The Unofficial DeFi Reference (MKR, MLN, KNC, POLY) - Part 1

I've been following crypto for a little over 2 years and have witnessed the mania and bust of many projects. I've read about hundreds of different coins and moved back and forth into positions as my knowledge of the space has evolved. NOT FINANCIAL ADVICE, but here is what I think deserves attention: DeFi (decentralized finance) protocols (MKR, MLN, POLY) on the Ethereum blockchain and projects that integrate with them (KNC). Yes, we are all fans of STEEM here, and so am I, but these projects also deserve attention. So without any pretty clickbait pictures, just useful links, here is the summary for those unfamiliar:

Maker (MKR)

- Utility: used to pay back the stability fee on CDPs, voting rights in MakerDAO, generates the popular stable coin DAI

- Supply: limited supply of 1 million tokens, no inflation

- Token Economics: MKR is continually burned to pay the stability fee on CDPs, circulating supply decreases with use

- Governance: Anonymous voting system established and in use based on ownership of MKR

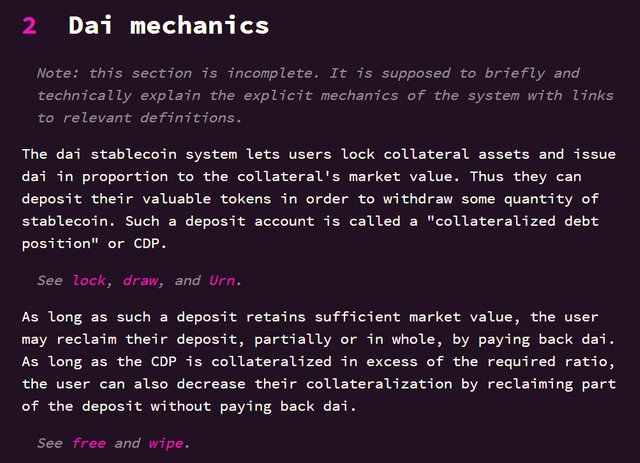

MKR is the governance token of the Maker Foundation, responsible for generation of the stable coin DAI. Over the past two year we have seen a roller coaster ride of crypto prices. The stable coin DAI however has been pegged for over a year very close to $1. It achieves this through an ingenious mechanism of allowing people to create collateralized debt positions (CDPs) in a completely decentralized and autonomous fashion. Every CDP has a liquidation price depending on the amount of DAI which was generated from the ether deposited as collateral. This essentially allows people to take a long margin position by generating DAI and using that to purchase more ether or other tokens. What is remarkable is how this has successfully created a stable coin which is quickly becoming widely used in the crypto world. The MKR token is limited to 1 million tokens and again allows voting rights for governance of the MakerDAO. A vote occurred recently for example to reduce the stability fee from 2.5% to 0.5%. The economic model of MKR is quite simple. Wiping debt (paying back DAI) to recover collateral is denominated in MKR which is then burned and removed from total circulating supply. This produces a continual pressure on supply for a token which is growing in demand.

DAI Stablecoin Purple Paper:

Maker seems to be the obvious giant right now. A fair argument can be made for how DAI may become the universal currency used throughout Ethereum dapps. While the price of Ethereum itself is of course hard to predict, continued use and expansion of DAI should continue to reduce available supply of MKR. I will let you speculate on the effect that will have on price. Given the relatively low market cap of MKR it would be interesting to speculate what would happen if the price per coin reached parity with the price of Bitcoin. With its low coin supply, this would happen without actually reaching the same marketcap. While price per coin and marketcap are two very different metrics, I would expect that reaching parity at a price per coin level would still fuel some attention from the wider media.

The DAI Stablecoin Purple Paper

Current amount of MKR burned MKR Burn Total

Maker Foundation Website Maker

The Maker CDP Portal Maker CDP Portal

In Part 2, I will continue on with a brief summary of other DeFi projects of note if I see any interest in this article.

Disclaimer: Crypto is risky. No one can predict future prices. This is not financial advice. We already saw the value of most coins drop over 90% recently. They could and very well might keep going down. This is simply an explanation of some interesting smart contract technology being developed.

Congratulations @steem.wizard! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP@steem.wizard for the last one year crypto's has continuous downfall in their economic worth due to which it seems very difficult to generate more coins.In all front of this what you think, how's it is in near future

No one can predict if or when we pull out of the crypto winter. I feel more comfortable buying now though than I did when prices were moving higher so quickly back in January 2018. It is a good time IMO to accumulate coins IF you think crypto will have another bull cycle. There has never been more development in the space.