Do you have to invest in bitcoin and cryptocurrencies? Experts share best practices in a volatile market.

Investing in Bitcoin and cryptocurrencies can be the right step ... if you know what to expect

Do you believe that Bitcoin and cryptocurrencies are ready to pop up again?

.jpeg)

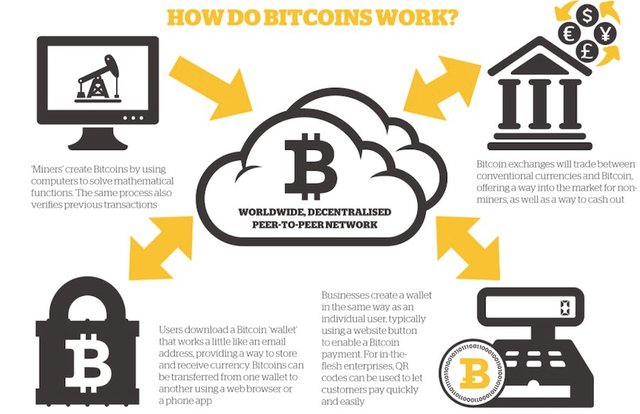

Since its founding in 2010, Bitcoin was the first digital tool to create an entire ecosystem of cryptocurrencies. For quite some time it has grown into an underground following of investors who seemed very interested in the future as a possible replacement for the physical monetary system, while traditional institutional players curiously followed the development.

Although we are probably many years away from a complete transition, the crypto space has been a fairly volatile playground. During ascension and the adoption of crypto, many people launched ICOs (Individual Coin Offerings, similar to offering a new supply) without supervision or regulation. During this time, Bitcoin led the charge to a valuation of nearly $ 20,000 per currency in 2017, but then the value declined steadily in the course of 2018 and settled for quite some time in the range of $ 3,500 to $ 4,000.

After witnessing the rapid rise and subsequent fall in the value of Bitcoin, many people became embarrassed about investing in cryptocurrencies. However, recent activity has led to a significant increase in the value of Bitcoin at the time of this writing and has attracted the attention of many existing and potential investors.

In recent years, the cryptomarket has matured with more supervision and regulatory controls by both institutions and government agencies. As a result of these measures and more institutional dollars that support the industry, more people are now looking for ways to reduce their risk and still use a profitable ROI.

Here are some tips on how you can successfully invest in cryptocurrencies from industry experts:

Diversify your risk when investing in Bitcoin and cryptocurrencies.

In the current "immediate satisfaction," society results in microwaves, many people look - again - at the time of the cryptomarket and win a lot, almost with a "win-the-lottery" style.

However, Parul Gujral says that this is a recipe for likely disasters. In my video interview with the CEO of Snowball, Gujral agrees that you can still win a lot if you hit the market just right, but as many people experienced in 2018, you can lose a lot just as quickly.

He believes that the key to success when it comes to investing in cryptocurrency is to diversify your risk by investing in a pool of cryptocurrencies that are audited by financial professionals, just like your 401k accounts or index funds.

"With our mobile app we let you invest in cryptocurrencies or digital assets such as Warren Buffet want you to invest in shares via the S&P 500. Warren Buffett, Ray Dalio and even Tony Robbins in his book, Money Master the Game, all recommend index By investing in an index the costs and risks are much lower, it is tax optimized and you can usually outperform the market, "Gujral said.

The recommendation to invest in an index fund means that you do not put "all your eggs in one basket", as many people did when they invested in a single currency or ICO and lost a lot when the cryptocurrency market emptied in 2018.

Paul Veradittakit, partner at Pantera Capital, also recommends the concept of diversifying cryptocurrency investments: "I think if you are an individual investor, it makes sense to try and diversify as much as possible, just because there is a lot of risk in cryptocurrency and a lot of volatility, and you want to make sure you have a basket and hopefully one of the investments that will do very well. "

However, most people only have access to invest in crypto funds or indices if they are an authorized investor - someone who earns more than $ 200,000 for 2+ consecutive years and / or has $ 1 million in assets excluding primary real estate. This means that the novice or average person usually does not have the option to invest in a crypto fund.

It is an important reason why Gujral founded Snowball and hopes that his app will help to democratize access to the best cryptofonds and index strategies. He believes that the average investor should be able to invest wisely in the cryptocurrency sector with less friction and less risk.

Invest through regulated professionals.

Another challenge is to find those financial professionals who can conduct effective research and recommend a portfolio of cryptos that offer a steady return-on-investment (ROI) while minimizing your exposure to a bear - or down - market.

There are many options when it comes to cryptocurrency apps and investment platforms, but one of the distinguishing factors that investors should look for when working with financial professionals are those who have achieved the status of Registered Investment Adviser (RIA) by the Securities Exchange Commission.

"RIAs have a fiduciary duty towards their clients, which means they have a fundamental obligation to provide investment advice that always acts in the best interest of their clients. As the first word of their title indicates, RIAs must register with the Securities and Exchange Commission (SEC) or state administrators. "

In essence, this designation means that RIAs are not only regulated, but are also fiscally responsible for their investment advice and recommendations.

"We have become a registered investment adviser or an RIA, just as Andreessen Horowitz announced that they require all their companies to have registered investment advisers," Gujral said. "Because we manage people's money and digital resources, we thought it was very important to 1) have a stamp of approval stating that we are qualified and then 2) have a set of eyes that regulate us. So now we are regulated by the SEC and FINRA and at some point in the horizon, we will also be regulated by FinCEN, but not yet. "

During an interview with Veradittakit, whose investment firm has funded more than 100 crypto-related projects, I asked how important the RIA designation is for the future of the industry. "I think it's very important. I think it's good that investors and entrepreneurs do what they can to protect themselves with regulations. When you manage other people's money, it's a great way to be credible and have the right licenses to do what you want to do in the field of asset management. That is why Pantera also became an RIA. "

As the cryptocurrency ecosystem continues to evolve and become more complex, it only becomes time-consuming and challenging to know on which coins and tokens it pays to bet and which to avoid like the plague. Working with registered professionals can help you save time and hopefully increase your chances of a profitable investment.

A worthwhile resource is the SEC investor bulletins which provide a list of tips and questions to ask before selecting a financial professional as a service to investors.

Focus on education and wealth accumulation.

Regardless, it's not wise to ignorantly entrust your capital to any financial advisor, app or crypto company without doing any of your own due diligence and research. After all, you're ultimately responsible for the outcome of your decision.

Gujral recommended Coinbase Earn as a good place to start for education. According to their site, Coinbase offers to pay people to learn about cryptocurrencies as people complete educational tasks like watching short video lessons and completing quizzes. Their organization is a regulated broker-dealer and, according to Gujral, they've received their RIA designation from the SEC as well.

During an interview with Gordy Bal, the CEO of Conscious Thought Revolution, who has invested in companies such as Bulletproof Coffee and WAX, I asked why people should inform themselves about the industry. He replied, "Over the next 25 years, Accenture is reporting that there will be more than $ 30 trillion capital transfer in North America from baby boomers to their heirs, and it will be the largest capital transfer in history. There is no doubt about cryptocurrency is going to be one thing. It's just an inevitability. I think what could really serve people well is to understand the underlying technology from a philosophical point of view and how it can serve a greater purpose. "

Although some people are willing to make a big effort in day trading and market timing, the average and novice investor may not want to expose themselves to significant risks and losses and take a more conservative approach.

According to Veradittakit: "If you have the time and you have the skills to trade actively and you are good at it, go for it. But I think most people just don't have the skill or the time. I think the biggest thing is to find real projects or companies that you are passionate about and to invest in a portfolio of cryptocurrencies for the long term. "

Bal agrees, "I would say, instead of focusing on the possibility of generating huge amounts of returns, aligning on a project that speaks for the future of our species, our species and our planet. Focus in the long run - find the founders who have a mission, who have already achieved several successes and who are already funded by the Andreessens of the world. Play with them by investing in these deals. "

With large financial institutions and companies such as JP Morgan, USAA, Goldman Sachs and IBM that support crypto, and Facebook's recent announcement of their own currency, it seems that cryptocurrencies continue to exist. Gujral is even so optimistic about the future of crypto that he plans to be one of the first to integrate Snowball with the Libra coin of Facebook.

In an email, Reese Jones, a venture strategist who serves as both Facebook and Snowball advisers, said, “Facebook's Libra will introduce more than one billion people to digital cryptocurrency payments and many of them naturally want to diversify their money investments in portfolios such as facilitated by Snowball. "

As the industry develops and grows, it may be wise to conduct research and learn how to invest intelligently in the cryptomarkets. Investing in your financial education is usually profitable, and a conservative cryptocurrency strategy can yield large dividends in the long run.

Even Yale suggests that investors should put up to six percent of their assets in cryptocurrencies.

"Do you remember when your Gmail name was used because it took you too long to get your Gmail address?" recalls Bal. "It's the same with investing in cryptocurrency. These are the moments when you can come in at an early stage like you could have done for the Googles and Amazons in the early 2000s. Just go into the game, no matter how seems don't be so behind the bend where you think a few years later and wish you to take action.