EXPERIMENT - Tracking Top 10 Cryptocurrencies of 2019 - Month Ten - UP 39%

Interested in earning cryptocurrency for publishing and reading articles? Join us at Publish0x!**

The Experiment:

Instead of hypothetically tracking cryptos, I made an actual $1000 investment, $100 in each of the Top 10 cryptocurrencies by market cap as of the 1st of January 2018. I then repeated the experiment on the 1st of January 2019. Think of it as a lazy man's Index Fund (no weighting or rebalancing), less technical, more fun (for me at least), and hopefully still a proxy for the market as a whole - or at the very least an interesting snapshot of the 2019 crypto space. I am trying to keep this project simple and accessible for beginners and those looking to get into crypto but maybe not quite ready to jump in yet. I try not to take sides or analyze, but rather report and document in a detached manner letting the numbers speak for themselves.

The Rules:

Buy $100 of each the Top 10 cryptocurrencies on January 1st, 2019. Hold only. No selling. No trading. Report monthly. Compare loosely to the 2018 Top Ten Experiment.

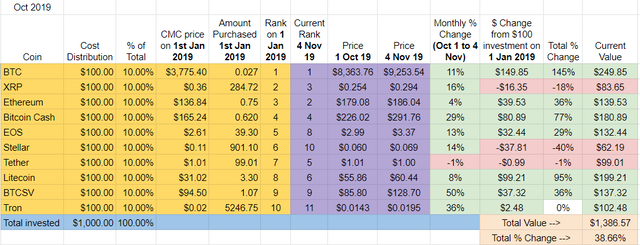

Month Ten - Up 39%

With each of the 2019 Top Ten Cryptos finishing in the green (except Tether of course, which was flat), October decisively snapped the downward trend we had seen over the three previous months. When Tether finishes last, the portfolio is having a good month.

Overall, the 2019 Top Ten portfolio is up a strong +39% on the year, but no where near the +114% peak this same portfolio achieved at the end of May 2019.

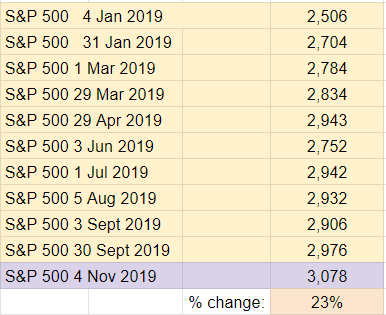

Tied last month with the stock market (as measured by the S&P 500), the 2019 Top Ten Portfolio has regained a healthy lead (see below).

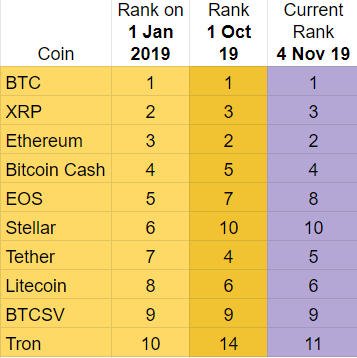

Ranking and October Winners and Losers

It's almost as if the rankings were reset in October: despite some internal maneuvering (Bitcoin Cash back into fourth place, EOS and Tether both slipping a spot to #8 and #5, respectively), the players remain almost exactly the same. Even Tron, which has slipped out of the Top Ten, is almost back in its original position thanks to a very strong month where it climbed from #14 to #11.

This is quite different from the 2018 Top Ten Experiment where after 10 months four cryptos had convincingly dropped out of the Top Ten. It's only gotten worse as those four have continued to fall as the 2018 experiment rolls on.

Again, despite its strong October, Tron stands alone as a Top Ten dropout, replaced by Binance Coin.

October Winners - BTCSV gained a massive +50%, easily outperforming the field. Second goes to Tron, up +36%.

October Losers - Tether alone was in the red this month, followed by Ethereum which gained a modest +4%.

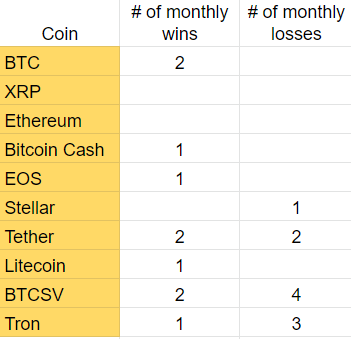

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first ten months of this experiment: a three way tie between Bitcoin, BTCSV, and Tether all with two monthly victories each. Bitcoin SV also has the most monthly loses, finishing last in four out of the first ten months of 2019.

Overall update – Bitcoin with a sizable lead followed by Litecoin. All cryptos in positive territory except Ripple and Stellar.

BTC and Litecoin are still far ahead of their peers, up +145% and +95% respectively in 2019. My initial $100 investment in Bitcoin is now worth $250.

All Top Ten cryptos are still either flat or in positive territory except Ripple and Stellar. Although each increased in value in October, Stellar remains in the basement down -40% so far in 2019, followed by Ripple, down -18%.

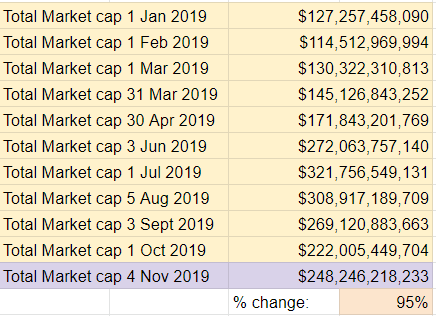

Total Market Cap for the entire cryptocurrency sector:

After three straight losing months, October saw a bounce. The total crypto market cap increased about $26B in October. The overall market cap is sitting around the $248B mark, a level we last saw in September 2019.

Still, it has been a very strong year for crypto: we've seen an increase of +95% in total crypto market cap since the beginning of 2019.

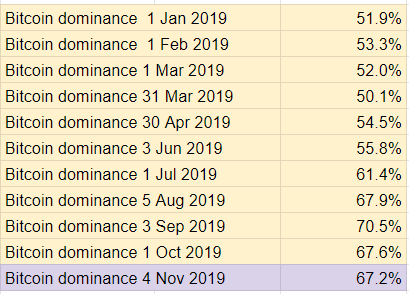

Bitcoin dominance:

Bitcoin dominance ticked down slightly in October, down about -1/2% to 67.2%. The month end high in 2019 was 70.5% in at the end of August.

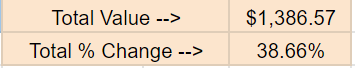

Overall return on investment from January 1st, 2019:

If I cashed out today, my $1,000 initial investment would return $1,386, a +39% gain.

I'm down significantly in my 2018 Top Ten Experiment. If I cashed that group out today, the $1000 initial investment would return about $192, down nearly -81%.

So, taken together, here's the bottom bottom line: after a $2000 investment in both the 2018 and the 2019 Top Ten Cryptocurrencies, my portfolios would be worth $1,579.

That's down about -21%.

Implications/Observations:

With the market as a whole up +95% on the year, how have the 2019 Top Ten cryptos performed? Up a respectable but still much lower +39%. As a reminder, in May 2019, the gains from the Top Ten and the entire market were both exactly the same: +114%. The last few months have seen that gap widen: for five straight months, focusing only on the Top Ten has been a losing strategy.

This is reminiscent of last year as at no point in the Top Ten 2018 Experiment did the Top Ten strategy outperform the overall market.

I'm also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 is up a very healthy +23% since the beginning of 2019, but still much less than the Top Ten of 2019, up +39%.

For reference, the gap has been extremely wide at different points during the year. For example, the Top Ten portfolio was up +114% compared to +10% for the S&P in late May of this year.

The initial $1k investment I put into crypto would have yielded +$230 had it been redirected to the S&P.

Conclusion:

Probably due to the news out of China, October saw a welcome reversal of a multi month slide in crypto. The last few months of the year have been busy in recent history. Around this time of year two years ago, the market started skyrocketing while last year it started to slide. We'll soon see which of these histories repeat itself or if crypto has something altogether different in store.

If you're just finding this experiment now, here's the backstory: On the 1st of January, 2018, I bought $100 each of the Top Ten cryptos at the time for a total investment of $1000 to see how they would perform over the year. I tracked the experiment and reported each month. The result? I ended 2018 down -85%, my $1000 worth only $150.

After last year's experiment ended, I decided to do two things:

- Extend the Top Ten 2018 Crypto project one more year. The experiment is now in its 22nd month. You can check out the latest update here.

- What you're reading now is the 10th report of a parallel project: this year I repeated the experiment, purchasing another $1000 ($100 each) of the new Top Ten cryptos as of January 1st, 2019.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

**As part of Publish0x's Ambassador program, signing up using this link may provide me with a small benefit, at no cost to you (Publish0x is 100% free to use).

***As part of Coinbase's referral program, signing up using this link will result in us both receiving $10 worth of free Bitcoin at no extra cost to you.

- A Walk Through A Hidden Redwood Grove in Southern California

- A Walk In Oak Canyon Nature Center - Anaheim, CA

- @checky Tribute Post

- My Steem Origin Story - eoj

- Proof there is indeed life after HF20

- Share Your World - @eoj

- The Get to Know Me Challenge - Top Ten Posts by @eoj

- A Lakeside Walk in Pokhara, Nepal - A Wednesday Walk

- Street Art in Pokhara, Nepal - A Lakeside Walk

- Steemit Survivor Contest UPDATE - 20 STEEM Grand Prize - IT'S ON!!!

- Giving Back: Nepal - Four Worthwhile Causes to Support

- More Street Art in Bangkok - A Walk Through Talat Noi, Bangkok

- The Stranger Than Fiction Digest - Edition One: Art Gone Wrong

- Personal Finance 101 - Part 1 - Step on the Scale, Get Organized, Feel the Pain

- Street Art in Bangkok - A Walk Through the Neighborhood

- WINNER ANNOUNCEMENT - Think you're well traveled? Name that.... TAIL!

- Giving Back: Thailand - Four Worthwhile Causes to Support

- Why I Disappear from Steemit on Sundays

- Well Off the Beaten Path - Restoration of Saat Tale Royal Palace - Nuwakot, Nepal

- It's July 4th - Happy Birthday America!

- Cox's Bazar Surf Report and the Father of Bangladeshi Surfing

- World's 50 Best Restaurants for 2018 Announced

- How to Overcome Screen Addiction - 5 Practical Tips

Almost back to even :)

I always liked following this experiment and I look forward to reading future updates.