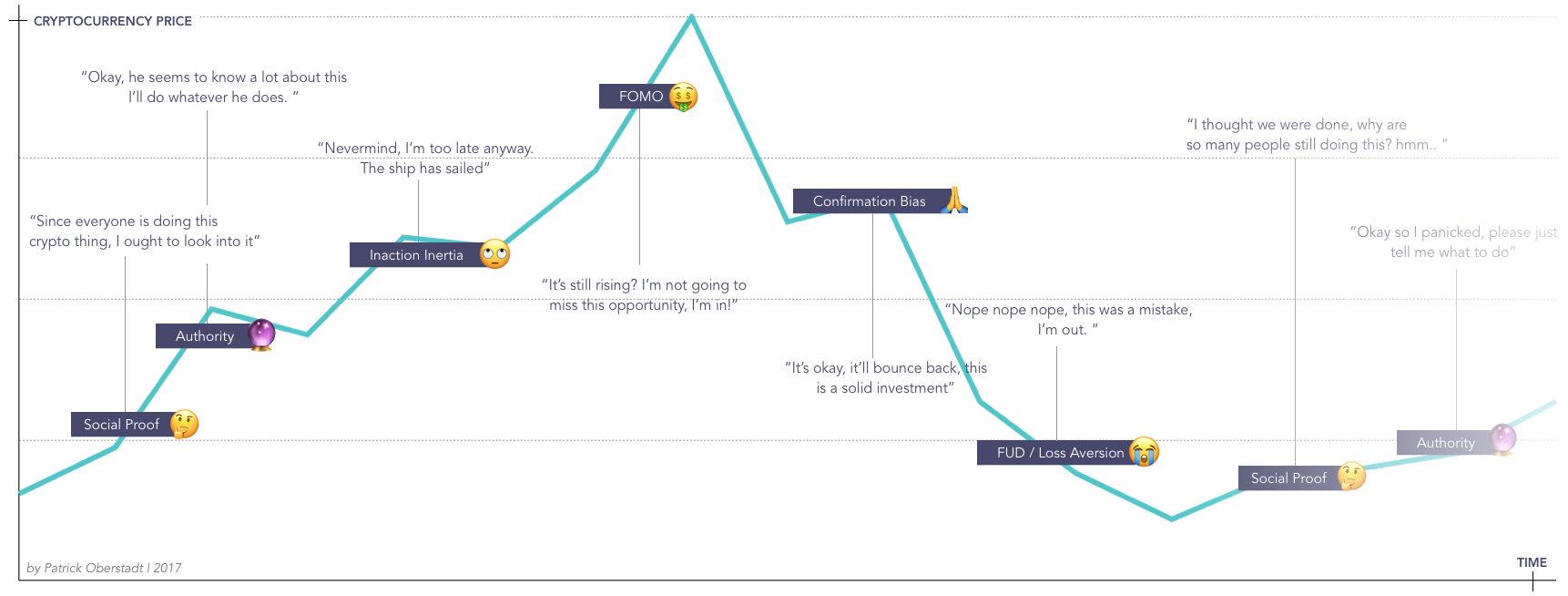

6 Psychological Biases you’ll experience when it comes to trading Cryptocurrency

Being aware of the mass emotion pitfalls that drive this market will save (and earn) you money.!

Cryptocurrency is a thing of the future. Even so, there’s only a small part of the population that’s invested in it. In the Netherlands alone, only 1% — 2% of the households invested in cryptocurrency this year. And an even smaller number of people that actually use cryptocurrencies, as there are few places that accept them as a method of payment.

Besides the fact that there isn’t yet much use for the various technology, it’s also hard to understand. Especially for someone who doesn’t have a technical background.

Even more than the stock market, this market is erratic, peaking and crashing on almost a weekly basis. Plus, it’s a technology that is only fully grasped by tech-oriented people, making it hard for a non-techie newcomer to successfully understand and invest in the market.

To deal with this, we use heuristics, mental shortcuts, and turn to the behavior of others to make decisions. But relying too much on these factors could get you in trouble. And to help prevent that from happening, I will lay out the most prevalent cognitive biases investors are susceptible to.

Irrational Exuberance

Few are able to resist the urge to engage in this cryptomarket when they hear about it, even after considering the potential losses that may counter the wins.

So, why is it so attractive for so many individuals? Well, there are many cognitive biases come into play. Because, as Kahneman once proposed, we are not as rational as we might think. Our choices are fuelled by irrationality, heuristics, and emotions. Which are useful in daily life, but often not so much when trading cryptocurrencies.

Getting pulled into the crypto market often starts with a promising pitch, probably by a friend or colleague, stating that it’s just easy money.

“Put your money somewhere and see how it doubles or triples!” they might say. Easy peasy, lemon-squeezy. And once you’ve started riding this cryptocurrency band wagon, you will find yourself surrounded by opportunities to turn your money into even more money.

But before you start thinking of which money-tree you’ll be watering, it’s best to mentally prepare yourself and look into the following biases and psychological factors that are widely present in this market.

-. Everyone at work is doing this / Social Proof

You notice that more and more people are looking into cryptocurrency and actually investing in the market. You still need to do your research before even considering going in, but if so many people are willing to confidently gamble their money, it must be something worth trying, right?

Why? Well, when we are unsure of what choice we need to make, we look at others for a behavior guideline.

Looking at what the majority is doing to guide your own choices is a heuristic is called social proof and is often exploited by other traders through shilling. Shilling is when traders make it seem like many people will invest in a coin in order to stimulate demand.

Since the cryptocurrency technology is very complicated and many don’t fully understand it, they will look for other cues that help them make a decision. One of those cues is to see how many others are invested in a certain project. This need for social proof helps us make daily decisions. But when you are about to put your money in a cryptocurrency, try to look past the herd mentality.

-Just tell me what to do/ Authority

In the beginning, it’s likely you don’t have a lot of knowledge about this subject. I mean, we all have to start somewhere — right? To deal with this lack in context, you will be inclined to follow someone who has (or acts like they have) made a lot of money with crypto trading.

In your eyes they will be seen as someone of authority. This image of the person will trigger you to follow whatever they say you should do because of their track record of making money with cryptocurrencies.

We are more likely to follow someone who has status in a subject because from a young age, we learn to take all authority figures seriously. However, it’s important to remember that even authority figures can’t be right all the time, especially in a market where new, hard-to-understand technology is popping up everyday.

- Nevermind, it’s too late / Inaction Inertia

Imagine hearing a peer talk about how they bought a specific coin at 10% of the current price. You might think it’s already too late. This feeling can lead to inaction inertia.

Inaction Inertia is the state one experiences after missing out on a deal, making you less likely to buy the same product in the future for an increased price. People hate to miss out, especially when it comes to money. This will affect most people, and because of its conservative nature, this is a bias that can actually save you sometimes.

But it can also diminish your winnings, especially in the world of cryptocurrencies. The first time you hear about a coin its price may have increased by 90%, which is now 120%, and tomorrow it’s at a whopping 290%. This is when inaction inertia is overridden by FOMO.

- Wait, it’s still rising? / Fear of Missing Out (FOMO)

Perhaps the most obvious psychological phenomenon that is making people excited to invest is called the FOMO-effect or the fear of missing out. Crypto investors don’t mind telling others how much they have earned since they started investing. I know I’ve done this. And almost everyone I talk to about my winnings has converted to cryptolife (you’re welcome).

The feeling of missing out can be very strong for us FOMO-sapiens. You missed out on a big win, but since it keeps rising you feel it would be stupid not to join in. You see it on social media and you hear it at work or at social gatherings.

People are enthusiastic and it seems as if there is a rocket heading to the moon but you still need to be quick to get a ticket. Unfortunately, by the time you experience this feeling of FOMO, the rocket has probably already left the station and you are bound to invest in something at a terrible moment.

- I’ll be fine / Confirmation Bias

Another dangerous element that can be seen is the confirmation bias. This bias is the human tendency to look for, or favor, information that strengthens our hopes or beliefs.

Imagine that you’ve put a decent amount of money in a project after your moment of FOMO. There are various rumors going around about this project, both positive and negative. In this situation, you are likely to look at the positive remarks to confirm that you made the right decision. For example making technical analyses and drawing lines on charts that keep reinforcing your theory and your wishful thinking.

-Hype and the Fear, Uncertainty, Doubt (FUD) lifecycle / Elliott Wave Theory , Loss Aversion

In 1938, an accountant, Ralph Nelson Elliott, noticed that when it comes to investing, there are various predictable traits to the masses. Elliot found that there are times of collective optimism and pessimism that recur in waves

his theory partially explains that social proof is the driving factor behind the predictable waves of behavior. It’s difficult to resist the appeal of social power. But, if one wants to be successful, they should fight the urge and pave their own way rather than follow the masses.

As Warren Buffet eloquently points out, “Be fearful when others are greedy and be greedy only when others are fearful.” People who are able to do this, have a better chance at making money in a market that is so fueled on mass emotion.

Things that go up, must come down. So the fact that a certain coin is going up without hesitation, doesn’t mean it will continue to do so. In fact, chances are it will go down just as fast after the run, which is okay because it will bounce back again if it’s a good project.

Unfortunately, this cycle of hype, hope, and despair is inevitable. But not knowing that this cycle exists will make it even harder not to give in to your sense of loss aversion.

We humans tend to put more weight on losses than equal gains. So gaining $10 is not as satisfying as losing $10 is dissatisfying. We are wired to prefer avoiding losses than we are driven to seek gains.

This feeling of loss aversion will be triggered full throttle when you see your money disappear because the value of your investment is dropping like it’s hot. Giving into loss aversion is not necessarily a bad thing as long as it’s funded in research (you found out the coin is a scam) or if you are still able to sell it at a profit.

If it’s solely based on the mass emotion in the market and you’re already at a loss, it’s usually better to keep your head cool and sit this one out.

There you have it, the ball is in your court now…