Digitex: Commissions free Trustless Futures Exchange

1.0 INTRODUCTION

Any industry sustains growth by improving on existing solutions. The ability to evolve, ensures that any business will thrive, and keep on attracting customers.

Previously, all exchanges ensure that the value their users derive from transactions is diminished, due to commissions in transaction and other fees users need to pay, to carryout one activity or the other.

.png)

Digitex is a futures exchange that does not collect any transaction fees from its users. It ensures that users are able to retain full value for tokens being swapped or sold internally.

Futures are a promise/contract to buy something at a specific date - a standardized asset or commodity (apples, oranges, etc), at a specific price.

If that is the case, how will Digitex be able to sustain operations?

2.0 COMMISSIONS-FREE FUTURES TRADING

Digitex ensures that all related costs-transaction costs included are covered by the introduction of its own native token DGTX token, which everyone that wants to make use of the platform will have to hold. This means that as the demand for DGTX increases, so will the value of tokens being held by users.

This increase in value will ensure that the cost of minting a little number of tokens yearly are adequately compensated for.

After the launch of the futures exchange, no tokens will be minted for the first two years, seeing the funds generated from the ICO will be enough to run the platform.

Initial demand for DGTX token will ensure that minting activities to be carried out after this period will fully be compensated for.

New tokens will be minted c. Q1, 2021. These will be used to cover costs such as maintenance, software development, staff, facilities and marketing activities, among other related costs.

Holders of DGTX will be responsible for voting via Decentralised Governance by Blockchain on how many tokens should be minted. The more DGTX held, the higher the users influence. 1 DGTX token=1 vote.

Purchases will be via a fully audited token creation smart contract. Audited smart contract will be used to keep record of tokens sold, to ensure that data held is verifiable and accurate. There will also be a minimum and maximum funding cap.

.png)

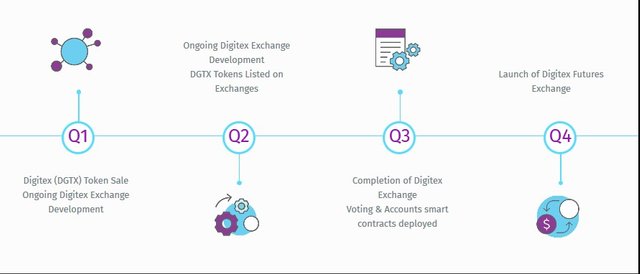

2019 will give Digitex enough time to get its act together, complete it’s ICO and study the platform, to see ways it can be improved. They will also see users trickling in, and majority of this will come aboard in 2020, which should see massive growth and Digitex accommodating these users seamlessly, without affecting operations.

This will all be in time for the first set of tokens to be minted in Q1 2021. Activities carried out by users that came aboard in 2019/2020 will fully compensate for this, and probably with some to spare.

3.0 DIGITEX PROTOCOL TOKEN (DGTX)

DGTX is an ERC-223 protocol compatible token based on the ethereum blockchain. All activities on the platform can only be carried out, when this token is held. Users assets are listed in the form of DGTX tokens.

Traders need to have enough funds to cover for potential losses, to be able to trade on the platform.

ICO: 1,000,000,000 tokens to be released during this phase.

700m will be available for purchase, 200m will be secured by the Digitex market makers, and 100m will be reserved as vested shares for the founding team (3years schedule).

*Users will be able to trade DGTX tokens for BTC, ETH and some other tokens, and users will be able to ensure that trading risks are done away with, by making use of the DGTX Peg System.

Digitex will ensure that DGTX tokens can be traded easily for other cryptos. It will make sure that its token will be listed on other exchanges, and will also integrate 0xProject into the platform to make sure that instant and trustless trading is a possibility.

Assumptions:

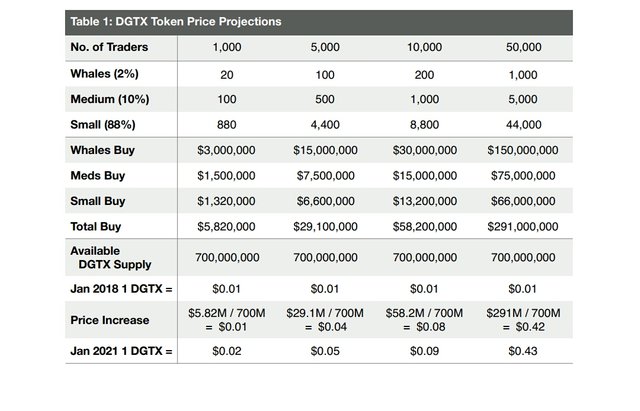

Assuming 2% of traders are big time buyers, who buy $150k worth of DGTX tokens, 10% are average traders that purchase $15k worth of DGTX tokens, and the rest are small traders that buy a total of $1500 of DGTX tokens, all over the initial 2 year period,

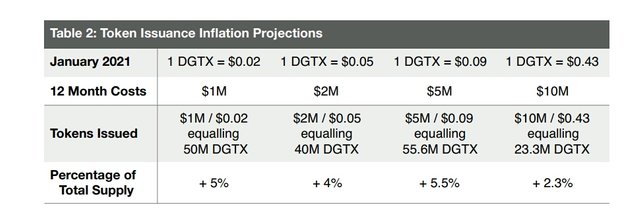

The table below shows inflation projections

4.0 TRUSTLESS FUTURES TRADING

Digitex ensures that account balances are replaced with independent decentralised smart contracts. This has a lot of benefits among which are better protection of users funds, high latency and removal of the fear factor. By taking the positives from centralised (speed and reliability) and decentralised (security) futures exchanges, Digitex is able to solve major problems.

Some problems decentralised exchanges face are:

- Scalability and reliability issues

- No On-chain privacy

- Costs associated with transactions

- Margin trading is not yet possible on-chain

Digitex exchange doesn’t have access to users funds. It makes use of smart contracts to update balances in real time. It also does not have access to trading keys, can’t hijack users funds or seize them, neither can it mismanage these funds. These all ensure user’s fund safety.

Communication between the centralised exchange and smart contracts might be a target for hackers, who will wish to game the system and withdraw more than they have. To combat this, Digitex calculates all traders profits and losses from the bottom for all matched trades, whenever smart contract tries to retrieve balance information.

The use of Metamask browser plugin could also be used to improve users security (only that user having access to withdraw funds).

4.1 Benefits of Centralised Matching Engine & Order Book vs Decentralised exchanges

- Transactions are basically free and such transactions on central servers are off-chain

- Central services are highly scalable, and efficient.

- Central servers are totally private.

- Seeing matching engines on central servers are very fast, this ensures that real time trading is possible.

.png)

5.0 THE DIGITEX FUTURES EXCHANGE

This is a trustless trading platform, where there are zero transaction fees. Funds are not held by the exchange, ensuring that users are adequately protected.

Some other benefits are:

- Having a highly liquid futures market

- Native token

- Automated market makers

- Users have total privacy

- Benefits from blockchain security

- Makes use of Decentralised Governance by Blockchain

- Lightening speed order matching.

- On-chain settlement for off-chain price discovery.

- Large Tick Sizes.

Digitex market makers are automated trading bots that ensures it always break-even. They assist in creating highly liquid futures markets that have tight bids and offering spreads, ensuring that users can carry out their activities with much lower risks.

A zero fee futures exchange ensures that users gain more from trades, because no piece of the pie is lost. With Digitex, what you see is what you get, as long as these activities are completely carried out within the exchange.

This ensures that users are motivated to make use of the platform more, and it will also ensure that users are motivated to hold and trade majority of their assets on Digitex, because of the better value they get-not just in savings, but also by deciding the way the platform evolves.

Fees are problematic, because users are discouraged when they lose value. In many cases, these transaction fees are not fixed, and are a real headache for users, seeing they can’t be sure of exactly how much is needed for a particular transaction in many cases. Digitex solves this problem.

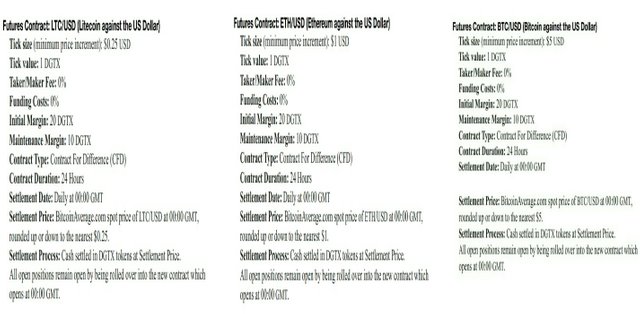

Digitex futures market is made up of three types, namely: BTC/USD, ETH/USD, & LTC/USD. They all have large tick sizes and are displayed in ladder styles. Tick sizes refer to the min. price increments that futures contracts can move up or down. For BTC/USD, $5. ETH/USD is $1 & LTC/USD is $0.25

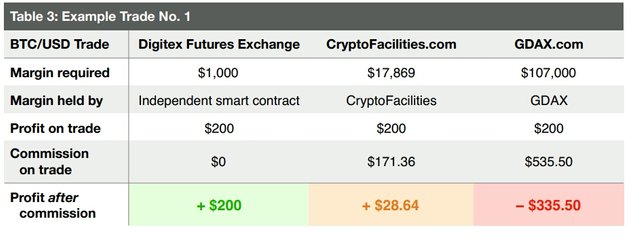

Looking at the table below, we see a great example of how traders can gain massively, when compared to CryptoFacilities and GDAX.com

6.0 DECENTRALISED GOVERNANCE BY BLOCKCHAIN (DGBB)

Digitex makes use of of the blockchain to issue new tokens more efficiently, and also ensure that this is carried out fairly, via ruling and voting system built into smart contracts.

Making use of the blockchain also ensures that Digitex is able to function without transaction fees.

Digitex users can delegate their voting power to other users.

.png)

7.0 USE CASE

Jane is a crypto trader, who has been active in the futures market space for some time. She is distraught, and is thinking of abandoning her pursuits for good, due to the fact that after making a tidy profit on trading, she losses almost everything to commissions charged.

She complains bitterly to her friend Emma, who sends her a referral link of Digitex. Jane tries the same procedure as before, and gets good results.

The difference being that what she sees is what she earned. She is now making a 300% profit, as compared to her previous exchange, and her worries are done away with.

Reliability is also a issue for her, so she seeks for better solutions.

She is able to retain more value by using a futures exchange that has zero transaction fees, and she also has a say over governance and the direction the platform goes, seeing users are responsible for making decisions by voting.

8.0 SUMMARY

Digitex ensures its market is highly liquid, by attracting traders with all types of intent-both long/short term traders.

The use of smart contracts ensures that Digitex will not be a target of hackers in that sense, seeing such activities are handled by independent smart contracts.

Users having power to decided how the exchange is funded will ensure that users feel included and in control. Everyone likes to be in control of their own situation. It will also ensure that users will be more involved in the platform, with regards to activities such as voting, and will ensure that users will treat the platform as their own, seeing doing such will protect their interests.

No transaction fees will ensure that more users will be open to trading in futures, thus injecting more funds and bringing about much need growth and increase in volume in the industry. Users will feel valued, and will be more likely to stick around. First time traders interest will grow and they will be more likely to get involved. Digitex will more often than not, be their go to platform in such a scenario.

My major concern though: Being able to delegate voting power, can’t this lead to the system being gamed to suit the interest of particular users, what measures are put in place to ensure this can’t happen with a loop-sided majority vote?

Digitex Website

Digitex WhitePaper

Digitex Blog

Digitex Telegram

Digitex Reddit

Digitex Facebook

Digitex Twitter

Digitex YouTube

Entry to @originalworks contest which can be seen here

My Twitter link:

https://twitter.com/deIdialu/status/1041995573564456962

digitex2018

digitextwitter

This post has been submitted for the OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Coins mentioned in post: