Investing in Cryptocurrency — Part 1/3

I’ve been following cryptocurrencies for the past 5 years, and I’m certain that 2017 was the inflection point for these new financial instruments.

Bitcoin is one of many cryptocurrencies that are being traded. A few months ago, it started to become mainstream. The CBOE launched trading of Bitcoin futures on December 10, giving access to Wall Street and institutional investors. Bloomberg and Business Insider listed Bitcoin as a legitimate currency.

In 2018, we’re going to see an incredible amount of trading volume in Bitcoin and other cryptocurrencies. People are always looking to make “easy” money and when they see cryptocurrencies returning 10x to 500x in less than a year, you can bet they’re going to want in on the action.

These are examples of the returns to be found in cryptocurrencies:

- Bitcoin | Dec 1, 2016: $753 → Dec 1, 2017: $9,958 | Return: 1,222%

- Ethereum | Dec 1, 2016: $8.41 → Dec 1, 2017: $443 | Return: 5,168%

- Ripple | Dec 1, 2016: $0.007 → Dec 1, 2017: $0.242 | Return: 3,357%

- Litecoin | Dec 1, 2016: $3.94 → Dec 1, 2017: $85.8 | Return: 2,078%

- Dash | Dec 1, 2016: $8.91 → Dec 1, 2017: $784 | Return: 8,699%

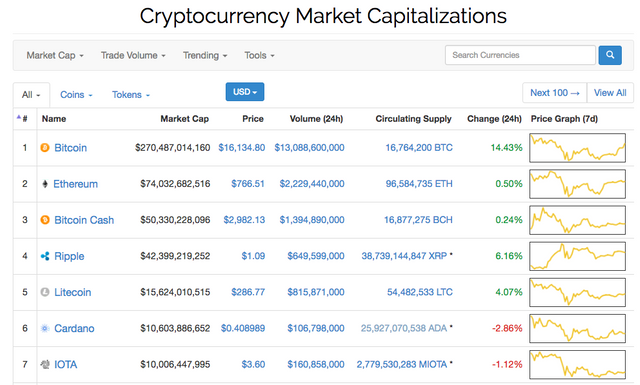

The mainstream media has only been focusing on Bitcoin, which was the first cryptocurrency created in 2008 in response to the financial meltdown. Since then, thousands of cryptocurrencies have been developed. As of December 26, 2017 there are 34 cryptocurrencies with a market cap of over a billion dollars.

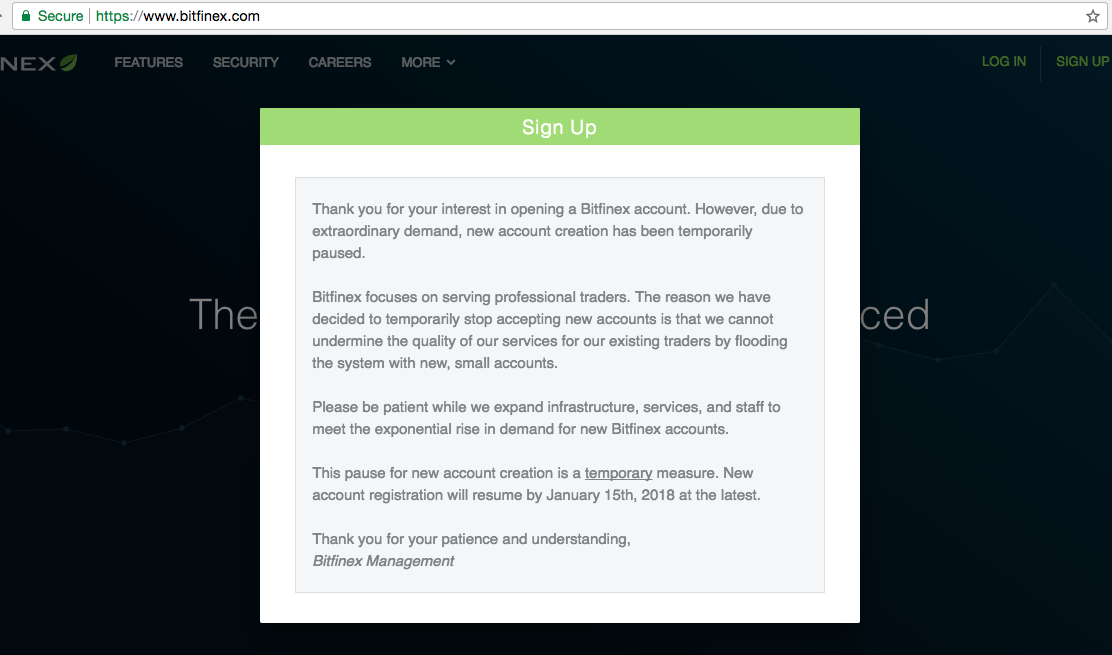

Exchanges to trade cryptocurrencies are increasing in popularity. The demand to trade has been growing so fast that many changes have had to halt trading, and in some cases stop new account creation.

For those who are interested in getting involved with cryptocurrencies as an investment, you’ll need to do these two things to get started:

- Sign up on an exchange.

- Research the cryptocurrencies you want to invest in.

Exchanges

I won’t recommend any exchanges because there are risks associated with each of them. You’ll have to do your own research before investing money into them. Not all exchanges let you transfer in dollars directly. So you’ll have to use an exchange like Coinbase. Here’s a list of exchanges you can research:

Coinbase

Kraken

Binance

Bittrex

Bitfinex

Cex.io

Gemini

Coinsquare

If you’re investing more than $10k, you should also research wallets (click here to read about wallets).

Researching Cryptocurrencies

The best place to start is Coinmarketcap. This will give you a good understanding of the various cryptocurrencies you can invest in. I’ll write a seperate post on how to research cryptocurrencies.

The question most people ask is, “Are we in a bubble?”

Cryptoeconomics is at a very early stage. Unlike stocks, the method of valuing cryptocurrencies has not been established. If you’re investing in cryptocurrencies, you are making a bet. At this point, I’d say it’s closer to gambling than it is to investing.

Why is it like gambling?

There are a lot of problems with the uses and underlying infrastructure of most cryptocurrencies. I’ll write about them in detail in my next post.

Here’s what you should do right now:

- Follow me to stay updated.

- Spread the knowledge by sharing and STEEMing

This post was meant to be basic and cover some of the background of what has been happening in cryptocurrency. My next posts will go into more detail on specific areas and cover things that most people don’t know, including red flags in the crypto world, and what to look for when investing in cryptocurrencies.

Congratulations @steeminfo! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!