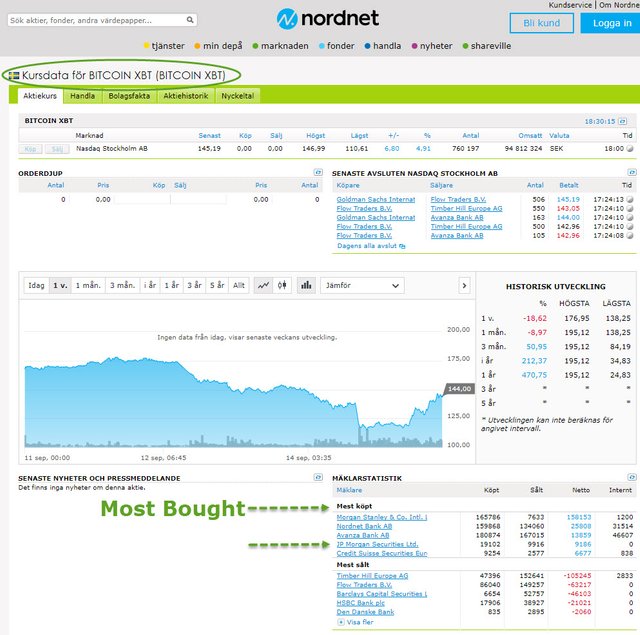

Despite Dimon’s remarks, JP Morgan has purchased Bitcoin in Europe leading to many speculating whether Dimon made the remarks to lower the price that the bank would buy in at.

It doesn't take much to see the game that JP Morgan could be playing. We know what you are doing Mr Dimon... and we are watching...

Share your thoughts in the comment section ladies and gentlemen.